In the ever-evolving world of technology, Apple Inc. (AAPL) has consistently maintained its position as a market leader. The company's stock price has been a subject of keen interest among investors and tech enthusiasts alike. This article delves into the factors that influence Apple's US stock price, offering a comprehensive analysis of its performance over the years.

Historical Performance

Apple's stock has seen significant growth over the past decade. From its IPO in 1980 to the present day, the stock has experienced both highs and lows. One of the key factors contributing to its rise has been the company's ability to innovate and introduce groundbreaking products. The launch of the iPhone in 2007, the iPad in 2010, and the Apple Watch in 2015 have all played pivotal roles in boosting the company's market value.

Innovation and Product Launches

Apple's commitment to innovation has been a driving force behind its stock price. The company's ability to consistently introduce new and improved products has kept investors interested. For instance, the iPhone 12 series, launched in 2020, featured several enhancements such as a more advanced camera system and 5G connectivity. This not only improved the user experience but also contributed to a surge in the company's stock price.

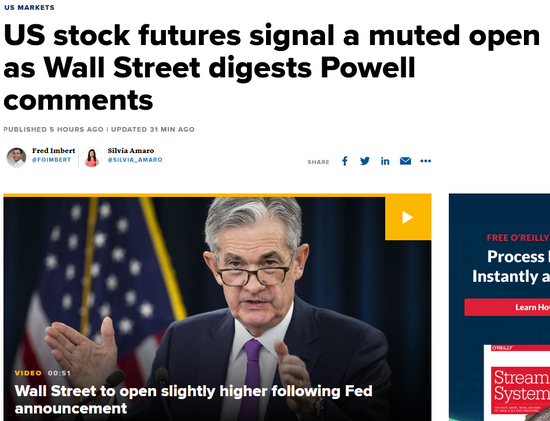

Market Trends and Economic Factors

The stock market is influenced by a variety of factors, including market trends and economic conditions. Apple's stock price is no exception. For instance, during the COVID-19 pandemic, there was a global shift towards remote work and online shopping. This trend benefited Apple, as its products became more essential in people's daily lives. As a result, the company's stock price experienced a significant increase.

Dividend Yield and Shareholder Returns

Apple has a strong track record of paying dividends to its shareholders. The company has increased its dividend payout for 49 consecutive years, making it one of the most reliable dividend-paying stocks in the market. This has attracted income-seeking investors, further boosting the stock's price.

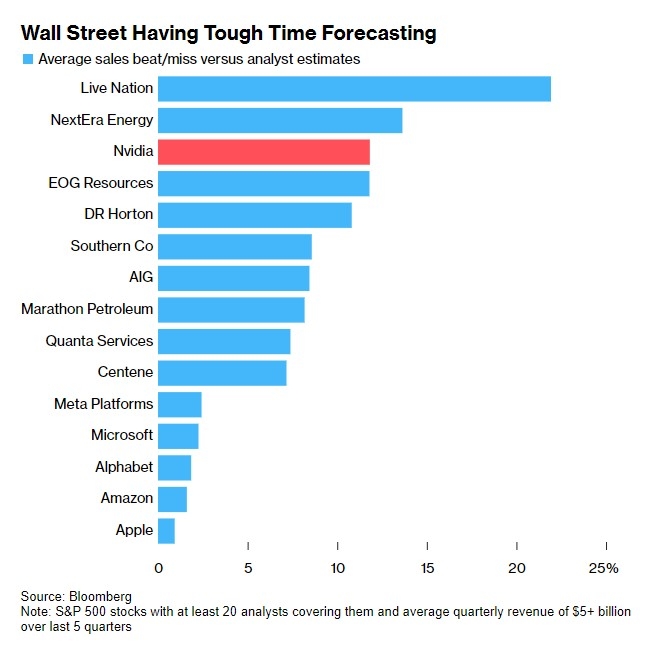

Competitive Landscape

Apple operates in a highly competitive market, with competitors such as Samsung, Huawei, and Google. However, the company has managed to maintain its market share by focusing on product differentiation and customer satisfaction. This competitive advantage has played a crucial role in supporting the stock's price.

Case Study: Apple's Stock Price Surge in 2020

One notable example of Apple's stock price surge was in 2020. The company's stock price increased by nearly 40% during the year, despite the global economic downturn caused by the COVID-19 pandemic. This surge can be attributed to several factors, including the strong demand for Apple products, the company's robust financial performance, and the favorable market conditions.

Conclusion

In conclusion, Apple's US stock price has been influenced by a variety of factors, including innovation, market trends, economic conditions, and competitive dynamics. As the company continues to innovate and adapt to changing market conditions, its stock price is likely to remain a key area of interest for investors and tech enthusiasts alike.

Is the US Stock Market Open? Understanding ? us stock market live