In today's fast-paced financial world, investing in Exchange Traded Funds (ETFs) has become increasingly popular. These funds offer a diverse range of investment opportunities, and US ETF stocks are at the forefront. Whether you're a seasoned investor or just starting out, understanding the nuances of US ETF stocks can significantly enhance your investment strategy. In this article, we delve into what US ETF stocks are, their benefits, and how they can be a game-changer for your portfolio.

What are US ETF Stocks?

Firstly, let's clarify what US ETF stocks are. An ETF is a type of investment fund that tracks a particular index, sector, or asset. US ETF stocks are those ETFs that are listed and traded on U.S. exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. They can be classified into various categories, including equity, fixed income, commodity, and sector ETFs.

The Benefits of Investing in US ETF Stocks

Diversification: One of the primary advantages of investing in US ETF stocks is diversification. By investing in a single ETF, you gain exposure to a broad range of assets, reducing your risk in case of market fluctuations.

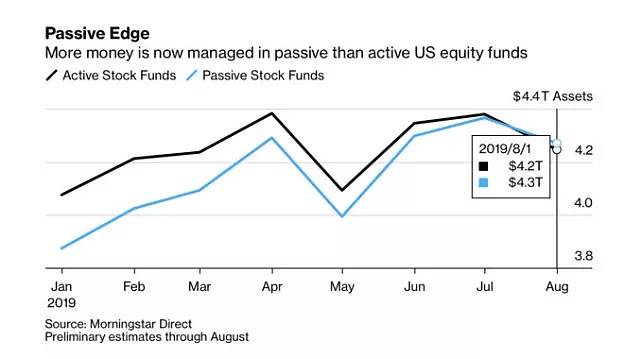

Lower Costs: ETFs generally have lower fees compared to mutual funds. This is because ETFs are passively managed, meaning they track an index rather than actively trading.

Transparency: ETFs provide transparency as their holdings are disclosed on a daily basis. This allows investors to make informed decisions based on the underlying assets.

Liquidity: US ETF stocks are highly liquid, which means they can be bought and sold quickly without affecting their price.

Understanding Different Types of US ETF Stocks

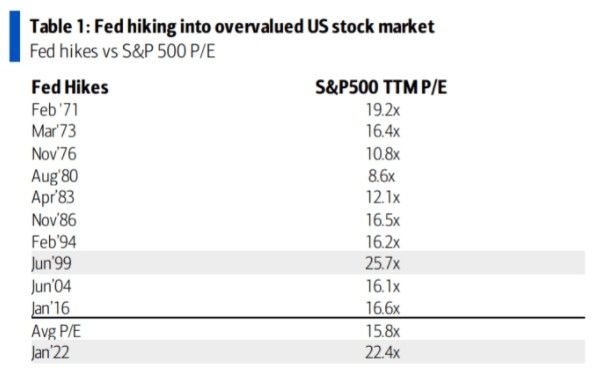

Equity ETFs: These ETFs track a specific stock index, such as the S&P 500. They are a popular choice for investors looking to gain exposure to the U.S. stock market.

Bond ETFs: Bond ETFs invest in a basket of fixed-income securities, offering investors a way to diversify their portfolios and generate income.

Sector ETFs: These ETFs focus on specific sectors, such as technology or healthcare, allowing investors to invest in a particular area of the market they believe will perform well.

Commodity ETFs: Commodity ETFs track the price of physical commodities, like gold or oil, offering investors a way to invest in commodities without physically owning them.

Case Study: SPDR S&P 500 ETF (SPY)

One of the most popular US ETF stocks is the SPDR S&P 500 ETF (SPY). This ETF tracks the S&P 500 index, representing the 500 largest companies listed on U.S. exchanges. By investing in SPY, investors gain exposure to a diverse range of companies across various sectors.

Since its inception in 1993, SPY has provided investors with a reliable way to invest in the U.S. stock market. Its liquidity and low fees have made it a favorite among both individual and institutional investors.

Conclusion

In conclusion, US ETF stocks offer a flexible and efficient way to invest in a diverse range of assets. Whether you're looking to diversify your portfolio, lower your costs, or gain exposure to specific sectors, US ETF stocks are a valuable tool for any investor. By understanding the different types of US ETF stocks and their benefits, you can make informed decisions and potentially enhance your investment returns.

Register Canadian Stocks for US Trade: A Co? us steel stock dividend