Are you considering investing in US Bank stock options? If so, you've come to the right place. This comprehensive guide will help you understand the basics of US Bank stock options, their benefits, and potential risks. Whether you're a seasoned investor or just starting out, this article will provide you with the knowledge you need to make informed decisions.

What are US Bank Stock Options?

US Bank stock options are a type of financial derivative that gives investors the right, but not the obligation, to buy or sell shares of US Bank stock at a predetermined price within a specific time frame. These options can be purchased on various exchanges and are often used for hedging, speculation, or generating income.

Types of US Bank Stock Options

There are two main types of US Bank stock options: call options and put options.

- Call Options: These options give the holder the right to buy US Bank stock at a specified price, known as the strike price, before the option expires.

- Put Options: These options give the holder the right to sell US Bank stock at the strike price before the option expires.

Benefits of US Bank Stock Options

- Potential for High Returns: Options can offer high returns if the stock price moves in the right direction.

- Leverage: Options provide leverage, allowing investors to control a larger position with a smaller investment.

- Hedging: Options can be used to protect investments against market downturns.

- Income Generation: Investors can generate income by selling options, known as writing options.

Risks of US Bank Stock Options

- Limited Profit Potential: If the stock price doesn't move in the right direction, the option will expire worthless, and the investor will lose the premium paid.

- Time Decay: Options have a limited lifespan, and their value decreases as they get closer to expiration.

- Complexity: Options can be complex, and it's essential to understand their intricacies before trading.

How to Trade US Bank Stock Options

To trade US Bank stock options, you'll need to open a brokerage account and deposit funds. Once your account is set up, you can place a trade by selecting the type of option (call or put), the strike price, and the expiration date.

Case Study: Hedging with US Bank Stock Options

Imagine you own 100 shares of US Bank stock, which you purchased at

If the stock price falls to

Conclusion

US Bank stock options can be a powerful tool for investors looking to maximize returns, hedge against market downturns, or generate income. However, it's crucial to understand the risks and complexities associated with options trading before getting started. By doing your research and seeking guidance from a financial advisor, you can make informed decisions and potentially benefit from the opportunities offered by US Bank stock options.

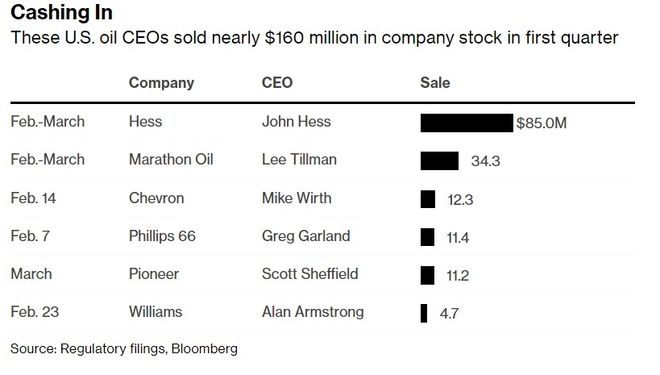

Insider Buying US Stocks: A Lucrative Inves? us steel stock dividend