Investing in US stocks can be a lucrative venture for Canadian investors, but it's crucial to understand the tax implications. This article delves into the intricacies of taxes on US stocks for Canadian investors, ensuring you're well-informed and prepared for potential tax obligations.

What Are Taxes on US Stocks for Canadian Investors?

When Canadian investors purchase US stocks, they are subject to both Canadian and US tax laws. This means that the income generated from these investments, including dividends and capital gains, is subject to taxation in both countries.

Dividend Taxation

Dividends paid on US stocks are taxed differently depending on whether they are qualified or non-qualified dividends. Qualified dividends are taxed at a lower rate, similar to long-term capital gains, while non-qualified dividends are taxed at the investor's regular income tax rate.

Capital Gains Taxation

Capital gains on US stocks are taxed in a similar manner as in Canada. The tax rate depends on the holding period of the investment. Short-term capital gains, which are realized within a year of purchase, are taxed at the investor's regular income tax rate. Long-term capital gains, which are realized after a year, are taxed at a lower rate.

Withholding Tax

When Canadian investors purchase US stocks, the US issuer is required to withhold a certain percentage of the dividend payment as tax. This withholding tax is based on the information provided by the investor on their W-8BEN form. Canadian investors can claim a credit for this withholding tax on their Canadian tax return.

Tax Planning Strategies

To minimize the tax burden on US stock investments, Canadian investors can consider the following strategies:

- Use a Tax-Efficient Account: Investing in US stocks through a tax-advantaged account, such as a RRSP (Registered Retirement Savings Plan) or TFSA (Tax-Free Savings Account), can help defer taxes on investment income.

- Holding Period: By holding US stocks for a longer period, investors can benefit from lower tax rates on long-term capital gains.

- Offsetting Gains: Canadian investors can offset capital gains from US stocks with capital losses from other investments to reduce their tax liability.

Case Study: Dividend Taxation

Let's consider a Canadian investor who holds a US stock and receives a qualified dividend of

Conclusion

Understanding the taxes on US stocks for Canadian investors is essential for making informed investment decisions. By familiarizing yourself with the tax implications and implementing tax-efficient strategies, you can maximize your investment returns while minimizing your tax burden.

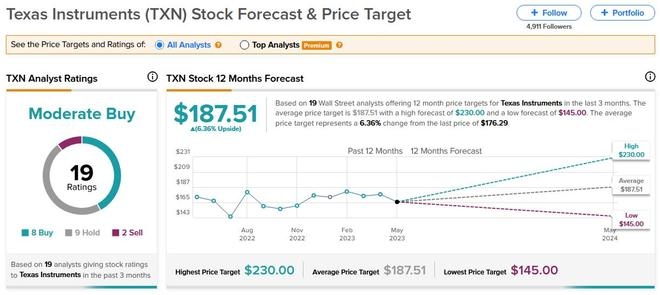

US Dividend Growing Stocks: A Strategic Inv? us steel stock dividend