In the ever-evolving world of finance, staying informed about the stock market is crucial for investors and traders. One of the most effective ways to gauge the market's performance is by analyzing a 30-day graph. This article delves into the intricacies of the US stock market over the past month, offering insights and analysis that could be invaluable for investors.

Understanding the 30-Day Graph

The 30-day graph is a visual representation of the US stock market's performance over the past month. It provides a snapshot of how various indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, have fared during this period. By examining this graph, investors can identify trends, patterns, and potential opportunities.

Key Trends and Patterns

Over the past 30 days, the US stock market has exhibited several notable trends and patterns. Here are some of the key observations:

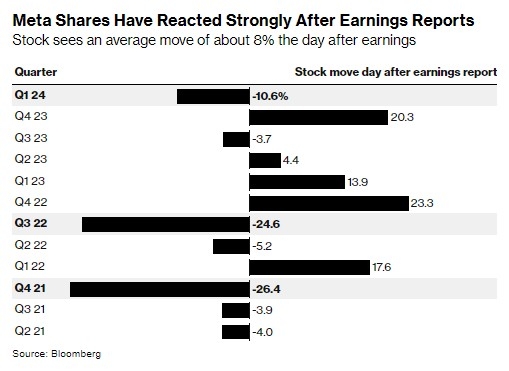

- Volatility: The market has been characterized by high volatility, with significant ups and downs. This volatility can be attributed to various factors, including economic data, geopolitical events, and corporate earnings reports.

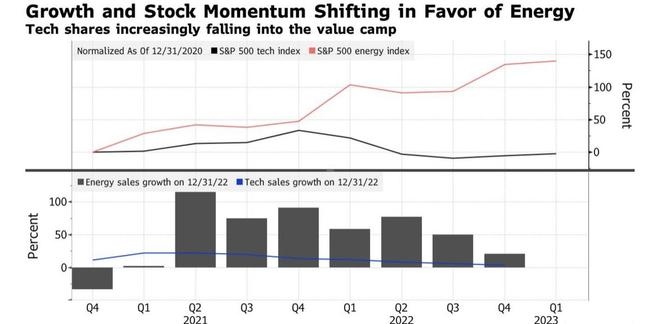

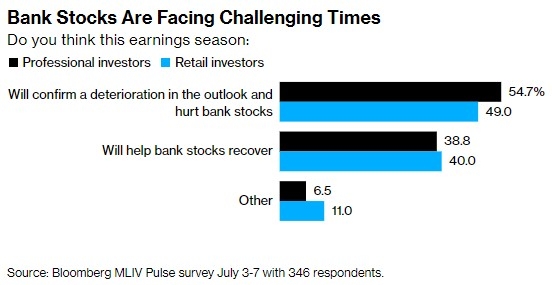

- Sector Performance: Certain sectors have outperformed others. For instance, technology and healthcare stocks have seen strong gains, while energy and financial stocks have underperformed.

- Market Indices: The S&P 500 has experienced a mixed performance, with some sectors leading the way while others lagged behind. The NASDAQ Composite has also been volatile, with tech stocks playing a significant role in its performance.

Case Studies

To illustrate the impact of these trends and patterns, let's look at a few case studies:

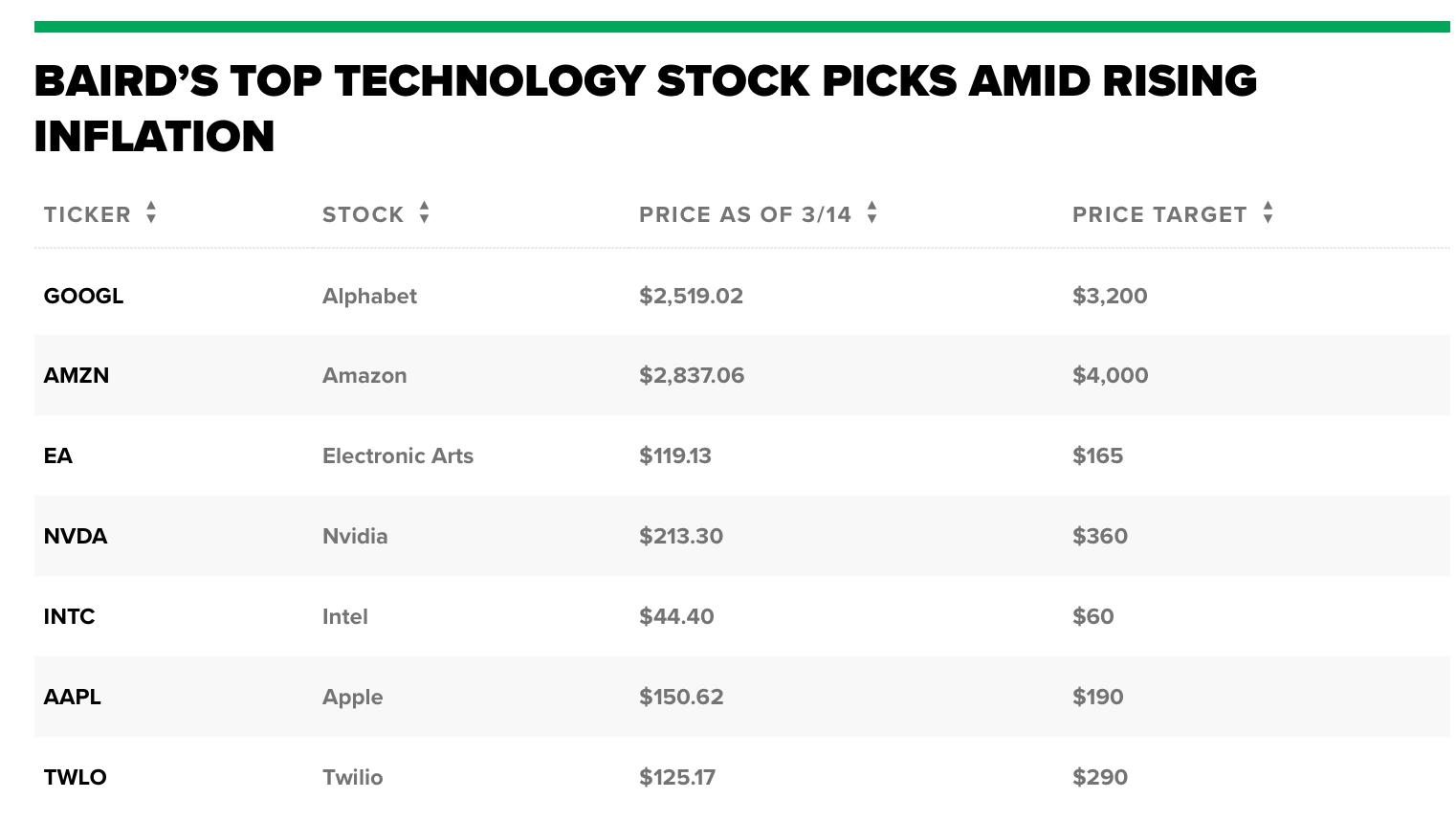

- Tech Stocks: Companies like Apple and Microsoft have seen significant gains over the past 30 days. This can be attributed to their strong fundamentals and the overall growth of the technology sector.

- Healthcare Stocks: Companies in the healthcare sector, such as Johnson & Johnson and Pfizer, have also performed well. This can be attributed to the sector's resilience and the increasing demand for healthcare products and services.

- Energy Stocks: On the other hand, energy stocks have underperformed, with companies like ExxonMobil and Chevron facing challenges due to geopolitical tensions and market conditions.

Conclusion

The 30-day graph of the US stock market provides valuable insights into the market's performance and potential opportunities. By understanding the key trends and patterns, investors can make informed decisions and capitalize on the market's movements. However, it's important to remember that the stock market is unpredictable, and risks are always present. As always, it's advisable to consult with a financial advisor before making any investment decisions.

Title: Stock Market Percentage and Its Impa? us steel stock dividend