Introduction

As we approach 2025, the world of finance is evolving rapidly, and with it, the landscape of investment opportunities. One of the most promising sectors to watch is momentum stocks in the United States. These stocks, known for their rapid price gains, have the potential to offer substantial returns for investors. In this article, we will explore the key trends and factors that are shaping the momentum stocks landscape in the US for 2025.

Understanding Momentum Stocks

Before diving into the specifics of US momentum stocks in 2025, it’s important to understand what these stocks are. Momentum stocks are those that have seen a significant increase in price and trading volume over a short period of time. These stocks are often driven by strong market sentiment and positive news, leading to an upward momentum that can continue for an extended period.

Factors Influencing Momentum Stocks in 2025

Several key factors are expected to influence the momentum stocks landscape in the US for 2025:

- Economic Growth: A strong economic outlook is often a catalyst for momentum stocks. As the US economy continues to grow, we can expect to see increased investment in industries such as technology, healthcare, and consumer goods.

- Technological Advancements: The rapid pace of technological innovation is creating new opportunities for momentum stocks. Companies at the forefront of emerging technologies, such as artificial intelligence, blockchain, and biotechnology, are likely to see significant growth in 2025.

- Market Sentiment: Positive market sentiment can drive momentum stocks higher. Factors such as low interest rates, strong corporate earnings, and favorable political conditions can contribute to a bull market environment that benefits momentum stocks.

- Regulatory Changes: Changes in regulations can have a significant impact on momentum stocks. For example, new regulations that favor certain industries or companies can lead to increased investment in those sectors.

Emerging Trends in Momentum Stocks

Several emerging trends are shaping the momentum stocks landscape in the US for 2025:

- Green Energy: As the world continues to shift towards sustainable energy sources, companies involved in renewable energy, electric vehicles, and clean technology are likely to see significant growth.

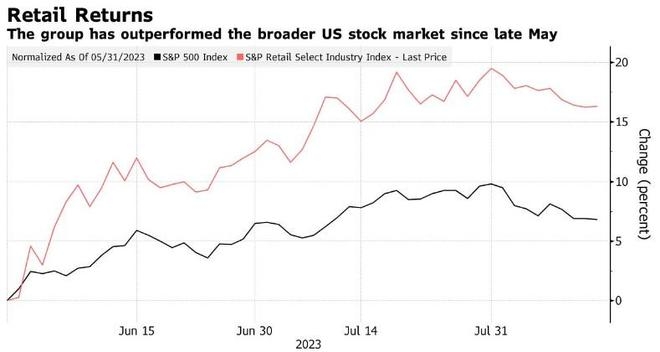

- E-Commerce: The e-commerce sector is expected to continue its growth trajectory in 2025, with companies like Amazon and Shopify leading the way.

- Healthcare: The healthcare industry is poised for significant growth due to factors such as an aging population and advancements in medical technology.

Case Study: Tesla

A prime example of a momentum stock that has shaped the landscape of the US stock market is Tesla. Founded in 2003, Tesla has become a household name in the automotive industry, thanks to its innovative electric vehicles and commitment to sustainable energy. Tesla’s stock price has skyrocketed over the past few years, driven by strong sales, positive earnings reports, and a growing market for electric vehicles.

Conclusion

As we move closer to 2025, the US momentum stocks landscape is poised for significant growth. By understanding the key factors and emerging trends, investors can identify promising opportunities in this dynamic sector. Whether you’re looking to invest in emerging technologies, green energy, or e-commerce, the US momentum stocks market offers a wealth of opportunities for those willing to stay informed and adapt to the changing landscape.

Cruise Stocks Plummet After US Tariffs Anno? us steel stock dividend