In the ever-evolving world of stock markets, understanding the momentum behind large-cap stocks is crucial for investors seeking to capitalize on market trends. This article delves into the analysis of US large cap stock momentum, providing insights into how to identify and capitalize on these trends. By examining key factors and real-world examples, we aim to equip investors with the knowledge needed to make informed decisions.

Understanding Large Cap Stocks

Large cap stocks refer to shares of companies with a market capitalization of over $10 billion. These companies are typically well-established, with a strong track record of profitability and stability. Examples include tech giants like Apple, Microsoft, and Google's parent company, Alphabet.

What is Stock Momentum?

Stock momentum is a measure of a stock's upward or downward trend. It indicates the speed at which a stock's price is moving and can be used to predict future price movements. A stock with positive momentum is on the rise, while a stock with negative momentum is falling.

Factors Influencing Large Cap Stock Momentum

Several factors influence the momentum of large cap stocks:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can impact the performance of large cap stocks. For example, a strong economy may lead to increased consumer spending, benefiting companies like Walmart and Home Depot.

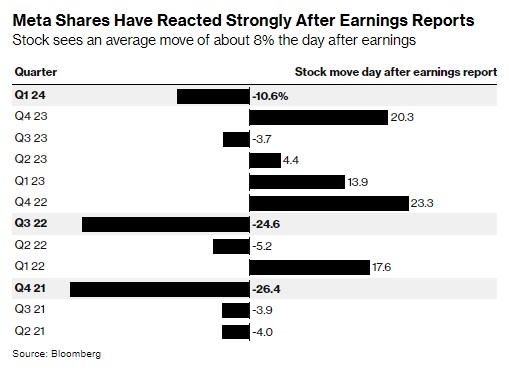

- Company Performance: Strong earnings reports and positive news can boost a stock's momentum. Conversely, poor performance or negative news can lead to a decline in momentum.

- Market Sentiment: Investor sentiment plays a significant role in stock momentum. Factors such as geopolitical events, political instability, and market trends can influence investor confidence and, subsequently, stock prices.

Analyzing Large Cap Stock Momentum

To analyze large cap stock momentum, investors can use various tools and techniques:

- Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

- Fundamental Analysis: Fundamental analysis involves evaluating a company's financial health, including its earnings, revenue, and debt levels. This analysis helps investors understand the intrinsic value of a stock.

- Sentiment Analysis: Sentiment analysis involves analyzing news, social media, and other sources to gauge investor sentiment. This information can provide insights into potential market trends.

Real-World Examples

Let's consider a few real-world examples of large cap stock momentum analysis:

- Apple: Apple's stock has shown strong momentum over the past few years, driven by its innovative products and robust financial performance. Its positive momentum can be attributed to factors such as strong earnings reports, a growing customer base, and increased demand for its products.

- Microsoft: Microsoft's stock has also demonstrated positive momentum, driven by its cloud computing business and strong partnerships with other tech companies. Its momentum can be attributed to factors such as its growing revenue from cloud services and increased demand for its software solutions.

- Alphabet: Alphabet's stock has experienced both positive and negative momentum over the years. Its positive momentum can be attributed to its strong advertising business and investments in emerging technologies. However, concerns about privacy and antitrust issues have sometimes caused its momentum to decline.

Conclusion

Analyzing the momentum of US large cap stocks is essential for investors seeking to capitalize on market trends. By understanding the factors influencing stock momentum and using various analysis techniques, investors can make informed decisions and potentially increase their returns. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

China's Alleged Sixth-Generation Fight? us steel stock dividend