The interplay between the US inflation rate and the stock market is a topic of great interest for investors and economists alike. This article delves into the intricate relationship between these two crucial economic indicators, exploring how they influence each other and the broader implications for market participants.

Understanding Inflation

To start, let’s clarify what inflation is. Inflation is the rate at which the general level of prices for goods and services is rising, leading to a decrease in the purchasing power of currency. It is typically measured using indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Inflation's Impact on the Stock Market

The US inflation rate can have a significant impact on the stock market in several ways:

Earnings Power: Higher inflation can lead to higher corporate costs, which could erode profit margins. This is especially true for companies in industries with high production costs, such as manufacturing or energy.

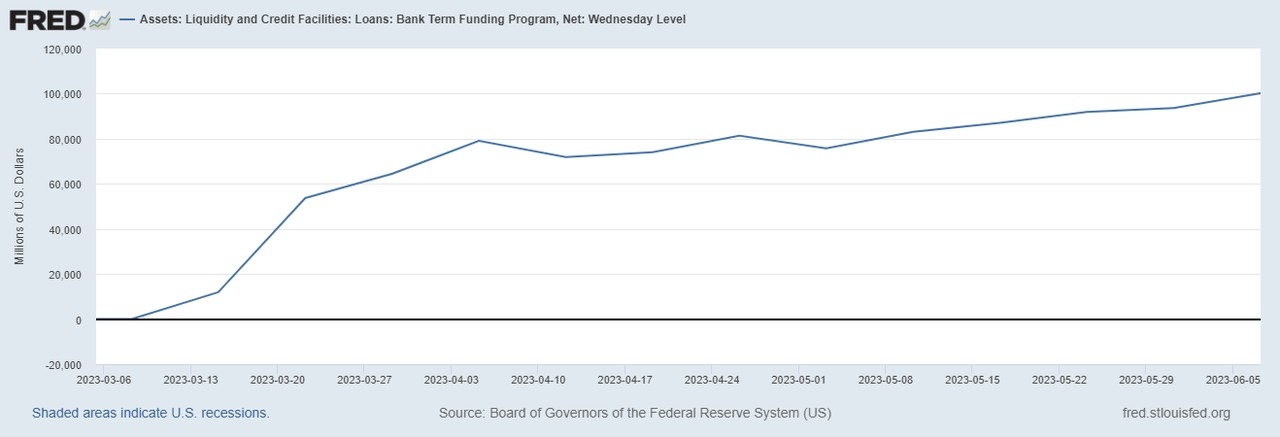

Interest Rates: Central banks often use interest rates as a tool to control inflation. If inflation is high, central banks might increase interest rates to cool down the economy. Higher interest rates can make borrowing more expensive, which can negatively impact corporate profits and consumer spending.

Investor Sentiment: Inflation can lead to uncertainty in the market, leading investors to be more risk-averse. This can result in lower stock prices as investors seek safer investments.

The Stock Market's Influence on Inflation

On the flip side, the stock market can also influence inflation in the following ways:

Equity Prices: When stock prices rise, it can lead to increased consumer confidence and spending. This higher level of spending can lead to higher inflation if it outpaces the economy's ability to produce goods and services.

Wage Pressure: As companies increase their stock prices, it can lead to increased wages as workers seek to maintain their purchasing power. Higher wages can lead to increased production costs, potentially pushing up inflation.

Case Studies

Let’s look at a few historical examples to understand the relationship between the US inflation rate and the stock market:

1970s: The 1970s saw a period of high inflation in the US. This was accompanied by a significant bear market in the stock market, as investors worried about the rising costs and uncertainty surrounding inflation.

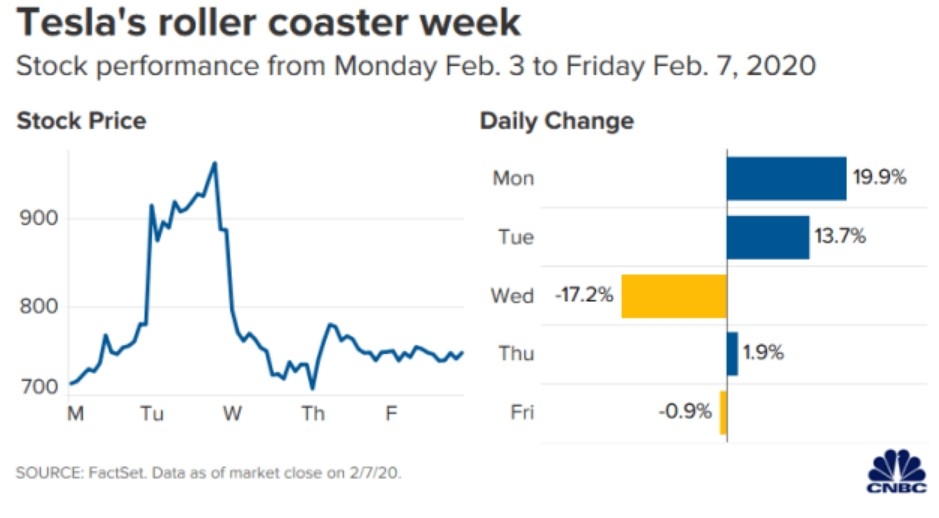

2020: The COVID-19 pandemic led to unprecedented measures by the Federal Reserve to control inflation. While the stock market initially fell in response to the pandemic, it eventually recovered as the economy began to reopen. This recovery was supported by strong corporate earnings and stimulus measures.

Conclusion

The relationship between the US inflation rate and the stock market is complex and multifaceted. Both have the potential to influence each other in various ways. Understanding this relationship is crucial for investors and economists alike, as it can help them make informed decisions about where to allocate their capital and how to manage their portfolios.

Beginners Guide to Stock Market in the US: ? us steel stock dividend