Are you looking to diversify your investment portfolio and trade US stocks from Singapore? With the global financial markets becoming increasingly interconnected, trading US stocks from Singapore has never been easier. In this comprehensive guide, we will explore the process, benefits, and tips for trading US stocks from Singapore.

Understanding the Process

To trade US stocks from Singapore, you need to follow a few simple steps:

Open a brokerage account: The first step is to open a brokerage account with a reputable online broker that offers US stock trading. Some popular brokers in Singapore include Saxo Markets, Interactive Brokers, and Charles Schwab.

Understand the risks: Before you start trading, it is crucial to understand the risks involved. The US stock market can be volatile, and there is always a risk of losing money.

Fund your account: Once your account is open, you need to fund it with your preferred payment method, such as credit/debit card, bank transfer, or PayPal.

Start trading: With your account funded, you can start trading US stocks. Use the broker's trading platform to place buy and sell orders.

Benefits of Trading US Stocks from Singapore

There are several benefits to trading US stocks from Singapore:

Diversification: Trading US stocks allows you to diversify your portfolio beyond local stocks, which can help reduce risk.

Access to global markets: The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities.

Technology and innovation: The US is home to many innovative companies, and trading US stocks allows you to invest in these companies before they become household names.

Tips for Successful Trading

Here are some tips to help you succeed in trading US stocks from Singapore:

Do your research: Before investing in any stock, do thorough research to understand the company's financial health, industry trends, and market conditions.

Use risk management techniques: Implement risk management techniques such as stop-loss orders and diversification to protect your investments.

Stay informed: Keep up with market news and developments to make informed trading decisions.

Stay disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

Case Study: Trading Apple Stock

Let's consider a case study where an investor in Singapore decides to trade Apple stock (AAPL) using their US brokerage account.

Research: The investor researches Apple's financials, market position, and industry trends. They determine that Apple is a strong investment due to its strong financial performance and innovative products.

Risk Management: The investor sets a stop-loss order at $150, aiming to minimize potential losses.

Execution: The investor buys 100 shares of Apple stock at

200 per share, totaling 20,000.Monitoring: The investor keeps a close eye on the stock price and market news, adjusting their position as needed.

By following these steps, the investor can potentially profit from Apple's growth while managing risks effectively.

In conclusion, trading US stocks from Singapore offers numerous benefits, including diversification, access to global markets, and investment opportunities in innovative companies. By understanding the process, managing risks, and staying informed, you can successfully trade US stocks from Singapore.

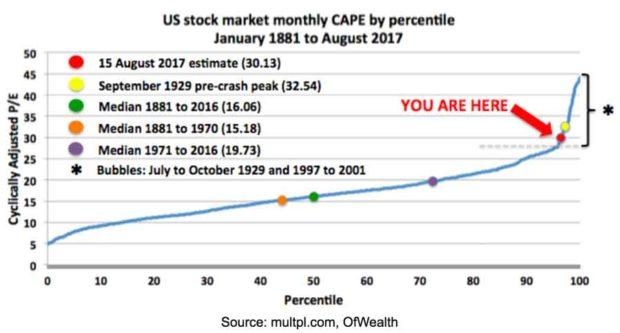

Title: Understanding the PE Ratio: A Key In? us steel stock dividend