Are you looking to invest in the energy sector? With the rise in renewable energy and technological advancements, the U.S. energy sector is brimming with opportunities. But with so many options available, it can be challenging to determine which stocks to invest in. In this article, we will highlight some of the top U.S. energy stocks to buy now, based on their potential for growth, profitability, and market stability.

Exxon Mobil Corporation (XOM)

Exxon Mobil is one of the largest publicly traded oil and gas companies in the world. The company operates in more than 50 countries and has a diverse portfolio of assets, including oil, gas, and renewable energy projects. With a strong focus on innovation and a commitment to sustainability, Exxon Mobil is well-positioned for future growth.

One of the key factors contributing to Exxon Mobil's strength is its strong financial performance. The company has consistently generated high returns on investment, and its dividend yield is among the highest in the industry. Additionally, Exxon Mobil has made significant investments in renewable energy, such as solar and wind projects, which is expected to drive future growth.

Chevron Corporation (CVX)

Chevron Corporation is another major player in the U.S. energy sector. Like Exxon Mobil, Chevron operates in various parts of the world and has a diverse portfolio of oil and gas assets. The company is known for its strong operational efficiency and financial stability.

Chevron's commitment to investing in new technologies and projects has helped the company achieve sustainable growth over the years. In addition, the company has made substantial investments in renewable energy, which is expected to contribute to its future revenue streams.

BP America Inc. (BP)

BP America Inc. is a division of the British Petroleum Company and is one of the largest oil and gas producers in the U.S. BP has a strong presence in various segments of the energy industry, including oil and gas production, refining, and retail.

BP's recent investments in renewable energy have been a major focus for investors. The company has made significant progress in developing its solar and wind projects, and these investments are expected to contribute to its long-term growth.

Enphase Energy, Inc. (ENPH)

Enphase Energy, Inc. is a leader in the solar energy industry. The company's microinverters and energy management solutions are used in residential, commercial, and utility-scale solar installations around the world. Enphase Energy is expected to see significant growth as the global demand for renewable energy continues to rise.

One of the reasons Enphase Energy stands out is its strong track record of innovation. The company is constantly developing new products and technologies that improve the efficiency and cost-effectiveness of solar energy systems.

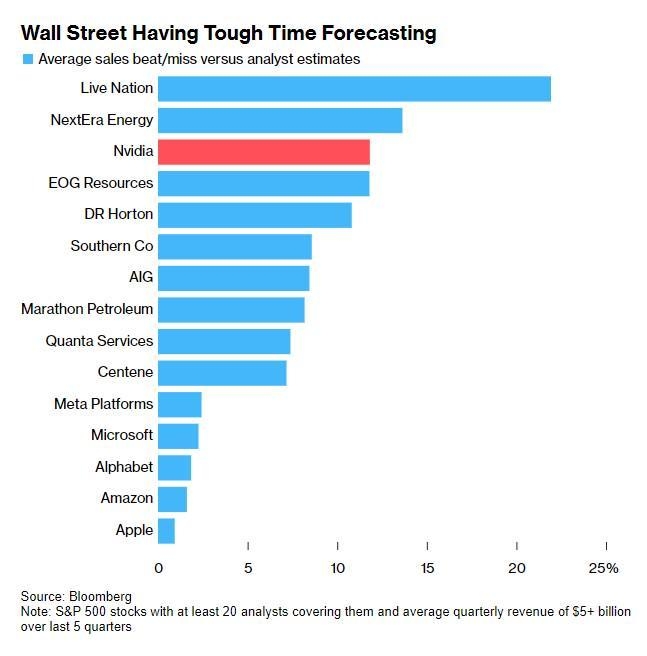

NextEra Energy, Inc. (NEE)

NextEra Energy, Inc. is the largest utility company in the U.S. and is a leading player in the renewable energy industry. The company's primary focus is on wind and solar energy, and it operates the largest fleet of renewable energy projects in the country.

NextEra Energy's commitment to sustainability has helped the company attract a loyal customer base. The company's strong financial performance and robust dividend yield make it an attractive investment opportunity for long-term investors.

In conclusion, investing in the U.S. energy sector can be a smart move for investors looking to diversify their portfolios and benefit from the growing demand for energy. By considering these top U.S. energy stocks to buy now, you can position yourself for potential growth and stability in the years ahead.

Title: Understanding the PE Ratio: A Key In? us steel stock dividend