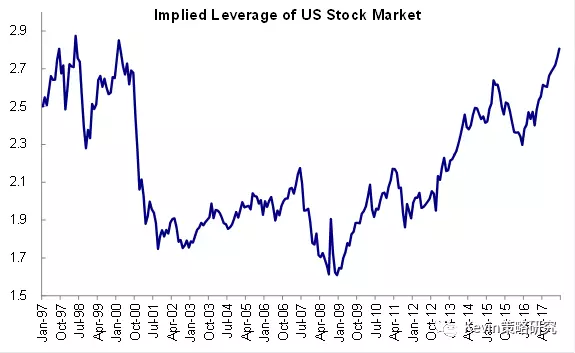

Introduction: In an era marked by economic uncertainty and rising inflation, investors are constantly on the lookout for opportunities that can protect and grow their wealth. One such strategy involves investing in US inflation stocks. These stocks are known for their ability to weather inflationary pressures and provide a hedge against rising prices. In this article, we will explore the world of US inflation stocks, their characteristics, and how they can be a valuable addition to your investment portfolio.

Understanding Inflation Stocks: Inflation stocks are companies that tend to perform well during periods of rising inflation. These stocks often have the following characteristics:

- Profit Margins: Companies with strong profit margins can better absorb the increased costs associated with inflation.

- Revenue Growth: Inflation stocks usually experience revenue growth as demand for their products or services increases during inflationary periods.

- Diversification: These stocks often belong to diverse sectors, providing a balanced approach to inflation hedging.

Why Invest in US Inflation Stocks? Investing in US inflation stocks can offer several advantages:

- Hedge Against Inflation: As the value of the dollar decreases, the prices of goods and services tend to rise. US inflation stocks can help protect your portfolio from the eroding purchasing power of your investments.

- Potential for Higher Returns: Inflation stocks have the potential to outperform the market during inflationary periods, providing higher returns compared to traditional assets.

- Diversification: Adding inflation stocks to your portfolio can help diversify your investments and reduce risk.

Top US Inflation Stocks to Consider: Here are some of the top US inflation stocks that investors should consider:

- Consumer Goods: Companies like Procter & Gamble (PG) and Coca-Cola (KO) have strong brand recognition and pricing power, allowing them to pass on increased costs to consumers.

- Energy Stocks: Companies like ExxonMobil (XOM) and Chevron (CVX) can benefit from higher oil prices during inflationary periods.

- Real Estate: Real estate investment trusts (REITs) like Vanguard Real Estate ETF (VNQ) can provide a hedge against inflation due to the fixed-income nature of real estate investments.

- Gold and Precious Metals: Companies like Barrick Gold (GOLD) and Silvercorp Metals (SVM) can act as a direct hedge against inflation due to the inherent value of gold and silver.

Case Study: Johnson & Johnson (JNJ) Johnson & Johnson (JNJ) is a well-known consumer goods company that has consistently performed well during inflationary periods. With a diverse portfolio of products, JNJ has the ability to pass on increased costs to consumers, ensuring strong profit margins. Over the past decade, JNJ has outperformed the S&P 500 index during periods of high inflation, making it a solid investment for inflation protection.

Conclusion: US inflation stocks can be a valuable tool for investors looking to protect their portfolios against rising inflation and potentially earn higher returns. By understanding the characteristics of inflation stocks and selecting the right companies, investors can build a diversified and resilient investment portfolio. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

How to Open a Stock Account in the US: A St? us steel stock dividend