Introduction:

The US stock market is one of the most dynamic and influential financial markets in the world. It is home to numerous publicly traded companies across various sectors, and investors from around the globe closely monitor its movements. One of the key indicators of the US stock market is the main index, which provides a snapshot of the overall market performance. This article aims to provide a comprehensive guide to understanding the main index in the US stock market, its significance, and how it can impact your investment decisions.

Understanding the Main Index:

The main index in the US stock market refers to a benchmark that measures the performance of a specific group of stocks. The most well-known and widely followed main index is the S&P 500 (Standard & Poor's 500), which tracks the performance of 500 large companies listed on stock exchanges in the United States. The Dow Jones Industrial Average (DJIA) and the NASDAQ Composite Index are also prominent main indices that offer different perspectives on the market.

S&P 500: The S&P 500 is considered the gold standard of US stock market indices. It represents approximately 80% of the total market capitalization of all stocks listed in the United States. The index includes companies from various sectors, such as technology, healthcare, financials, and consumer goods. The S&P 500 is weighted by market capitalization, meaning that the larger a company is, the more influence it has on the index's performance.

Dow Jones Industrial Average: The DJIA is a price-weighted average of 30 large publicly traded companies in the United States. It includes some of the most iconic companies in the world, such as Apple, Microsoft, and Visa. The index is a good representation of the overall health of the US stock market, as it covers a broad range of sectors.

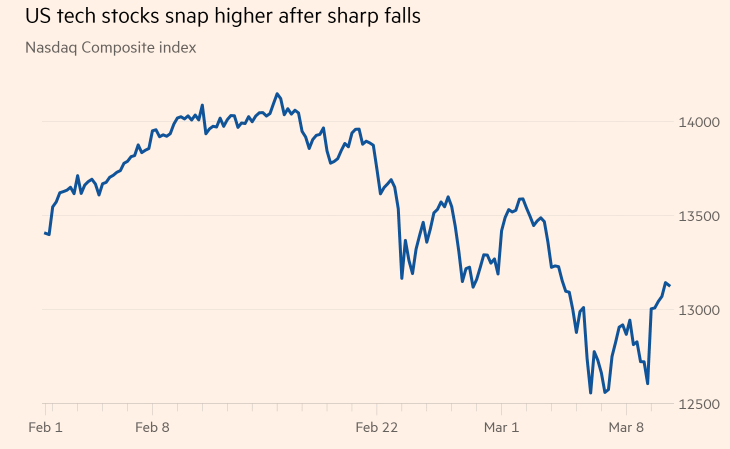

NASDAQ Composite Index: The NASDAQ Composite Index tracks the performance of all domestic and international common stocks listed on the NASDAQ Stock Market. It is well-known for representing the technology sector, which has been a significant driver of the US stock market's growth in recent years.

Significance of the Main Index:

The main index plays a crucial role in the US stock market for several reasons:

Market Performance Benchmark: The main index serves as a benchmark for evaluating the performance of the overall market. It allows investors to quickly assess the market's direction and make informed decisions based on historical data.

Investor Confidence: The main index provides investors with a sense of confidence and stability. A rising index often indicates a strong market, while a falling index may suggest market weakness.

Portfolio Management: The main index is an essential tool for portfolio managers and investors. It helps them gauge the performance of their investments against the market and make adjustments as needed.

Economic Indicators: The main index can also serve as an economic indicator, reflecting the overall health of the US economy. A rising index often suggests strong economic growth, while a falling index may signal economic challenges.

Case Study: Tech Sector's Impact on the NASDAQ Composite Index:

The technology sector has been a significant driver of the US stock market's growth, particularly in the NASDAQ Composite Index. Companies like Apple, Microsoft, and Google have seen their stock prices soar, contributing to the index's rise. In 2020, the NASDAQ Composite Index reached an all-time high, driven by strong performance in the technology sector. This highlights the importance of the main index in reflecting market trends and sector performance.

Conclusion:

Understanding the main index in the US stock market is essential for investors and market participants. By tracking the performance of key indices like the S&P 500, DJIA, and NASDAQ Composite, investors can gain valuable insights into market trends and make informed decisions. As the US stock market continues to evolve, staying informed about the main index is crucial for long-term success.

Title: Typical Values of Mu and Sigma for U? us steel stock dividend