Introduction: The US stock market has long been a beacon of economic prosperity and investment opportunity. However, there has been a growing debate among investors and analysts regarding whether the market is currently overvalued. In this article, we delve into the key factors that contribute to this debate and examine the evidence to determine if the US stock market is indeed overpriced.

Understanding Market Valuation Market valuation is a critical aspect of evaluating the stock market. It involves assessing the current price of stocks relative to their intrinsic value. Several valuation metrics are commonly used, including the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio.

P/E Ratio: A Key Indicator The P/E ratio is a widely used valuation metric that compares the price of a stock to its earnings per share (EPS). A high P/E ratio suggests that the market is overvalued, as investors are willing to pay a premium for earnings. Conversely, a low P/E ratio indicates that the market is undervalued.

As of the time of writing, the S&P 500 has a P/E ratio of around 22, which is above its historical average of around 15. This suggests that the market may be overvalued, as investors are paying a premium for earnings.

P/B Ratio: A Different Perspective The P/B ratio compares the market value of a company to its book value. A high P/B ratio indicates that the market is overvalued, while a low P/B ratio suggests that the market is undervalued.

The S&P 500's P/B ratio is currently around 3.2, which is higher than its historical average of around 2.0. This further supports the argument that the market may be overpriced.

P/S Ratio: A Broader Perspective The P/S ratio compares the market value of a company to its revenue. A high P/S ratio suggests that the market is overvalued, while a low P/S ratio indicates that the market is undervalued.

The S&P 500's P/S ratio is currently around 2.7, which is higher than its historical average of around 1.5. This further reinforces the notion that the market may be overpriced.

Market Sentiment and Valuation Market sentiment plays a crucial role in driving stock prices. When investors are optimistic, they are more willing to pay higher prices for stocks, leading to overvaluation. Conversely, when investors are pessimistic, they may be more inclined to sell off their holdings, leading to undervaluation.

Several factors have contributed to the current optimistic market sentiment, including strong economic growth, low interest rates, and the Federal Reserve's accommodative monetary policy. However, this optimism may be driving up stock prices to levels that are not sustainable in the long term.

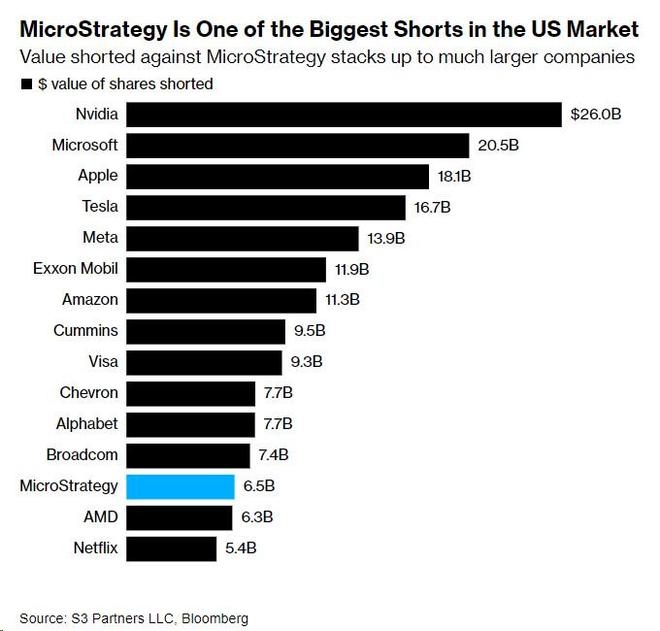

Case Studies: Tech Stocks and Crypto Currencies The debate over market valuation is further illustrated by the performance of tech stocks and crypto currencies. Tech stocks, such as Apple, Amazon, and Microsoft, have seen significant growth in recent years, pushing their valuations to unprecedented levels. Similarly, crypto currencies, such as Bitcoin and Ethereum, have experienced massive price increases, raising concerns about their long-term sustainability.

Conclusion: While the US stock market has experienced strong growth in recent years, there is evidence to suggest that it may be overvalued. The high P/E, P/B, and P/S ratios, coupled with optimistic market sentiment, indicate that investors may be paying too much for stocks. As investors, it is crucial to remain vigilant and consider the long-term implications of overvaluation.

Title: Barchart.com All US Mid Cap Stock Ex? us steel stock dividend