Introduction:

When it comes to the financial sector, Citibank stands out as a global leader. Its stock performance in the United States has been a subject of intense interest for investors. In this article, we delve into the key aspects of Citibank's US stock, providing you with a comprehensive analysis that will help you understand its potential and risks.

Understanding Citibank's Business Model:

Citibank, a subsidiary of Citigroup Inc., operates as a financial services provider with a diverse portfolio of services, including consumer banking, corporate banking, and wealth management. This broad business model allows Citibank to benefit from various economic cycles and sectors, which contributes to its stock's stability.

Historical Stock Performance:

Over the years, Citibank's US stock has displayed a moderate yet steady growth trend. During the financial crisis of 2008, the stock experienced significant volatility but has since recovered and maintained its position as a preferred investment among many investors.

Key Factors Influencing Citibank's Stock Performance:

Interest Rates: Citibank's revenue is significantly influenced by interest rates. With the Federal Reserve's recent policy adjustments, the impact on Citibank's stock performance can be anticipated.

Global Economic Conditions: As a global bank, Citibank's operations are exposed to economic conditions across various countries. The performance of its stock is closely tied to global economic stability and growth.

Regulatory Environment: The regulatory landscape in the financial sector can impact Citibank's profitability. Changes in regulations, such as the Dodd-Frank Act, have influenced the bank's operations and profitability.

Dividends and Yield:

Citibank has been known for its dividends, which have provided steady income to investors over the years. Its current yield stands at around 2.3%, making it an attractive investment for income-seeking investors.

Comparison with Peers:

When compared to its peers, such as JPMorgan Chase and Bank of America, Citibank's stock performance has shown moderate outperformance in certain periods. However, it's essential to consider that each bank has unique strengths and weaknesses, which may influence their stock performance.

Case Study:

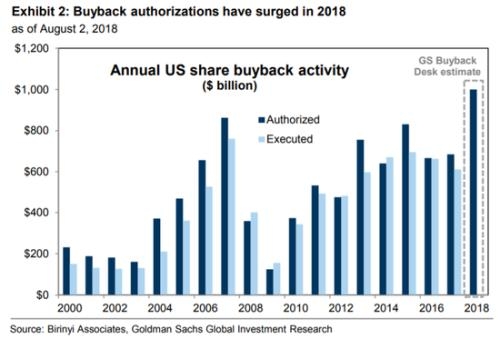

In 2020, Citibank announced a share buyback program worth $15 billion, signaling its confidence in its future performance. Following the announcement, the stock experienced a significant upsurge, demonstrating the positive impact of such strategic decisions on its stock.

Conclusion:

Investing in Citibank's US stock can be a prudent decision for investors seeking stability and growth in the financial sector. By understanding its business model, key factors influencing its stock performance, and its historical data, investors can make informed decisions. As always, it's crucial to conduct thorough research and consider the risks involved before investing.

Title: "US Stock Exchange: Most Ac? us steel stock dividend