Introduction: In the volatile world of the stock market, investors often worry about the potential impact of a crash in one country's stocks on the others. The year 2017 brought significant concerns as the US stock market faced a possible downturn. This article delves into whether Canadian stocks would remain safe if the US stocks were to crash in 2017.

The Interconnectedness of Stock Markets: Stock markets around the world are interconnected, with investors and traders constantly analyzing global events and economic indicators to make informed decisions. The US stock market, specifically the S&P 500, is often considered a bellwether for the global economy. Therefore, any significant crash in the US stock market can have a ripple effect on other markets, including Canada.

Understanding the Impact: When the US stock market crashes, it can lead to a decrease in investor confidence, causing a sell-off across various sectors and markets. This, in turn, can lead to a decrease in stock prices worldwide. However, it is important to note that the impact on Canadian stocks may not be as severe as one might expect.

Factors Contributing to Canadian Stock Safety:

- Diversification: Canadian stocks are often seen as a diversified investment option due to the presence of various industries and sectors. This diversification can help mitigate the impact of a crash in any single market.

- Economic Resilience: The Canadian economy has shown resilience in the face of global economic challenges. The country's stable banking system and diverse economy can act as a cushion against a potential US stock market crash.

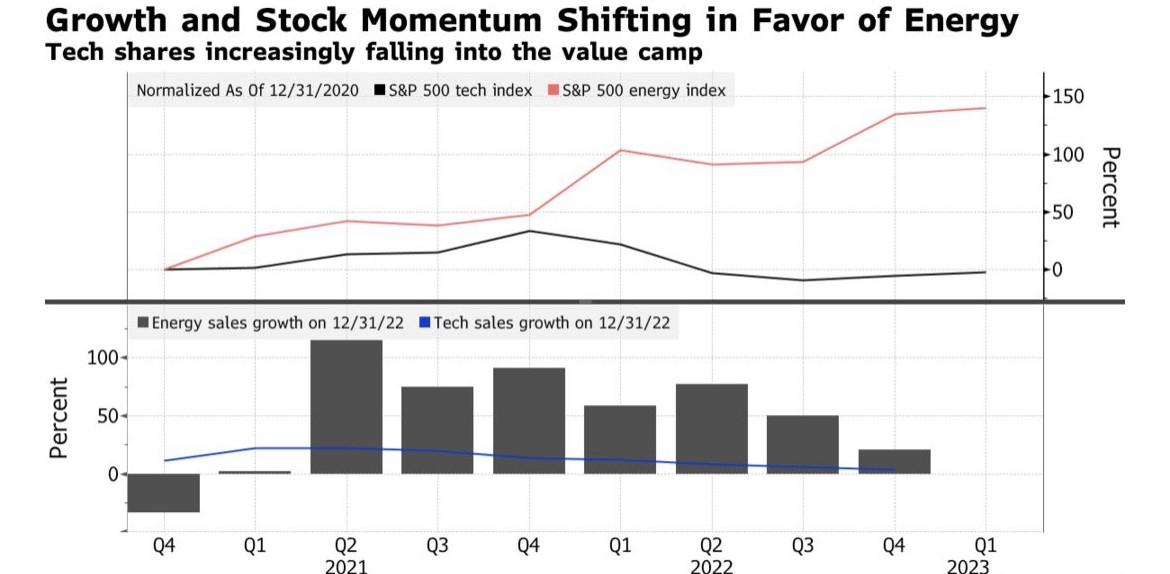

- Resource-based Industries: Canada's economy heavily relies on resource-based industries, such as oil and gas, mining, and forestry. These industries often have a different performance trajectory compared to the US stock market, providing some level of insulation.

- Regulatory Environment: The regulatory environment in Canada is often seen as stricter compared to the US. This can lead to a more stable and transparent market, reducing the risk of a severe crash.

Case Studies:

- 2017's US Stock Market Crash: In 2017, the US stock market experienced a significant correction, with the S&P 500 falling by approximately 6% in a short period. Despite this, Canadian stocks were relatively stable, with the TSX Composite Index experiencing a modest decline.

- 2015's Oil Price Crash: In 2015, the oil price crash had a significant impact on the Canadian stock market, particularly on resource-based companies. However, the overall market did not experience a severe crash, and the TSX Composite Index recovered relatively quickly.

Conclusion: While it is difficult to predict the outcome of a stock market crash, it is evident that Canadian stocks can remain relatively safe even if the US stocks crash in 2017. Factors such as diversification, economic resilience, and a stable regulatory environment contribute to the Canadian stock market's ability to withstand potential downturns. However, it is essential for investors to conduct thorough research and consider their risk tolerance before making any investment decisions.

Blackrock US Stocks Analysis: Key Insights ? us steel stock dividend