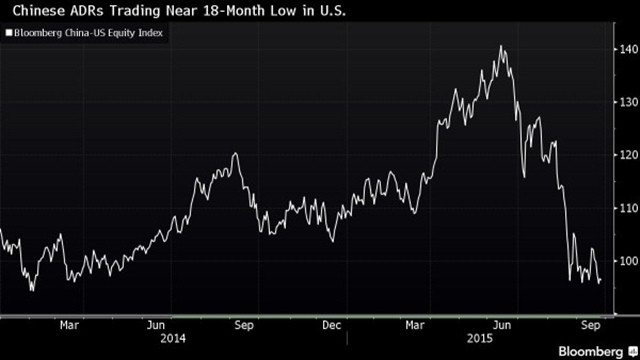

In the ever-evolving world of technology, the rise of Tencent has been nothing short of remarkable. As a leading Chinese multinational conglomerate, Tencent's stock price in the US has captured the attention of investors and analysts alike. This article delves into the current trends and future predictions for Tencent's stock, providing a comprehensive overview of its performance in the American market.

Understanding Tencent's Stock Performance

Tencent, a company known for its diverse portfolio, has made significant strides in various industries including gaming, social media, and online advertising. Its stock performance in the US reflects the company's global influence and potential for growth. Let's take a closer look at the key factors that have influenced Tencent's stock price.

1. Diversified Portfolio

One of the primary reasons for Tencent's stock growth is its diversified portfolio. The company operates in multiple sectors, including finance, entertainment, and technology. This diversification helps mitigate risks and contributes to steady growth. As a result, investors are more likely to view Tencent as a stable and reliable investment.

2. Strong Revenue Growth

Tencent's revenue growth has been a key driver behind its stock price in the US. The company's robust financial performance, particularly in its gaming and social media segments, has attracted investors. Moreover, Tencent's expansion into new markets, such as Southeast Asia, has further bolstered its revenue growth.

3. Strategic Partnerships and Acquisitions

Tencent's strategic partnerships and acquisitions have also played a significant role in its stock performance. The company has formed alliances with major players in various industries, including Facebook, Google, and Microsoft. These partnerships have helped Tencent gain a competitive edge and expand its market reach.

4. Market Sentiment and Speculation

Market sentiment and speculation also play a crucial role in determining Tencent's stock price. The stock's performance often mirrors the broader market's mood, and any positive news or speculation about the company can lead to a surge in its share price.

Current Trends and Predictions

As of now, Tencent's stock price in the US is on the rise. Several factors have contributed to this trend:

- Positive Revenue Growth: Tencent's strong revenue growth, particularly in its gaming and social media segments, has been a major factor behind its stock price surge.

- Market Speculation: Speculation about the company's future growth potential has also driven its stock price higher.

- Diversification: The diversification of Tencent's portfolio has made it a more appealing investment for investors looking for stability and growth.

Looking ahead, several factors could impact Tencent's stock price in the US:

- Global Economic Conditions: The global economy's performance could have a significant impact on Tencent's stock price. A downturn in the global economy could lead to reduced revenue for the company.

- Regulatory Changes: Changes in regulations, particularly in the gaming industry, could affect Tencent's revenue and stock price.

- Technological Advancements: The rapid pace of technological advancements could present both opportunities and challenges for Tencent.

Conclusion

In conclusion, Tencent's stock price in the US has been influenced by various factors, including its diversified portfolio, strong revenue growth, strategic partnerships, and market sentiment. As the company continues to expand its global presence, investors should stay tuned for future developments that could impact its stock price.

US Large Cap Momentum Stocks: Top 5 for 5 D? us steel stock dividend