In the ever-evolving world of finance, investors are constantly seeking the best opportunities to grow their wealth. One of the most popular methods for achieving this is through stock investment. However, with thousands of stocks available, how do you determine which ones are the best for you? This article will delve into the art of stocks comparison, highlighting key factors to consider and providing actionable insights to help you make informed decisions.

Understanding the Basics of Stocks Comparison

When comparing stocks, it's crucial to understand the fundamental aspects that differentiate one stock from another. These aspects include:

Market Capitalization: This refers to the total value of a company's outstanding shares. It is calculated by multiplying the number of shares by the current market price. Companies are typically categorized into small-cap, mid-cap, and large-cap based on their market capitalization.

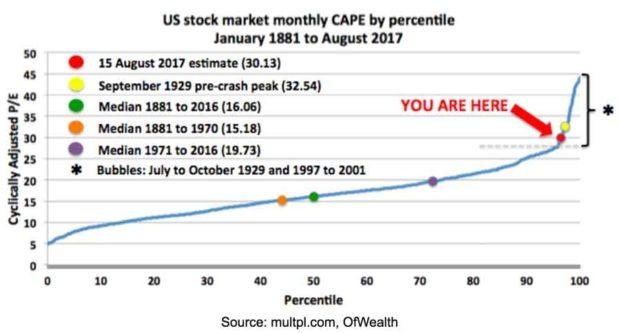

P/E Ratio: The price-to-earnings (P/E) ratio is a valuation metric that compares a company's stock price to its per-share earnings. A higher P/E ratio indicates that investors are willing to pay more for each dollar of earnings, which could suggest high growth expectations.

Dividend Yield: This is the percentage return on an investment, calculated by dividing the annual dividend per share by the stock's current price. A higher dividend yield can be an attractive feature for income-focused investors.

Earnings Growth: The rate at which a company's earnings are growing over time is a critical factor to consider. Consistent earnings growth can indicate a healthy and sustainable business.

Key Factors to Consider When Comparing Stocks

To effectively compare stocks, you should consider the following factors:

Industry: Different industries have varying growth prospects and risk profiles. It's essential to research the industry in which a company operates to understand its long-term potential.

Management: The quality of a company's management team can significantly impact its performance. Look for experienced and capable leaders with a strong track record.

Financial Health: Analyze a company's financial statements, including its balance sheet, income statement, and cash flow statement, to assess its financial health and stability.

Dividend Policy: If you're an income-focused investor, consider a company's dividend policy and history. Consistent dividend payments can provide a steady stream of income.

Case Study: Comparing Apple and Amazon

Let's take a look at a real-world example of stocks comparison. Consider two of the most well-known companies in the tech industry: Apple (AAPL) and Amazon (AMZN).

Market Capitalization: Apple has a higher market capitalization than Amazon, making it a large-cap company. This suggests that it is well-established and has a strong market presence.

P/E Ratio: Apple has a lower P/E ratio compared to Amazon, indicating that investors may be willing to pay less for each dollar of earnings in Apple.

Dividend Yield: Apple offers a higher dividend yield than Amazon, making it more attractive for income-focused investors.

Earnings Growth: Both companies have shown consistent earnings growth over the years, but Amazon has been the faster-growing of the two.

In this case, an investor looking for a stable, large-cap company with a strong dividend yield might prefer Apple, while someone seeking high growth potential might lean towards Amazon.

Conclusion

Stocks comparison is a critical skill for any investor looking to make informed decisions. By understanding the basics of stocks comparison and considering key factors such as market capitalization, P/E ratio, dividend yield, and earnings growth, you can identify the best investment opportunities for your needs. Remember to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

Stock Plan Connect: Connect with Us for Exp? us steel stock dividend