In the fast-paced world of investing, staying updated with the latest stock market trends is crucial. Today, we delve into the stocks chart to provide you with essential insights and analysis. Whether you are a seasoned investor or just starting out, understanding the current market trends can significantly impact your investment decisions.

Understanding the Stocks Chart Today

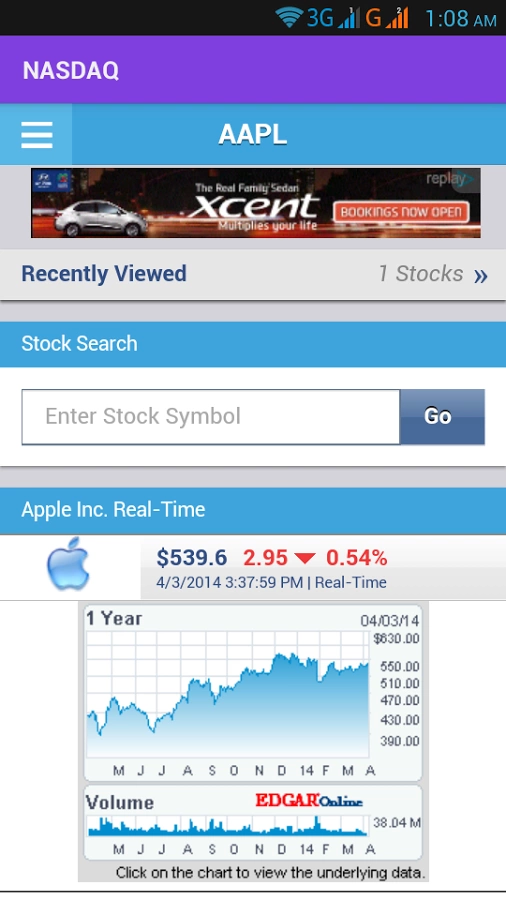

The stocks chart today presents a snapshot of the market's performance. It includes various elements such as opening and closing prices, highs and lows, trading volume, and technical indicators. By analyzing these factors, investors can gain valuable insights into the market's direction and potential opportunities.

Key Indicators to Watch

Opening and Closing Prices: These indicate the market's sentiment at the start and end of the trading day. A significant gap between the opening and closing prices can suggest strong buying or selling pressure.

Highs and Lows: These represent the highest and lowest prices reached during the trading day. They help identify the market's range and potential reversal points.

Trading Volume: This metric shows the number of shares traded during a specific period. An increase in trading volume often indicates a strong trend, while a decrease may suggest consolidation.

Technical Indicators: These tools, such as moving averages and RSI (Relative Strength Index), provide additional insights into the market's direction and momentum.

Stocks to Watch

Technology Stocks: The technology sector has been a major driver of the stock market's growth. Companies like Apple (AAPL) and Microsoft (MSFT) have seen significant gains in recent months.

Energy Stocks: The energy sector has experienced a surge due to rising oil prices. Companies like ExxonMobil (XOM) and Chevron (CVX) are worth keeping an eye on.

Healthcare Stocks: The healthcare sector has been a safe haven for investors, with companies like Johnson & Johnson (JNJ) and Pfizer (PFE) performing well.

Case Study: Tesla (TSLA)

Tesla (TSLA) has been a major player in the stock market, with its shares skyrocketing in recent years. Analyzing its stocks chart today, we can observe several key trends:

- Opening and Closing Prices: The stock has seen significant volatility, with both highs and lows reaching new record levels.

- Highs and Lows: The stock has experienced several pullbacks, but it has consistently managed to bounce back and reach new highs.

- Trading Volume: The trading volume has been consistently high, indicating strong interest in the stock.

- Technical Indicators: The RSI indicator shows that the stock is currently in an overbought territory, suggesting a potential pullback.

Conclusion

Analyzing the stocks chart today is essential for investors looking to make informed decisions. By understanding key indicators and keeping an eye on major sectors, investors can identify potential opportunities and mitigate risks. Remember, the stock market is unpredictable, and staying informed is crucial for long-term success.

Title: Buy or Sell US Stocks: Key Strategie? us steel stock dividend