Are you a Canadian investor considering expanding your portfolio to include US stocks? The decision to invest abroad can be daunting, but it also offers numerous opportunities. In this article, we will explore the advantages and disadvantages of investing in US stocks, providing you with valuable insights to help you make an informed decision.

Understanding the US Stock Market

The US stock market is the largest and most liquid in the world. It boasts a wide array of companies across various sectors, making it an attractive destination for international investors. Some of the key advantages of investing in the US stock market include:

- Diversification: By investing in US stocks, you can diversify your portfolio and reduce exposure to the Canadian market's volatility.

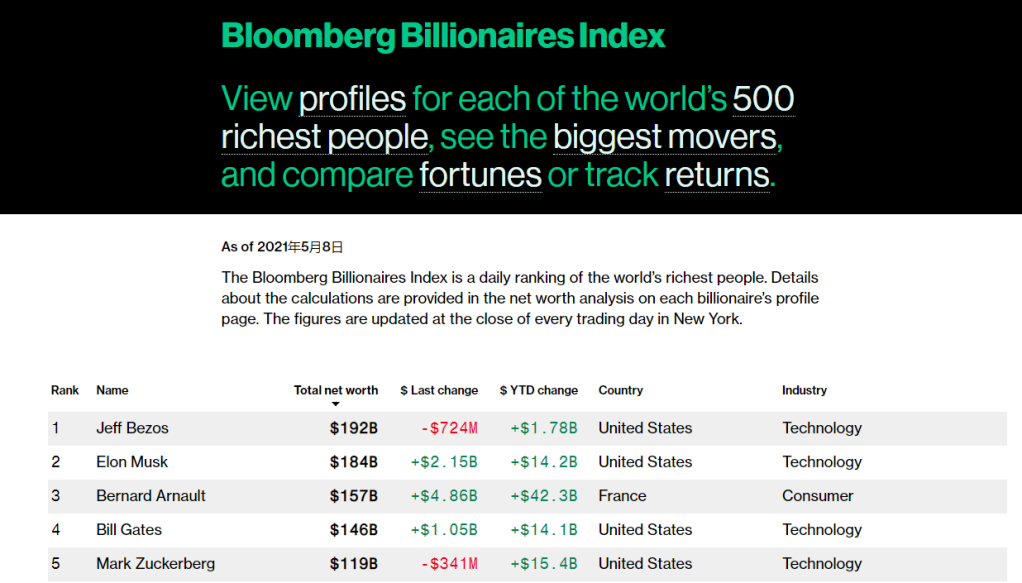

- Access to World-Class Companies: The US market is home to some of the most innovative and successful companies globally, such as Apple, Google, and Microsoft.

- Potential for High Returns: The US stock market has historically provided investors with high returns, making it an appealing option for those seeking long-term growth.

Advantages of Investing in US Stocks

1. Strong Economic Growth

The US economy has been consistently growing over the years, leading to strong corporate earnings and, subsequently, higher stock prices. This trend is expected to continue, making US stocks a compelling investment opportunity for Canadian investors.

2. Favorable Taxation

While Canadian investors are subject to taxes on dividends received from US stocks, the tax treatment can be more favorable compared to other countries. Additionally, tax treaties between Canada and the US can further mitigate tax burdens.

3. Access to a Larger Market

The US stock market offers a wider selection of investment options, allowing Canadian investors to access companies in industries that may not be well-represented in the Canadian market.

Disadvantages of Investing in US Stocks

1. Currency Risk

Investing in US stocks means dealing with currency exchange rates. Fluctuations in the CAD/USD exchange rate can impact the value of your investments in Canadian dollars.

2. Regulatory Challenges

Navigating the complexities of the US regulatory environment can be challenging for Canadian investors. Understanding the nuances of US securities laws is crucial to avoid legal issues.

3. Higher Transaction Costs

Purchasing and selling US stocks may incur higher transaction costs compared to Canadian stocks, particularly if you are not using a Canadian brokerage firm with US trading capabilities.

Case Studies

Consider the following case studies to understand the potential of investing in US stocks:

- Apple Inc. (AAPL): Apple is a global leader in technology and consumer electronics. Its strong performance in the US market has made it a valuable investment for Canadian investors.

- Tesla Inc. (TSLA): Tesla, an electric vehicle manufacturer, has experienced rapid growth in the US. Investing in Tesla stocks can provide exposure to the emerging electric vehicle market.

Conclusion

Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. However, it is crucial to carefully consider the advantages and disadvantages before making a decision. Conduct thorough research, seek professional advice, and stay informed about market trends to make the most of your investments.

Title: Understanding the PE Ratio: A Key In? us steel stock dividend