In the world of investing, stability is often synonymous with safety and profitability. Investors looking for long-term gains often gravitate towards most stable US stocks that offer consistent returns and reduced volatility. This article will delve into the characteristics of stable stocks and highlight some of the best options in the U.S. stock market.

What Makes a Stock Stable?

Stable stocks typically exhibit the following characteristics:

- Consistent Earnings: Companies with stable earnings are less likely to be affected by market fluctuations.

- Low Debt: A low debt-to-equity ratio indicates that a company can weather economic downturns without resorting to bankruptcy.

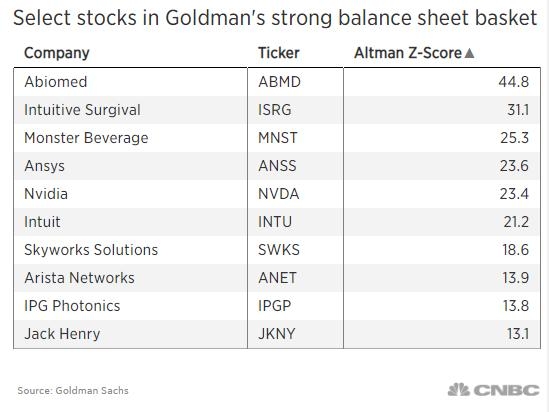

- Strong Balance Sheet: Companies with a strong balance sheet are better positioned to handle unexpected expenses and investments.

- Robust Dividends: Dividend-paying stocks often provide a steady stream of income, making them attractive to income investors.

- Strong Management: A company with a visionary and competent management team is more likely to navigate market challenges successfully.

Top Stable US Stocks to Consider

- Apple Inc. (AAPL)

Apple is a technology giant known for its iPhones, iPads, and Mac computers. The company's strong financial position and consistent earnings make it one of the most stable stocks in the U.S. market. With a market capitalization of over $2 trillion, Apple is a staple in many diversified portfolios.

- Johnson & Johnson (JNJ)

Johnson & Johnson is a healthcare giant with a diverse product portfolio that includes pharmaceuticals, medical devices, and consumer goods. The company has a long history of stable earnings and a strong dividend yield, making it an attractive investment for income investors.

- Procter & Gamble (PG)

Procter & Gamble is a consumer goods company with a wide range of well-known brands, such as Tide, Crest, and Pampers. The company has a strong track record of stable earnings and dividends, making it a popular choice for investors seeking stability.

- Microsoft Corporation (MSFT)

Microsoft is a technology powerhouse known for its Windows operating system, Office productivity suite, and cloud computing services. The company has a strong balance sheet and a history of consistent earnings, making it a solid investment for long-term growth.

- Visa Inc. (V)

Visa is a financial services company that provides payment processing and transaction services. The company has a dominant position in the global payments market and generates significant revenue from transaction fees. Visa's strong financial position and consistent earnings make it a stable investment choice.

Case Study: Procter & Gamble (PG)

To illustrate the stability of Procter & Gamble, let's consider the company's financial performance over the past decade:

- Revenue: Procter & Gamble's revenue has grown consistently over the past decade, with a compound annual growth rate (CAGR) of 3.5%.

- Earnings: The company's earnings per share (EPS) have also grown steadily, with a CAGR of 6.7%.

- Dividends: Procter & Gamble has increased its dividend payments each year, with a yield of approximately 2.6%.

This case study demonstrates Procter & Gamble's ability to generate consistent earnings and dividends, making it a stable investment choice for long-term investors.

In conclusion, investing in most stable US stocks can provide investors with consistent returns and reduced volatility. By focusing on companies with strong financial positions, consistent earnings, and robust dividends, investors can build a diversified portfolio that stands the test of time.

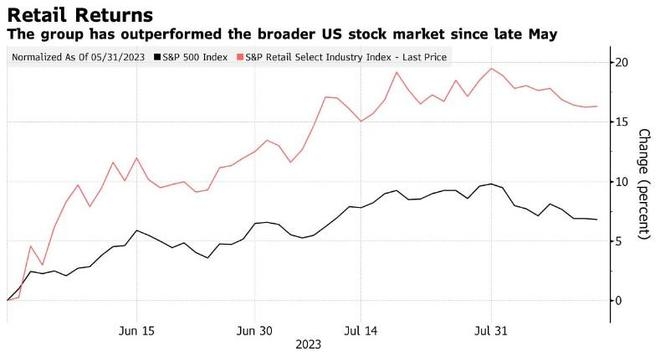

Top Performing US Large Cap Stocks July 202? us steel stock dividend