Introduction: Investing in low price volatile stocks can be an exciting and potentially lucrative venture. These stocks often attract the attention of seasoned investors who are looking for significant returns on their investments. However, as with any investment, it is crucial to understand the risks involved. In this article, we will explore the world of low price volatile stocks in the US, discussing their opportunities, risks, and key factors to consider.

Understanding Low Price Volatile Stocks: Low price volatile stocks are characterized by their relatively low price and high price fluctuations. These stocks are often associated with smaller companies or emerging markets, which can make them more risky but also more rewarding. While these stocks may experience rapid price swings, they also have the potential to deliver substantial returns.

Opportunities:

High Potential Returns: One of the main attractions of low price volatile stocks is the potential for high returns. Investors who are able to identify and invest in these stocks at the right time can see significant gains in a short period.

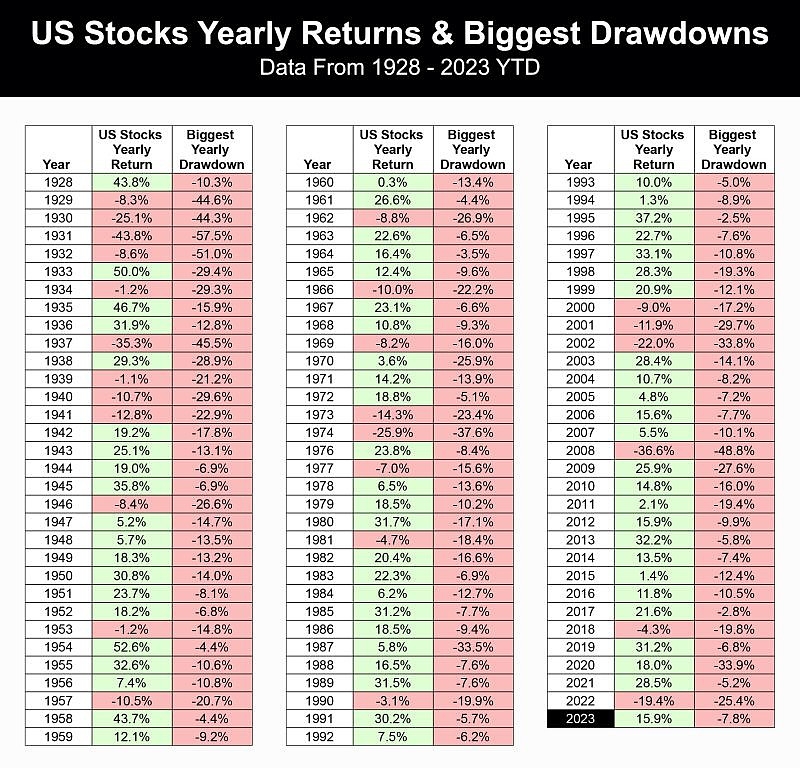

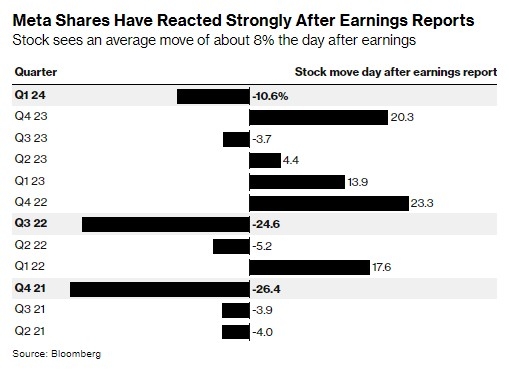

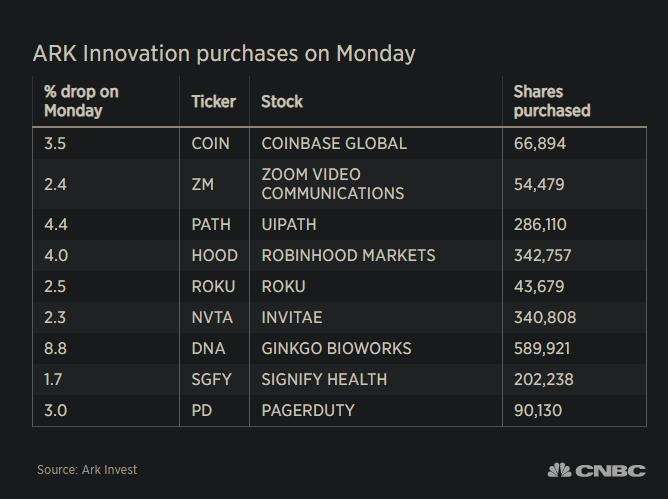

Market Timing: Successful investors often capitalize on market volatility to buy low and sell high. Low price volatile stocks provide opportunities for market timing, allowing investors to profit from market fluctuations.

Diversification: Including low price volatile stocks in a diversified portfolio can help reduce overall risk. These stocks can provide exposure to different sectors and industries, potentially enhancing portfolio performance.

Risks:

Market Risk: Low price volatile stocks are often more sensitive to market movements, which can lead to significant losses during market downturns.

Liquidity Risk: These stocks may be less liquid, meaning they may not be easily bought or sold without affecting the stock price. This can make exiting positions more challenging.

Company-Specific Risk: Investing in smaller companies can expose investors to higher risks, including poor financial performance, management issues, and regulatory challenges.

Key Factors to Consider:

Company Financials: Conduct thorough research on the financial health of the company, including revenue growth, profit margins, and debt levels.

Market Trends: Stay informed about market trends and economic indicators that could impact the company's performance.

Technical Analysis: Utilize technical analysis tools to identify patterns and trends in the stock's price movement.

Risk Management: Implement risk management strategies, such as setting stop-loss orders and diversifying your portfolio.

Case Study: Consider a low price volatile stock like XYZ Corporation, a small tech company with high growth potential. After conducting thorough research, you identify that the company has a strong product pipeline and a dedicated management team. Utilizing technical analysis, you notice a trend of increasing price momentum. By investing in XYZ Corporation, you can benefit from its potential growth while managing the risks associated with low price volatile stocks.

Conclusion: Low price volatile stocks in the US present unique opportunities and risks. While these stocks can offer significant returns, they also require careful analysis and risk management. By understanding the key factors and conducting thorough research, investors can make informed decisions and potentially capitalize on the volatility of these stocks.

US Liquid Natural Gas Stock: A Comprehensiv? us steel stock dividend