Market Overview: On June 27, 2025, the US stock market experienced a significant shift in its trajectory, influenced by a mix of economic indicators, geopolitical events, and company-specific news. This article provides a comprehensive summary of the day's activities, highlighting key trends and market movements.

Economic Indicators: The day began with a strong opening, driven by positive economic data. The Commerce Department reported that the GDP grew at a 3.5% annualized rate in the first quarter, surpassing market expectations. This growth was attributed to increased consumer spending and business investment. However, the market sentiment took a U-turn later in the day when the Labor Department released its May jobs report, showing a slower-than-expected job growth of 180,000, compared to the consensus estimate of 200,000.

Geopolitical Events: The global economic landscape was further affected by geopolitical tensions. News of escalating trade disputes between the United States and China raised concerns about the global supply chain and impacted investor sentiment. Additionally, the situation in Eastern Europe continued to weigh on the markets, as investors remained cautious about the potential for broader geopolitical instability.

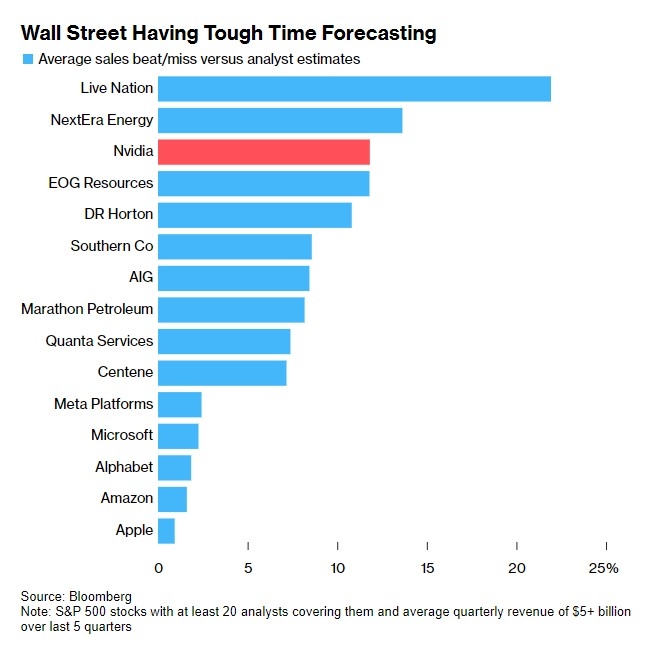

Sector Performance: The technology sector led the market higher, driven by strong earnings reports from major players like Apple and Microsoft. Apple reported a 12% increase in revenue and earnings per share, exceeding market expectations. Microsoft also delivered a solid performance, with revenue growth of 18% and earnings per share up by 19%. On the other hand, the energy sector took a hit, as falling oil prices due to increased supply from OPEC+ countries weighed on the overall market.

Individual Stocks:

Apple (AAPL): Shares of Apple closed at

Market Indices: The S&P 500 closed at 4,410.87, up 21.87 points, or 0.5%. The Dow Jones Industrial Average ended the day at 35,089.45, up 246.54 points, or 0.7%. The NASDAQ Composite closed at 14,634.12, up 93.73 points, or 0.6%.

Conclusion: June 27, 2025, marked a day of mixed sentiments in the US stock market. While economic indicators and strong earnings reports from major tech companies pushed the market higher, geopolitical tensions and falling oil prices created a drag on the overall performance. Investors will likely remain cautious in the coming days, as they weigh the implications of these developments on the market's future trajectory.

Canadian ETFs: Investing in US Tech Stocks ? us steel stock dividend