In the annals of American economic history, joint stock companies have played a pivotal role. These entities, characterized by the pooling of capital from multiple investors, have been instrumental in the nation's growth and development. This article delves into the definition of joint stock companies and their significance in the context of American history.

What Are Joint Stock Companies?

A joint stock company is a type of business organization where the capital is divided into shares, and investors buy these shares to become part-owners of the company. This structure allows for large-scale investments in projects that might otherwise be unfeasible due to the high capital requirements. The shares can be bought, sold, or transferred, making it a flexible and dynamic way of raising capital.

The Genesis of Joint Stock Companies in the United States

The concept of joint stock companies in the United States can be traced back to the colonial era. The Virginia Company and the Lloyd's of London were among the earliest examples of such entities. These companies were primarily involved in maritime ventures, including exploration, trade, and colonization.

The Role of Joint Stock Companies in American History

Colonial Era: Joint stock companies were instrumental in the colonization of America. The Virginia Company and the Lloyd's of London were key players in this era, raising capital for exploration and settlement.

The 18th Century: During the 18th century, joint stock companies played a significant role in the development of infrastructure. The Baltimore and Ohio Railroad and the Canal Company of New York are notable examples.

The 19th Century: The 19th century saw a surge in the formation of joint stock companies. These entities were involved in various sectors, including mining, manufacturing, and transportation. The Union Pacific Railroad and the Cincinnati, Hamilton, and Dayton Railroad are prominent examples.

Case Study: The Union Pacific Railroad

The Union Pacific Railroad is a classic example of a joint stock company's impact on American history. Formed in 1862, the company was instrumental in completing the transcontinental railroad. The project required a massive amount of capital, which was raised through the issuance of shares. The railroad not only connected the East and West coasts but also facilitated the movement of goods and people, thereby fostering economic growth.

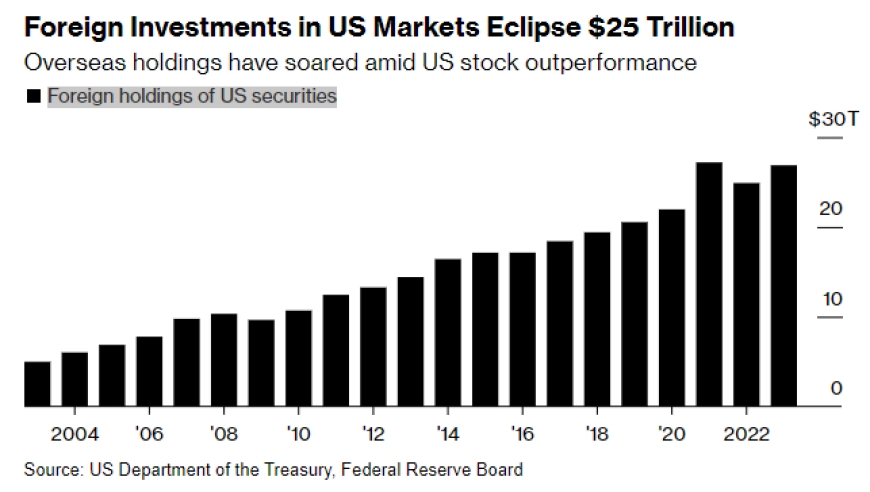

The Impact of Joint Stock Companies on the Modern Business Landscape

Today, joint stock companies are a common feature of the business landscape. They offer a flexible and efficient way of raising capital, allowing businesses to expand and innovate. The structure also provides investors with a way to diversify their portfolios and participate in the growth of companies.

Conclusion

In conclusion, joint stock companies have been a cornerstone of American economic history. Their ability to pool capital and facilitate large-scale investments has been instrumental in the nation's growth and development. From colonial times to the modern era, these entities have played a vital role in shaping the American business landscape.

Unlocking the Potential of GE Stock: A Smar? us steel stock dividend