In recent years, there has been a lot of buzz about the Federal Reserve (US Fed) potentially buying stocks. This has sparked debates and discussions among investors, economists, and the general public. But is there any truth to these claims? Let's delve into the topic and uncover the facts.

Understanding the Federal Reserve's Role

The Federal Reserve, often referred to as "the Fed," is the central banking system of the United States. Its primary role is to manage the country's monetary policy, which includes controlling interest rates, regulating financial institutions, and ensuring the stability of the economy. However, the Fed's involvement in the stock market is a topic that requires closer examination.

The Fed's Main Functions

The Federal Reserve has three main functions:

- Monetary Policy: The Fed adjusts interest rates to control inflation and stimulate economic growth.

- Supervising and Regulating Financial Institutions: The Fed ensures that banks and other financial institutions operate in a safe and sound manner.

- Lender of Last Resort: The Fed provides emergency liquidity to financial institutions during times of financial crisis.

Is the Fed Buying Stocks?

Contrary to popular belief, the Federal Reserve does not buy stocks. Its main focus is on monetary policy and the stability of the financial system. The Fed's actions, such as adjusting interest rates or implementing quantitative easing, can indirectly impact the stock market, but it does not directly purchase stocks.

Quantitative Easing and the Stock Market

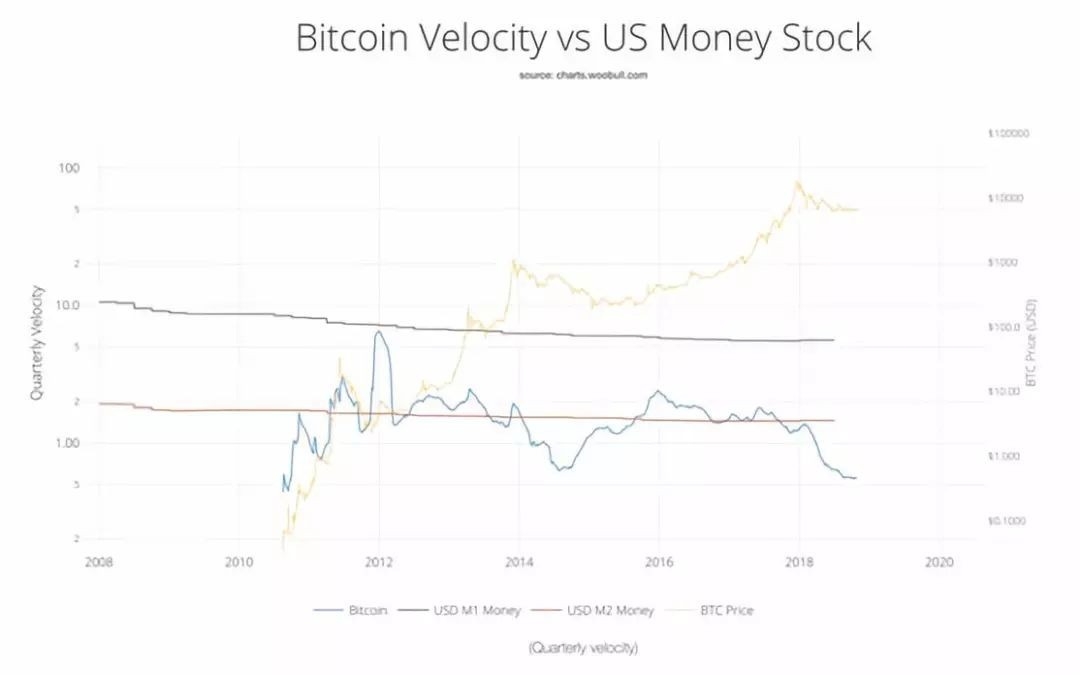

Quantitative easing (QE) is a monetary policy tool used by the Fed to stimulate the economy. During QE, the Fed buys government securities and other financial assets to increase the money supply and lower long-term interest rates. This can lead to an increase in stock prices, as investors seek higher returns in a low-interest-rate environment.

However, it's important to note that while QE can have a positive impact on the stock market, it is not the same as the Fed buying stocks. The Fed's purchases are aimed at influencing the broader economy, not targeting specific stocks.

Examples of the Fed's Actions

To illustrate the Fed's role, let's consider a few examples:

- 2008 Financial Crisis: During the 2008 financial crisis, the Fed implemented various emergency lending facilities and purchased mortgage-backed securities to stabilize the financial system.

- 2010-2011 QE2: The Fed launched QE2 in 2010, purchasing $600 billion in Treasury securities to stimulate economic growth and lower long-term interest rates.

- 2020 Pandemic Response: In response to the COVID-19 pandemic, the Fed implemented a series of unconventional monetary policies, including purchasing corporate bonds and other assets to support the economy.

Conclusion

In conclusion, the Federal Reserve does not buy stocks. Its primary focus is on monetary policy and the stability of the financial system. While the Fed's actions can indirectly impact the stock market, it is not involved in direct stock purchases. Understanding the Fed's role and its functions is crucial for investors and the general public to make informed decisions.

US Lighting Group Stock Price: A Comprehens? us steel stock dividend