Have you ever wondered about the number of US stocks that have options available? The options market is a crucial component of the stock trading landscape, providing investors with diverse strategies to manage risk and enhance returns. In this article, we'll explore the vast array of US stocks with options and provide valuable insights into this dynamic market.

Understanding US Stocks with Options

To answer the question, "how many US stocks have options?" it's essential to first understand what options are. Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. The underlying asset can be a stock, bond, commodity, or index.

In the United States, options are primarily traded on two major exchanges: the Chicago Board Options Exchange (CBOE) and the Options Clearing Corporation (OCC). These exchanges list options on a wide range of US stocks, making it possible for investors to trade options on virtually any publicly-traded company.

The Number of US Stocks with Options

The number of US stocks with options is vast and continually growing. According to data from the OCC, there are currently over 3,000 US stocks with options available for trading. This figure represents a significant portion of the total number of publicly-traded companies in the United States.

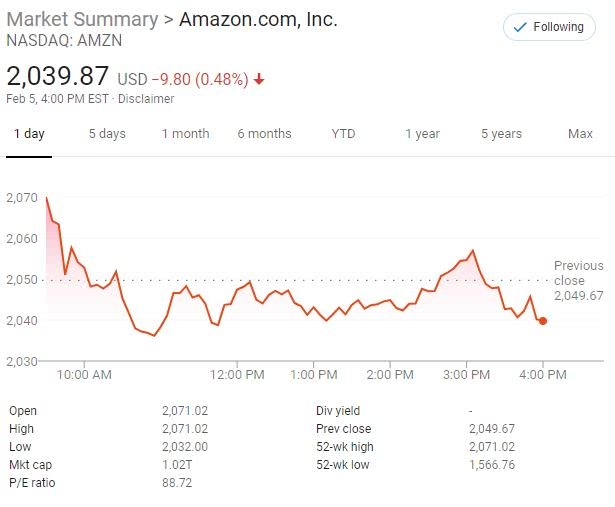

While the number of stocks with options may seem overwhelming, it's important to note that not all stocks have the same level of liquidity or trading volume. Some of the most popular and widely-traded US stocks, such as Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN), have the highest number of options available.

Benefits of Trading Options on US Stocks

Trading options on US stocks offers several benefits, including:

- Risk Management: Options allow investors to hedge their positions against potential market downturns, protecting their investments from significant losses.

- Leverage: Options provide leverage, enabling investors to control a larger position with a smaller amount of capital.

- Diversification: Options allow investors to diversify their portfolios by taking positions in various sectors and industries.

- Strategic Flexibility: Options provide investors with a wide range of strategies to profit from market movements, including covered calls, put spreads, and collars.

Case Study: Apple Inc. (AAPL)

Apple Inc. (AAPL) is one of the most popular and widely-traded US stocks with options. As of this writing, there are over 200 options available for trading on AAPL. This level of liquidity makes it easier for investors to enter and exit positions quickly, with minimal slippage.

One popular option strategy on AAPL is the covered call. This strategy involves owning the underlying stock and selling a call option on that stock. The covered call strategy can generate income from the premium received while still allowing the investor to participate in potential upside gains.

Conclusion

In conclusion, the number of US stocks with options is vast and continues to grow. With over 3,000 stocks available for trading, investors have a wide range of options to choose from. Understanding the benefits and strategies associated with trading options on US stocks can help investors enhance their portfolio returns and manage risk effectively.

US Airline Stock ETF: A Comprehensive Guide? us steel stock dividend