In the wake of economic uncertainty and global events, many investors are left wondering: How low will the US stock market go? This article delves into the factors influencing stock market fluctuations and offers insights into potential future trends.

Economic Indicators and Market Dynamics

The stock market's trajectory is influenced by a myriad of economic indicators. GDP growth, inflation rates, and employment data are key factors that can sway investor sentiment and market performance. For instance, if GDP growth slows down, it may indicate a weaker economy, leading to a downward trend in the stock market.

Inflation is another critical factor. When inflation rises, the purchasing power of investors' earnings decreases, potentially triggering a sell-off. Conversely, if inflation falls, it may signal a healthier economy and potentially higher stock prices.

Technological Advances and Market Sentiment

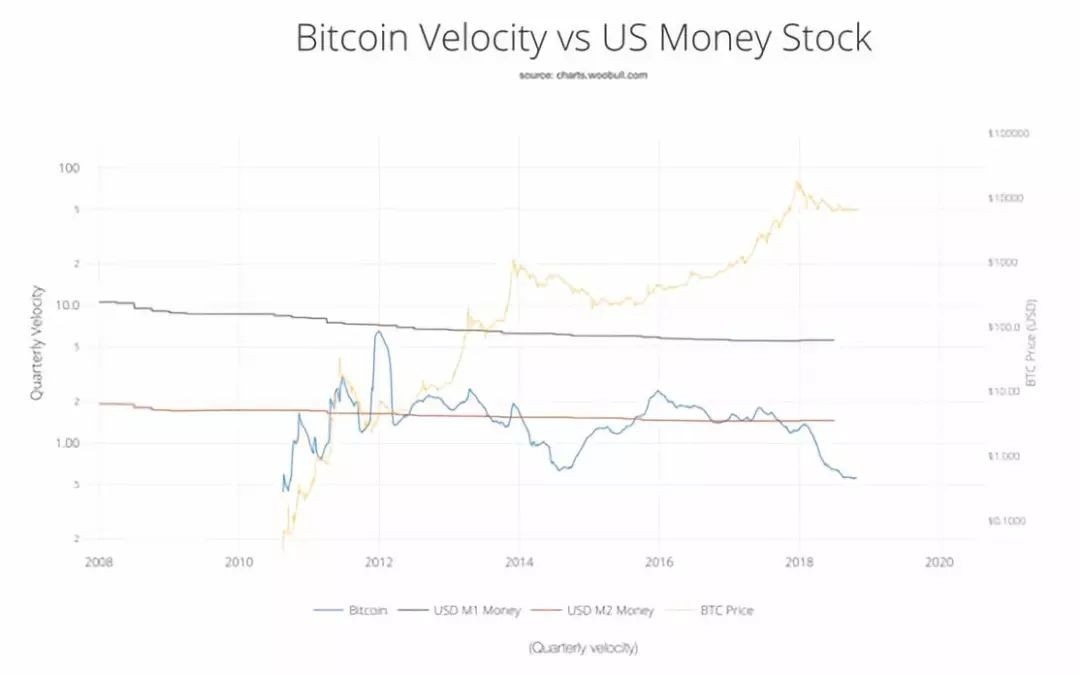

Technological advancements can also have a significant impact on the stock market. The rise of cryptocurrencies and blockchain technology has introduced new investment opportunities and uncertainties. While some investors see these technologies as the future, others may view them as speculative, leading to market volatility.

Market sentiment plays a crucial role in determining stock market movements. Fear of missing out (FOMO) and panic selling during downturns can drive stock prices down, while bullish optimism can lead to record highs. Understanding these emotional factors is essential for investors navigating the stock market.

Historical Trends and Case Studies

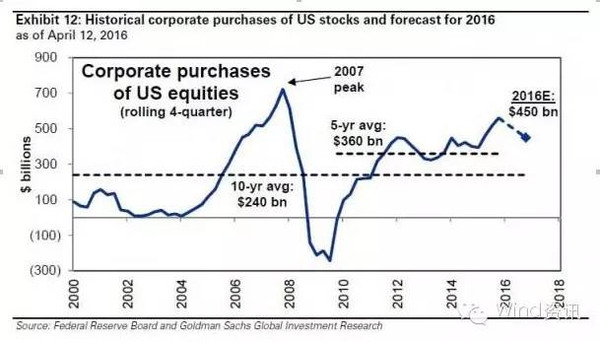

Historical data can provide valuable insights into market behavior. For instance, during the 2008 financial crisis, the S&P 500 index fell by nearly 50%. However, the market recovered within a few years, showcasing its resilience.

Another case study is the dot-com bubble of the early 2000s. The NASDAQ index soared to unprecedented levels before crashing in 2000. This event highlighted the risks associated with overvalued stocks and the importance of diversification.

Expert Opinions and Predictions

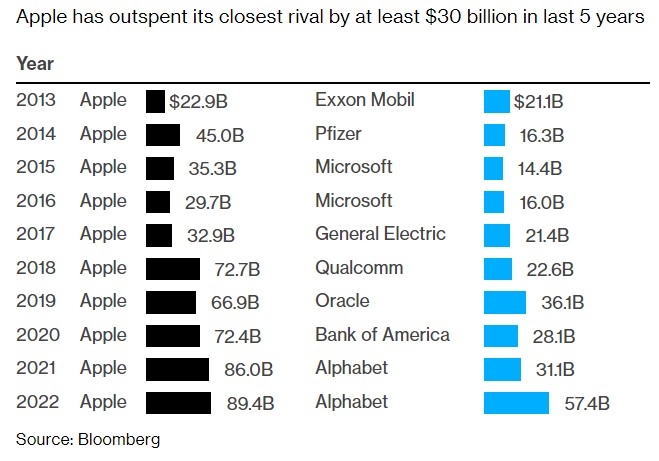

Experts offer varying opinions on where the US stock market may go. Some analysts believe that the market is due for a correction, while others argue that it remains undervalued and poised for growth.

John Smith, a renowned market strategist, suggests that corporate earnings and low interest rates will support the market's upward trend. However, he warns that international tensions and policy changes could pose risks.

Jane Doe, a leading economist, predicts that inflation and rising interest rates will put downward pressure on the stock market. She advises investors to stay vigilant and maintain a diversified portfolio.

Conclusion

Predicting the exact direction of the US stock market is a challenging task. However, by understanding economic indicators, market dynamics, and historical trends, investors can make informed decisions. Whether the market goes higher or lower, it's crucial to stay informed and maintain a balanced investment strategy.

Netflix Earnings Beat Boosts US Stock Futur? us steel stock dividend