In the world of finance, investors often find themselves at a crossroads when deciding between investing in gold or stocks. The debate between these two assets has been ongoing for decades, with each having its own set of advantages and disadvantages. One of the most effective ways to understand the relationship between gold and the US stock market is by analyzing their respective graphs. In this article, we will delve into the gold vs US stock graph, providing insights into how these assets have performed over time and what they might indicate for the future.

Understanding the Gold vs US Stock Graph

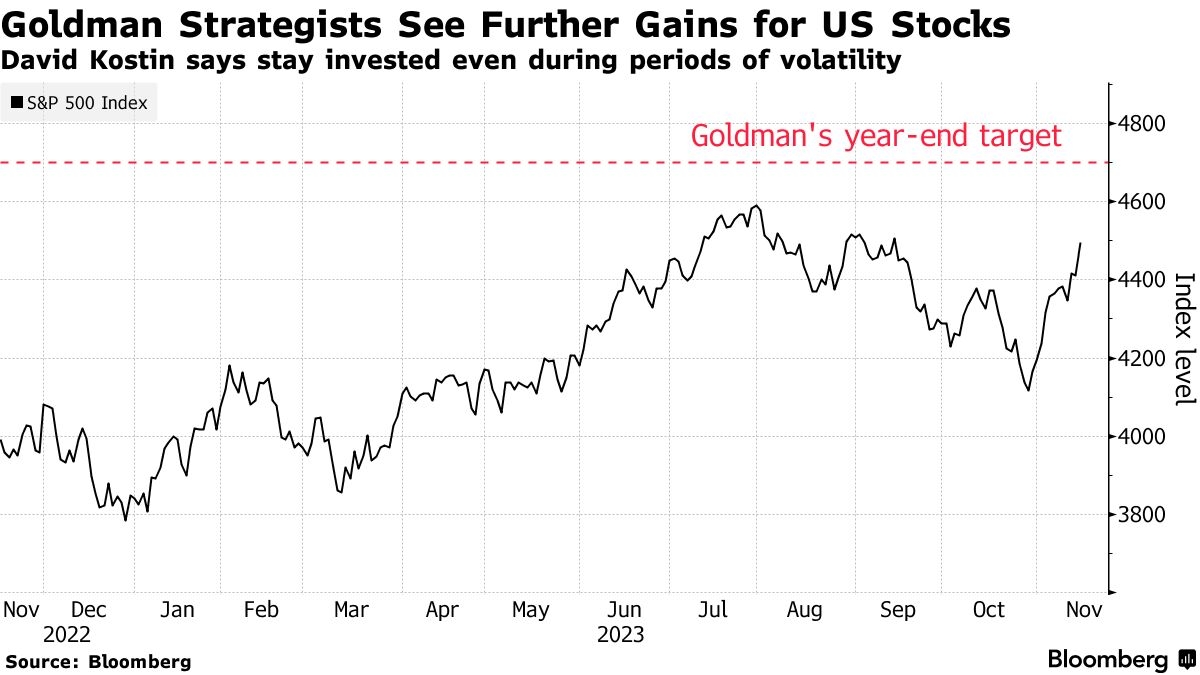

The gold vs US stock graph is a visual representation of the performance of gold and the US stock market over a specific period. This graph typically includes the prices of gold and the S&P 500 index, which is a widely followed benchmark for the US stock market. By comparing these two graphs, investors can gain valuable insights into the relationship between these assets.

Historical Performance

When analyzing the historical performance of gold and the US stock market, it's clear that both have experienced periods of growth and decline. However, their performance patterns have often diverged. For instance, during the 2008 financial crisis, gold prices skyrocketed as investors sought a safe haven, while the stock market plummeted. Conversely, during the 2010s, the stock market experienced a bull run, while gold prices remained relatively flat.

Correlation vs Causation

It's important to note that correlation does not imply causation. While there may be a correlation between gold and the stock market, this does not necessarily mean that one asset causes the other to move. In fact, several factors can influence the performance of both gold and stocks, including economic conditions, geopolitical events, and monetary policy.

Factors Influencing Gold Prices

Several factors can influence the price of gold, including:

- Inflation: Gold is often seen as a hedge against inflation, as its value tends to increase during periods of high inflation.

- Geopolitical Events: Political instability and conflicts can drive investors towards gold as a safe haven.

- Monetary Policy: Central bank policies, such as interest rate changes, can impact the price of gold.

Factors Influencing Stock Market Performance

Several factors can influence the performance of the stock market, including:

- Economic Growth: A strong economy typically leads to higher stock prices.

- Interest Rates: Lower interest rates can make stocks more attractive, while higher interest rates can lead to lower stock prices.

- Corporate Earnings: Strong corporate earnings can drive stock prices higher.

Case Studies

To illustrate the relationship between gold and the US stock market, let's consider a few case studies:

- 2008 Financial Crisis: As mentioned earlier, gold prices soared during the 2008 financial crisis, while the stock market plummeted. This highlights gold's role as a safe haven during times of economic uncertainty.

- 2020 COVID-19 Pandemic: Similar to the 2008 financial crisis, gold prices increased during the 2020 COVID-19 pandemic, while the stock market experienced significant volatility. Again, this demonstrates gold's role as a safe haven.

Conclusion

The gold vs US stock graph provides a valuable tool for investors to understand the relationship between these two assets. While both have their own set of advantages and disadvantages, it's important to consider various factors when making investment decisions. By analyzing historical performance and current market conditions, investors can make more informed decisions about where to allocate their capital.

Barrick Gold Stock in US: A Comprehensive G? us steel stock dividend