Introduction

In recent years, the global financial landscape has seen a significant shift, with China emerging as a major player in the U.S. stock market. The surge in Chinese investments has sparked discussions and debates about its implications. This article delves into the reasons behind China's purchase of U.S. stocks and its potential impact on the American economy.

Understanding the Numbers

China's Investment Surge

The data speaks for itself. Over the past decade, China has been on a buying spree in the U.S. stock market. According to the U.S. Treasury Department, Chinese investors have been purchasing a significant portion of American stocks. In 2021 alone, China bought $123 billion in U.S. equities, making it the second-largest foreign buyer.

Reasons for Investment

- Seeking Higher Returns: With the rapid growth of the Chinese economy, investors are looking for new avenues to diversify their portfolios and secure higher returns. The U.S. stock market, known for its robustness and innovation, is seen as an attractive destination for Chinese investors.

- Currency Hedging: As the Chinese Yuan strengthens against the U.S. Dollar, Chinese investors are hedging their currency exposure by investing in U.S. stocks. This strategy helps protect their wealth from currency fluctuations.

- Technology and Innovation: China's investment in U.S. technology companies is driven by its desire to learn and adopt the latest technological advancements. Companies like Apple, Microsoft, and Alphabet are among the favorites.

Impact on the U.S. Economy

- Job Creation: The influx of foreign investment has contributed to job creation in the U.S. Many technology and manufacturing companies have expanded their operations due to increased investment, leading to more job opportunities for Americans.

- Market Stability: Chinese investment has added stability to the U.S. stock market. With a major player like China in the mix, the market becomes more resilient to fluctuations and volatility.

- Trade Balance: While Chinese investment in U.S. stocks does not directly affect the trade balance, it has the potential to create a positive ripple effect. As Chinese companies expand their presence in the U.S., it can lead to increased exports and imports, benefiting the trade balance.

Case Studies

- Alibaba: In 2014, Alibaba, a Chinese e-commerce giant, went public on the New York Stock Exchange. Its IPO raised $21.8 billion, making it the largest in history. Since then, Alibaba has been a significant presence in the U.S. stock market, attracting Chinese investors and creating a win-win situation for both parties.

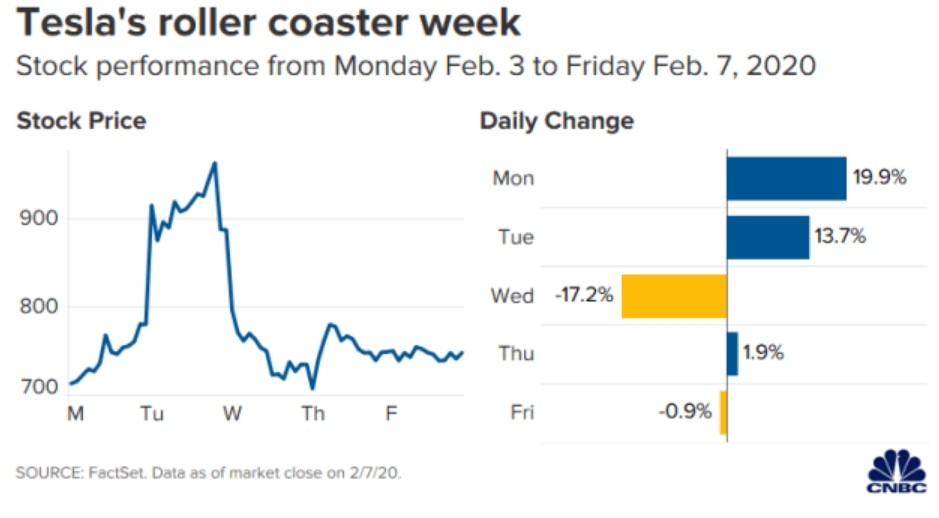

- Tesla: Tesla, an American electric vehicle manufacturer, has been a favorite among Chinese investors. The company has received significant funding from Chinese venture capital firms, propelling its growth and solidifying its position in the global market.

Conclusion

China's purchase of U.S. stocks is a testament to the interconnectedness of the global economy. While it presents opportunities for growth and innovation, it also raises questions about the long-term implications of such a significant foreign investment. As the relationship between China and the U.S. continues to evolve, it is crucial to monitor the impact of these investments and ensure that they benefit both nations.

The Effects of Stocks After the U.S. Electi? us steel stock dividend