In recent years, the cannabis industry has experienced a significant boom, with companies across the United States capitalizing on the growing demand for legal marijuana products. As this sector continues to expand, investors are increasingly looking to invest in cannabis stocks. This article provides a comprehensive guide to understanding cannabis companies in the US stock market, including their potential, risks, and how to invest in them.

Understanding the Cannabis Industry

The cannabis industry encompasses a wide range of products, from medical marijuana to recreational cannabis. The market has seen a surge in growth, primarily due to the legalization of cannabis in several states and the increasing acceptance of medical marijuana. This has opened up opportunities for companies to produce, distribute, and sell cannabis products.

Key Players in the US Cannabis Stock Market

Several companies have made a name for themselves in the US cannabis stock market. Some of the notable players include:

- Canopy Growth Corporation (CGC): One of the largest cannabis companies in the world, Canopy Growth has a strong presence in the Canadian and US markets.

- Aurora Cannabis Inc. (ACB): Another major player in the cannabis industry, Aurora Cannabis has operations in Canada, Europe, and the US.

- Curaleaf Holdings Inc. (CURL): Curaleaf is one of the largest operators of medical cannabis clinics in the US and has a significant market share in the recreational cannabis market.

Investing in Cannabis Stocks

Investing in cannabis stocks can be a lucrative opportunity, but it's essential to understand the risks involved. Here are some key points to consider when investing in cannabis stocks:

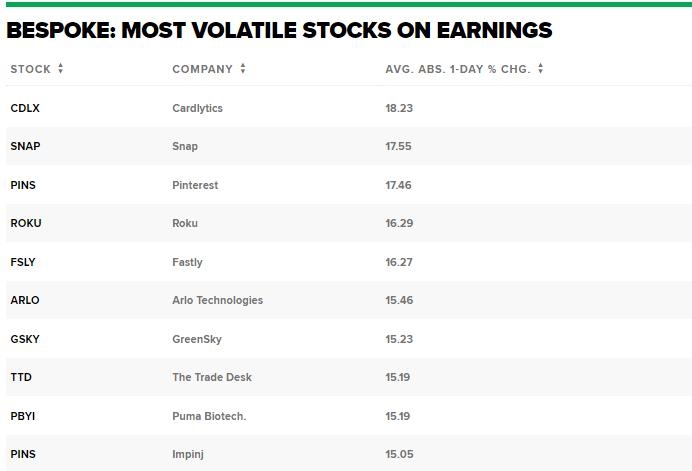

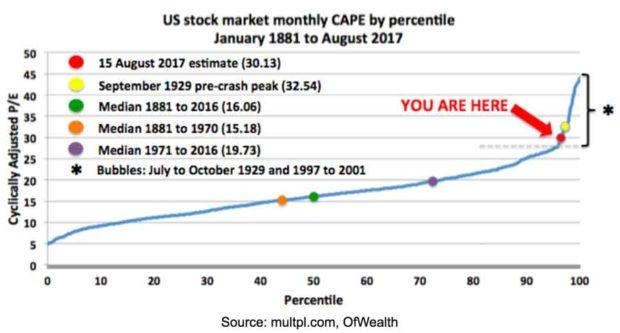

- Market Volatility: The cannabis industry is highly volatile, and stock prices can fluctuate significantly based on various factors, including regulatory changes and market trends.

- Regulatory Risk: The legal status of cannabis varies by state, and federal regulations remain uncertain. This can pose significant risks to companies operating in the industry.

- Company Performance: It's crucial to research and analyze the financial performance and growth potential of individual companies before investing.

How to Invest in Cannabis Stocks

Investing in cannabis stocks can be done through various methods, including:

- Stock Market: You can buy shares of cannabis companies directly through a stockbroker or online trading platform.

- ETFs: Exchange-Traded Funds (ETFs) provide investors with exposure to the cannabis industry without the need to buy individual stocks.

- Mutual Funds: Some mutual funds invest in cannabis companies, allowing investors to diversify their portfolios.

Case Studies

Let's take a look at a couple of case studies to better understand the potential and risks of investing in cannabis stocks:

- Canopy Growth Corporation (CGC): Canopy Growth has seen significant growth since its IPO in 2014, with its stock price rising from around

5 to over 50. However, the company has faced challenges, including increased competition and regulatory hurdles. - Aurora Cannabis Inc. (ACB): Aurora Cannabis has experienced similar growth to Canopy Growth, with its stock price rising from around

3 to over 30. Like Canopy Growth, Aurora has faced challenges, including increased competition and regulatory uncertainty.

In conclusion, investing in cannabis stocks can be a profitable opportunity, but it's essential to understand the risks and conduct thorough research before making investment decisions. By staying informed and cautious, investors can navigate the volatile cannabis stock market and potentially reap significant rewards.

US Markets News Today: Stocks, Bonds, and E? us steel stock dividend