Are you a non-US citizen dreaming of investing in the bustling stock market of the United States? The good news is that you can indeed invest in stocks without holding American citizenship. This article will guide you through the process, highlighting key considerations and potential benefits.

Understanding the Basics

Firstly, it's essential to understand that investing in stocks involves purchasing shares of a company, which represents a portion of that company's ownership. The U.S. stock market, known as the New York Stock Exchange (NYSE) and the NASDAQ, is one of the largest and most liquid in the world, offering a wide range of investment opportunities.

Opening a Brokerage Account

To invest in U.S. stocks, you'll need to open a brokerage account. This account serves as a platform for buying and selling stocks. Many reputable brokerage firms, such as Charles Schwab, Fidelity, and TD Ameritrade, offer accounts to non-US citizens.

When opening an account, you'll typically need to provide identification, proof of residence, and financial information. It's important to choose a brokerage firm that is well-regarded and has a strong track record of customer service and security.

Understanding the Risks

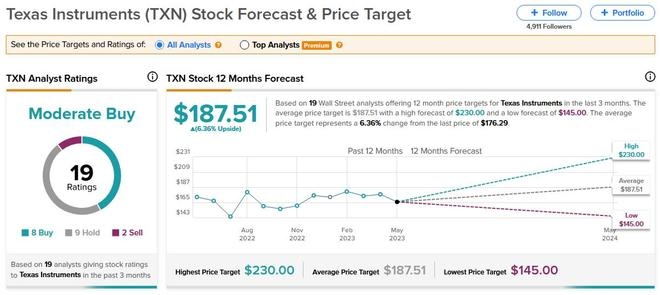

Before diving into the stock market, it's crucial to understand the risks involved. The stock market can be volatile, and investments can fluctuate significantly in value. It's essential to do thorough research and consider your risk tolerance before investing.

Tax Considerations

As a non-US citizen, you'll need to be aware of tax implications when investing in U.S. stocks. Generally, you'll be subject to U.S. tax on any dividends or capital gains you earn from your investments. However, there are certain tax treaties between the U.S. and other countries that may reduce your tax liability.

It's advisable to consult with a tax professional to understand the specific tax implications of investing in U.S. stocks as a non-US citizen.

Types of Investments

There are various types of investments available in the U.S. stock market, including:

- Individual Stocks: Investing in individual stocks allows you to own a portion of a specific company.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on a stock exchange, allowing for more flexibility.

Case Study: John from Germany

Let's consider a hypothetical case. John, a German citizen, wants to invest in the U.S. stock market. After researching and comparing different brokerage firms, he decides to open an account with Charles Schwab. He starts by investing in a mix of individual stocks and ETFs, focusing on companies he believes have strong growth potential.

After a few years, John's investments have grown significantly, and he decides to sell some of his shares. Thanks to his careful research and diversification, he earns a substantial profit. However, he also consults with a tax professional to ensure he understands the tax implications of his earnings.

Conclusion

Investing in stocks without being a U.S. citizen is indeed possible. By opening a brokerage account, understanding the risks, and considering tax implications, you can take advantage of the opportunities offered by the U.S. stock market. Remember to do thorough research and consult with professionals as needed to make informed investment decisions.

US Insurance Stock: A Comprehensive Guide t? us steel stock dividend