In today's globalized world, investing in foreign stocks has become more accessible than ever. If you're considering adding Japanese stocks to your investment portfolio, you might be wondering, "Can I buy Japanese stocks in the US?" The answer is a resounding yes! This guide will walk you through the process, the benefits, and the potential risks of investing in Japanese stocks from the United States.

Understanding Japanese Stocks

Japan is one of the world's largest economies, with a stock market that's been around since the 1870s. The Tokyo Stock Exchange (TSE) is the largest stock exchange in Japan and the fourth-largest in the world by market capitalization. It's home to many of the world's most recognizable companies, including Toyota, Sony, and Nintendo.

How to Buy Japanese Stocks in the US

There are several ways to buy Japanese stocks from the US:

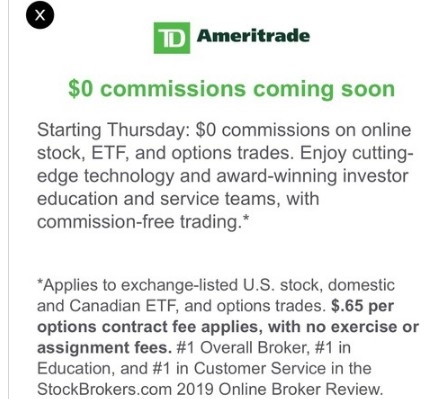

Through a Brokerage Account: The most common method is to open a brokerage account with a firm that offers access to international markets. Many major brokerage firms, such as Fidelity, Charles Schwab, and TD Ameritrade, provide this service.

Through an Exchange-Traded Fund (ETF): An ETF is a type of investment fund that tracks the performance of a specific index, such as the Nikkei 225. By investing in a Japanese ETF, you can gain exposure to the Japanese stock market without having to buy individual stocks.

Through a Mutual Fund: Some mutual funds invest in foreign stocks, including Japanese stocks. This can be a good option if you prefer a hands-off approach to investing.

Benefits of Investing in Japanese Stocks

Diversification: Investing in Japanese stocks can help diversify your portfolio, reducing the risk of market volatility.

Strong Economic Performance: Japan has a strong and stable economy, making it an attractive investment destination.

High-Quality Companies: Many Japanese companies are known for their innovation, quality, and stability.

Risks of Investing in Japanese Stocks

Currency Risk: The value of the Japanese yen can fluctuate against the US dollar, affecting the returns on your investment.

Political and Economic Risk: Japan faces various political and economic challenges, such as aging population and trade disputes.

Market Volatility: The Japanese stock market can be volatile, especially during economic downturns.

Case Study: Investing in Toyota

Toyota Motor Corporation is one of the most successful Japanese companies, with a market capitalization of over

Conclusion

Buying Japanese stocks in the US is a viable option for investors looking to diversify their portfolios and gain exposure to a strong and stable economy. However, it's important to understand the risks and do your research before making any investment decisions.

Stock Market Downturns Often Precede Major ? us steel stock dividend