Welcome to the pulsating heart of the financial world, the Borsa di New York, also known as the New York Stock Exchange (NYSE). This iconic institution has been shaping global markets for over two centuries, and it remains a beacon of innovation, opportunity, and financial prowess. In this article, we'll delve into the history, significance, and impact of the Borsa di New York, showcasing why it's a must-watch for investors and financial enthusiasts alike.

The Rich History of the NYSE

Established in 1792, the Borsa di New York has a storied past that predates the United States itself. The Buttonwood Agreement, signed by 24 traders under a buttonwood tree in lower Manhattan, laid the foundation for what would become the NYSE. Over the years, the exchange has seen the rise and fall of numerous companies, and it has played a pivotal role in shaping the modern financial landscape.

The Significance of the NYSE

The Borsa di New York is more than just a stock exchange; it's a symbol of American capitalism and the power of free markets. Here are some key reasons why the NYSE is so significant:

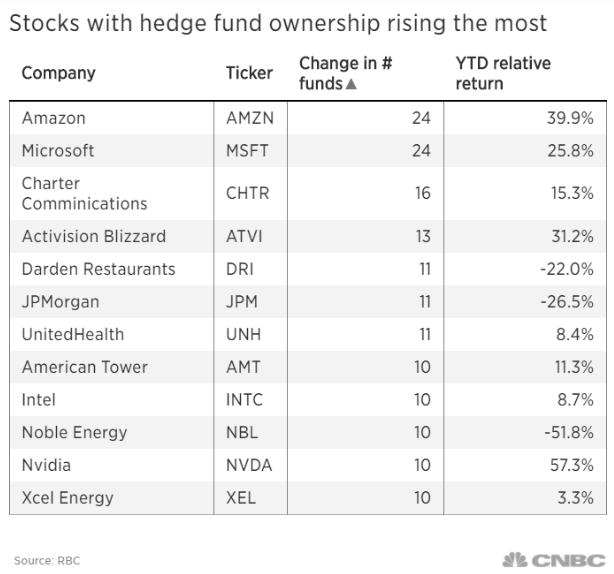

- Global Influence: The NYSE is home to some of the world's most influential companies, including Apple, Microsoft, and Amazon. The exchange's listings have a global impact, influencing markets and economies around the world.

- Innovation Hub: The NYSE has been at the forefront of technological innovation, introducing electronic trading in the 1980s and embracing new trading platforms and technologies to keep pace with the evolving financial landscape.

- Investor Confidence: The NYSE's robust regulatory framework and transparent operations have earned the trust of investors worldwide, making it a preferred destination for companies looking to go public and for investors seeking to invest in the most promising companies.

The Impact of the NYSE

The Borsa di New York has had a profound impact on the global financial system. Here are some notable examples:

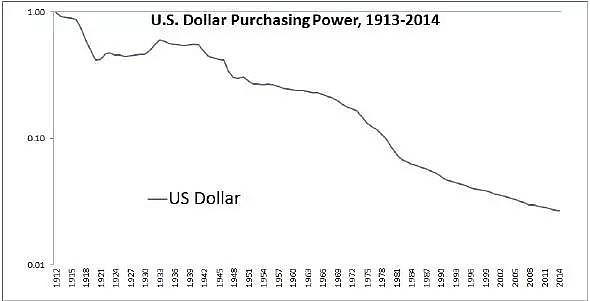

- The Great Depression: During the 1920s, the NYSE experienced a period of rapid growth and speculation, leading to the stock market crash of 1929 and the subsequent Great Depression. This event highlighted the need for regulatory oversight and led to the creation of the Securities and Exchange Commission (SEC).

- The Dot-Com Bubble: In the late 1990s, the NYSE saw a surge in tech stocks, leading to the dot-com bubble. While the bubble eventually burst, it paved the way for the rise of the internet and e-commerce.

- The Financial Crisis of 2008: The NYSE was not immune to the financial crisis of 2008, but its robust regulatory framework and quick response helped mitigate the impact on the global financial system.

Case Studies: Iconic Companies Listed on the NYSE

The Borsa di New York has been the launching pad for numerous iconic companies. Here are a few notable examples:

- Apple: Apple's initial public offering (IPO) on the NYSE in 1980 marked the beginning of its meteoric rise. The company has since become a global powerhouse, revolutionizing the tech industry.

- Microsoft: Microsoft's IPO in 1986 on the NYSE helped solidify its position as the leading software company in the world. The company has continued to innovate and expand its product offerings.

- Amazon: Amazon's IPO on the NYSE in 1997 was a turning point for the company. It has since become the world's largest online retailer and a leader in cloud computing and streaming services.

The Borsa di New York, or the New York Stock Exchange, is a cornerstone of the global financial system. Its rich history, significant influence, and profound impact make it a must-watch for investors and financial enthusiasts worldwide. As the financial world continues to evolve, the NYSE remains at the forefront, shaping the future of global markets.

What Did the S&P 500 Do Today?? us steel stock dividend