In the ever-evolving world of the stock market, investors must stay vigilant for potential market downturns. One such potential threat is a big short in US stocks. This article delves into what a big short is, why it's a concern, and what investors can do to protect themselves.

What is a Big Short?

A big short refers to a situation where a significant number of investors believe that a stock or a group of stocks is overvalued and will decline in price. These investors then borrow shares from brokers, sell them at the current market price, and hope to buy them back at a lower price in the future. If their prediction is correct, they can profit from the difference between the selling and buying prices.

Why is a Big Short a Concern?

A big short can have severe consequences for the stock market and the broader economy. When a large number of investors engage in short selling, it can create downward pressure on stock prices, leading to a market downturn. This can have a ripple effect, impacting investor confidence, causing a sell-off in other stocks, and potentially leading to a full-blown financial crisis.

Signs of a Big Short

There are several signs that may indicate a potential big short in the US stock market:

- High Short Interest: If a significant number of shares are being shorted, it could be a sign of a big short.

- Unusual Trading Activity: Sudden spikes in trading volume or unusual trading patterns can be a sign of short sellers at work.

- Negative News: Negative news or rumors about a company can be used as a catalyst for short sellers to push down stock prices.

Protecting Yourself

Investors can take several steps to protect themselves from the potential impact of a big short:

- Diversify Your Portfolio: Diversifying your investments across different asset classes can help mitigate the risk of a big short impacting your portfolio significantly.

- Stay Informed: Keep up with market news and trends to stay informed about potential risks.

- Use Stop-Loss Orders: A stop-loss order can help protect your investments by selling a stock if it falls below a certain price.

Case Studies

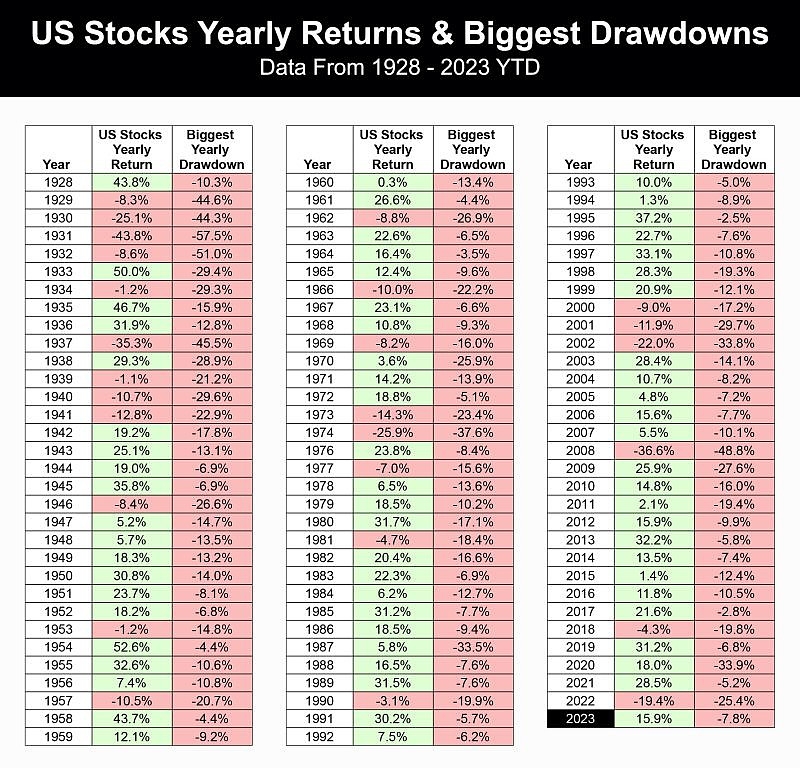

One notable example of a big short in the US stock market is the 2008 financial crisis. During this period, investors like Jim Chanos and John Paulson predicted that the housing market was overvalued and would collapse. They bet against the market and made significant profits when the housing bubble burst.

Another example is the short-selling of technology stocks in the early 2000s. Investors believed that the technology bubble was overvalued and shorted these stocks, leading to a significant market downturn.

Conclusion

A big short in the US stock market is a potential threat that investors need to be aware of. By staying informed, diversifying their portfolios, and using risk management strategies, investors can protect themselves from the potential impact of a big short.

IGM US Stock Price: A Comprehensive Guide t? us steel stock dividend