In today's fast-paced financial world, investing in high-definition (HD) US stocks has become a popular choice for investors seeking growth and stability. With the rise of digital platforms and advanced technology, accessing and understanding HD US stocks has never been easier. This article delves into the world of HD US stocks, offering insights, tips, and a comprehensive guide to help you make informed investment decisions.

What are HD US Stocks?

HD US stocks refer to shares of companies listed on major U.S. stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. These stocks are characterized by their high liquidity, transparency, and stability. Investors often look for HD US stocks to gain exposure to the world's largest and most innovative companies.

Key Features of HD US Stocks

- Liquidity: HD US stocks are highly liquid, meaning they can be bought and sold quickly without significantly impacting their price. This feature makes them ideal for active traders and investors.

- Transparency: U.S. stock exchanges require companies to disclose financial information regularly, ensuring transparency and accountability.

- Stability: Many HD US stocks come from well-established companies with strong track records, providing investors with a sense of stability and security.

- Innovation: The U.S. is home to some of the world's most innovative companies, and HD US stocks offer investors a chance to invest in these cutting-edge businesses.

How to Identify HD US Stocks

To identify HD US stocks, consider the following factors:

- Market Capitalization: Look for companies with a high market capitalization, as these are often more stable and liquid.

- Financial Health: Analyze the company's financial statements, including revenue, profit margins, and debt levels.

- Sector Performance: Consider the performance of the sector in which the company operates, as this can impact its stock price.

- Management Team: Evaluate the experience and track record of the company's management team.

Top HD US Stocks to Watch

- Apple Inc. (AAPL): As the world's largest technology company, Apple offers investors exposure to the rapidly growing tech sector.

- Microsoft Corporation (MSFT): Microsoft is a leading player in the software and cloud computing industries, with a strong track record of innovation.

- Amazon.com, Inc. (AMZN): Amazon is a dominant force in e-commerce and cloud computing, with a vast product portfolio and global reach.

- Facebook, Inc. (FB): Now known as Meta Platforms, Inc., Facebook is a leading social media and advertising company with a significant global presence.

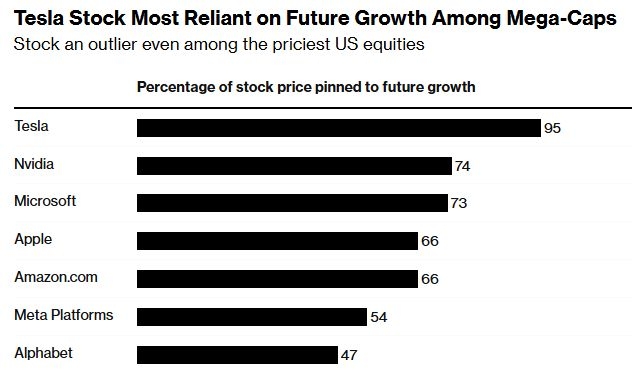

Case Study: Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA) is a prime example of an HD US stock that has seen significant growth in recent years. Founded by Elon Musk, Tesla is a leader in electric vehicles and renewable energy solutions. The company's stock has surged due to its innovative products, strong financial performance, and growing market share.

Conclusion

Investing in HD US stocks can be a lucrative opportunity for investors seeking growth and stability. By understanding the key features of these stocks and conducting thorough research, you can make informed investment decisions. Remember to stay updated with market trends and news, as this will help you stay ahead of the curve and maximize your returns.

US Stock Exchange Today Open: A Comprehensi? new york stock exchange