Friday is often a pivotal day in the world of US stocks, marking the end of the trading week and providing investors with a snapshot of market trends and potential opportunities. This article delves into the key insights and market movements that define "US Stock Friday," offering valuable information for both seasoned investors and newcomers to the stock market.

Market Open and Early Moves

On a typical "US Stock Friday," the market opens with a mix of optimism and cautious optimism. Investors closely monitor the opening bell for any significant news or economic data that could impact the market. Early moves in the market can set the tone for the rest of the day and provide clues about the overall sentiment.

Economic Data and Reports

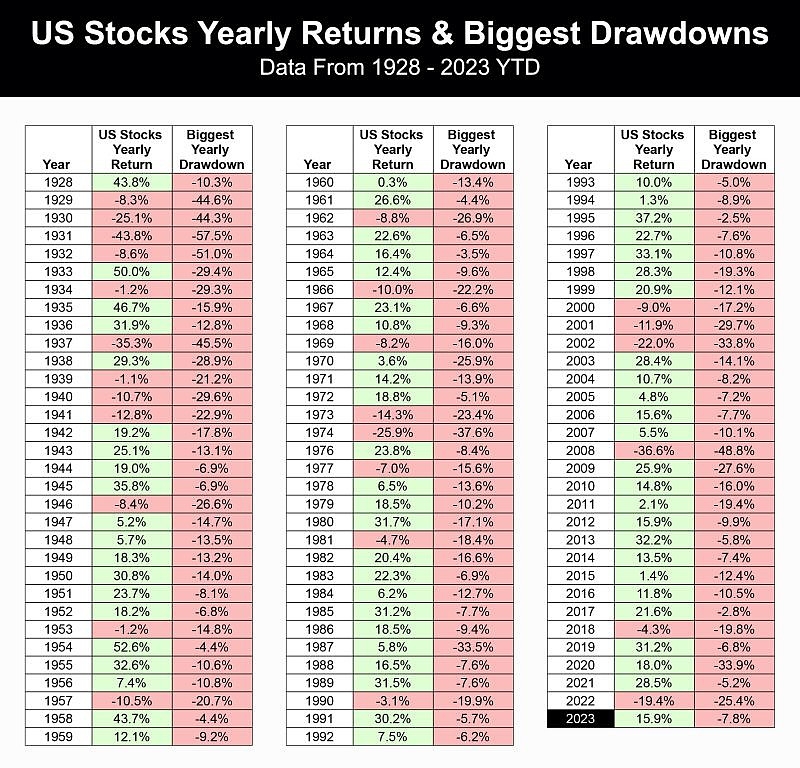

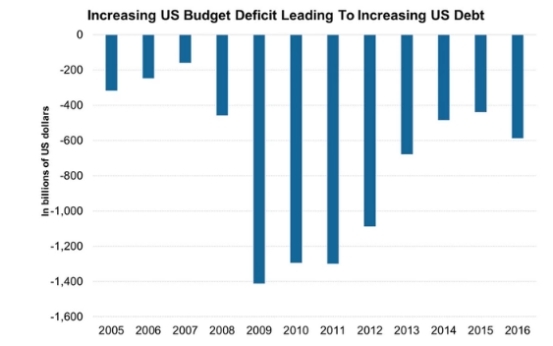

One of the most critical factors influencing "US Stock Friday" is the release of economic data and reports. These reports, such as the unemployment rate, inflation, and GDP growth, can have a significant impact on market sentiment. For example, a strong GDP report can boost investor confidence and lead to higher stock prices, while a weak report can cause concern and lead to selling pressure.

Sector Performance

Another key aspect of "US Stock Friday" is the performance of different sectors. Some sectors, such as technology and healthcare, may outperform while others, such as energy and financials, may lag. Understanding the reasons behind these movements can help investors make informed decisions about their portfolios.

Market Indices and Individual Stocks

"US Stock Friday" also provides a snapshot of the overall market's performance through major indices like the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices can provide a general sense of market direction, but it's also important to pay attention to individual stocks, as they can sometimes move independently of the broader market.

Case Study: Tech Sector on US Stock Friday

One recent example of "US Stock Friday" was the strong performance of the technology sector. Companies like Apple, Microsoft, and Amazon saw significant gains, driven by strong earnings reports and positive outlooks. This trend was attributed to the sector's resilience in the face of economic uncertainty and its ability to adapt to changing consumer needs.

Impact of Global Events

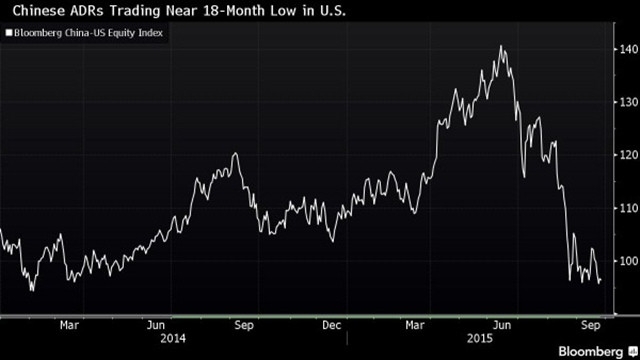

Global events can also have a significant impact on "US Stock Friday." For example, geopolitical tensions, trade disputes, and international crises can cause volatility in the market. Investors need to stay informed about these events and understand how they could affect their investments.

Conclusion: Staying Informed and Making Informed Decisions

In conclusion, "US Stock Friday" is a critical day in the world of US stocks, offering valuable insights into market trends and potential opportunities. By staying informed about economic data, sector performance, and global events, investors can make informed decisions and navigate the complexities of the stock market. Whether you're a seasoned investor or a beginner, understanding the dynamics of "US Stock Friday" can help you achieve your investment goals.

How to Do Stock Trading in the US: A Compre? new york stock exchange