In today's globalized financial world, the US Dollar Index (USDX) plays a crucial role in the stock market. Understanding its impact and opportunities is essential for investors looking to navigate the stock market successfully. This article aims to provide a comprehensive overview of the US Dollar Index, its stock implications, and strategies to leverage its influence.

What is the US Dollar Index?

The US Dollar Index is a weighted average of the value of the US dollar against a basket of major currencies. The basket typically includes the Euro, Japanese Yen, Canadian Dollar, British Pound, and Swedish Krona. The index is used as a benchmark to gauge the strength or weakness of the US dollar compared to other major currencies.

How the US Dollar Index Impacts Stocks

The US Dollar Index has a significant impact on the stock market for several reasons:

- Currency Fluctuations: A strong US dollar can make US stocks more expensive for foreign investors, potentially leading to lower demand and lower stock prices. Conversely, a weak US dollar can make US stocks more attractive to foreign investors, potentially driving up stock prices.

- Economic Indicators: The US Dollar Index often reflects economic indicators, such as inflation and employment data. These indicators can influence stock market sentiment and performance.

- Interest Rates: The US Federal Reserve sets interest rates, which can affect the value of the US dollar. Higher interest rates can strengthen the US dollar, while lower interest rates can weaken it.

Opportunities in US Dollar Index Stocks

Despite the potential challenges posed by currency fluctuations, there are opportunities to capitalize on the US Dollar Index:

- Dividend Stocks: Companies with strong dividend yields can benefit from a weaker US dollar, as they become more attractive to foreign investors.

- Export-Heavy Companies: Companies that generate a significant portion of their revenue from exports can benefit from a weaker US dollar, as their products become more competitive internationally.

- Consumer Discretionary Stocks: A weaker US dollar can lead to lower import prices, potentially boosting consumer spending and benefiting consumer discretionary stocks.

Case Studies: US Dollar Index Stocks in Action

To illustrate the impact of the US Dollar Index on stocks, let's consider a few case studies:

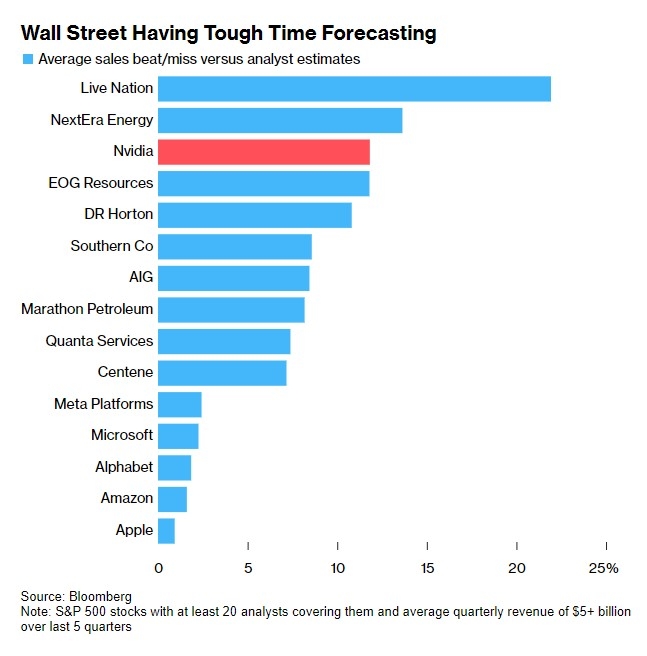

- Apple Inc. (AAPL): As a leading technology company with a significant portion of its revenue from international markets, Apple has been sensitive to currency fluctuations. When the US dollar weakened, Apple's stock price increased, as its products became more affordable for international consumers.

- Procter & Gamble Co. (PG): As a consumer goods giant, Procter & Gamble has benefited from a weaker US dollar. When the dollar weakened, the company's overseas revenue became more valuable in US dollars, boosting its overall earnings and stock price.

Conclusion

The US Dollar Index is a crucial factor to consider when analyzing the stock market. Understanding its impact and opportunities can help investors make informed decisions and capitalize on currency fluctuations. By focusing on dividend stocks, export-heavy companies, and consumer discretionary stocks, investors can potentially mitigate the risks associated with the US Dollar Index and benefit from its potential opportunities.

AMD US Stock Price: Trends, Analysis, and F? new york stock exchange