Introduction: In today's interconnected global market, Canadian investors are often curious about expanding their portfolio beyond the borders of their own country. One of the most popular questions is whether or not a Canadian should invest in US stocks. This article delves into the factors to consider and provides insights to help you make an informed decision.

Understanding the US Stock Market: The US stock market is known for its liquidity, diversity, and size. It's the largest and most sophisticated market in the world, offering a wide range of investment opportunities. Investing in US stocks can provide Canadian investors with exposure to industries and companies that are not available in Canada.

Benefits of Investing in US Stocks:

- Diversification: Investing in US stocks allows Canadian investors to diversify their portfolio and reduce risk. The US market is home to many large, established companies across various sectors, including technology, healthcare, and finance.

- Currency Exchange: The potential for currency exchange gains can be a significant benefit. If the Canadian dollar strengthens against the US dollar, your returns will be worth more when converted back to CAD.

- Innovative Companies: The US is home to many innovative companies that are leaders in their respective industries. Investing in these companies can offer long-term growth opportunities.

Risks to Consider:

- Currency Fluctuations: Fluctuations in the exchange rate can impact your investment returns. If the CAD weakens, your returns will be worth less when converted back to CAD.

- Political and Economic Instability: The US faces political and economic challenges, such as trade wars and political polarization. These factors can affect the stock market.

- Regulatory Changes: Changes in regulations can impact the performance of US stocks. It's important to stay informed about any potential regulatory changes that could affect your investments.

How to Invest in US Stocks:

- Brokerage Accounts: Open a brokerage account that allows you to trade US stocks. Many Canadian brokers offer access to the US market.

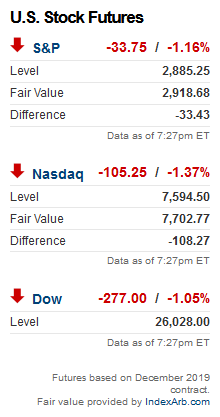

- Index Funds: Consider investing in US index funds. These funds track a specific index, such as the S&P 500, and offer diversification and lower fees compared to individual stocks.

- Individual Stocks: Research and invest in individual US stocks if you have the time and expertise to do so.

Case Studies:

- Tesla (TSLA): Tesla is a prime example of a US company that has provided significant returns to investors. Since its initial public offering in 2010, the stock has seen a remarkable rise, offering a lesson in the potential of investing in innovative companies.

- Apple (AAPL): Apple is another US stock that has consistently provided strong returns over the years. As a leader in the technology sector, the company has expanded its product line and has a strong presence globally.

Conclusion: Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. However, it's important to carefully consider the benefits and risks before making a decision. Diversification, exposure to innovative companies, and potential currency exchange gains are just a few of the advantages of investing in the US market. As with any investment, do your research and consult with a financial advisor to ensure it aligns with your investment goals and risk tolerance.

Hundred Years Chart of the US Stock Market:? new york stock exchange