As we step into 2025, the US stock market continues to be a beacon of global financial activity. However, the landscape is shaped by a myriad of economic factors that can significantly impact stock prices. This article delves into the key economic factors that are expected to influence US stocks in the coming year.

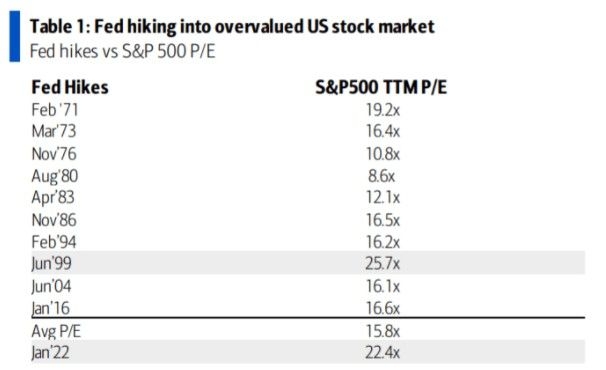

Interest Rates: The Key Driver

The Federal Reserve's monetary policy, particularly interest rates, is a pivotal factor affecting US stocks. In 2025, we anticipate that the Fed will continue its policy of gradual rate hikes to combat inflation. Higher interest rates can lead to increased borrowing costs for companies, potentially affecting their profitability and stock prices.

Inflation: The Persistent Challenge

Inflation remains a persistent challenge for the US economy. As of 2025, we expect inflation to remain above the Fed's target of 2%. Inflationary pressures can erode corporate profits and reduce the purchasing power of investors, leading to potential stock market volatility.

Corporate Earnings: The Cornerstone of Stock Performance

Corporate earnings are a fundamental driver of stock prices. In 2025, we anticipate that strong earnings growth will continue to support the US stock market. However, companies may face challenges due to higher input costs and increased regulatory scrutiny.

Global Economic Conditions: A Major Influence

The global economic landscape is another critical factor affecting US stocks. In 2025, we expect the following global economic conditions to impact the US stock market:

- Trade Wars: Ongoing trade tensions between the US and China, as well as other major economies, could lead to increased tariffs and reduced international trade, affecting US companies' earnings.

- Emerging Markets: The performance of emerging markets can have a ripple effect on the US stock market, particularly for companies with significant exposure to these regions.

- Geopolitical Risks: Global geopolitical events, such as political instability or conflicts, can lead to increased uncertainty and volatility in the stock market.

Sector-Specific Factors

Different sectors of the US stock market are sensitive to various economic factors. For instance:

- Technology Sector: The technology sector, particularly companies like Apple and Microsoft, is sensitive to global economic conditions and regulatory changes.

- Energy Sector: The energy sector is influenced by oil prices and geopolitical events, such as the conflict in Ukraine.

- Healthcare Sector: The healthcare sector is affected by government policies and the aging population.

Case Study: Apple Inc.

Apple Inc. is a prime example of how economic factors can impact a company's stock. In 2025, Apple's stock price was influenced by several economic factors:

- Interest Rates: As interest rates increased, Apple's borrowing costs rose, affecting its profitability.

- Inflation: Inflationary pressures led to higher input costs for Apple's products, impacting its profit margins.

- Global Economic Conditions: The ongoing trade tensions between the US and China affected Apple's supply chain and sales in these regions.

In conclusion, as we navigate the economic landscape of 2025, it is crucial to understand the various factors that can influence the US stock market. By staying informed and monitoring these factors, investors can make more informed decisions and potentially mitigate risks.

US Stock Market 2017 Holidays: Understandin? new york stock exchange