The US stock market has been on a remarkable uptrend over the past few years, raising concerns about whether it's currently in a bubble. In this article, we delve into the factors contributing to this speculation and analyze the market's current state.

Market Performance

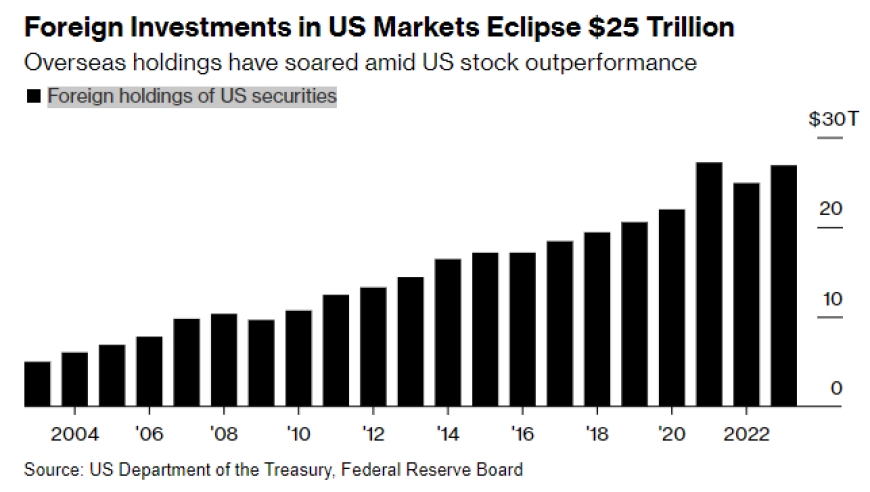

The S&P 500, a widely followed benchmark for the US stock market, has surged over the past decade, reaching record highs multiple times. However, this upward trajectory has sparked concerns about a potential bubble. Critics argue that the market's current valuation is unsustainable, given the low interest rates and economic uncertainties.

Factors Contributing to Bubble Speculation

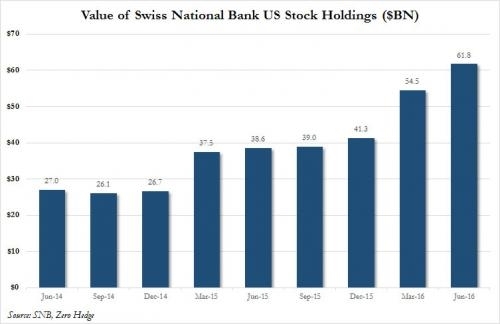

Low Interest Rates: The Federal Reserve has kept interest rates at historically low levels to stimulate economic growth. This has led to investors seeking higher returns in riskier assets like stocks.

Pandemic-Driven Market Surge: The COVID-19 pandemic has caused significant disruptions to the global economy, but it also triggered a massive market rally. Some analysts believe this rally is overvalued and unsustainable.

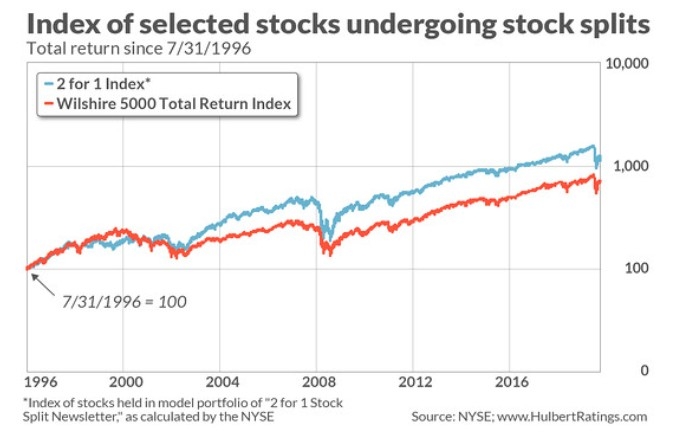

Technology Stocks Leading the Charge: Technology stocks have been a major driver of the market's growth. However, some argue that these stocks are overvalued and vulnerable to a correction.

Analyzing the Market's Current State

Valuation Metrics: The price-to-earnings (P/E) ratio is a common valuation metric used to assess the market's health. Currently, the S&P 500's P/E ratio is well above its long-term average, raising concerns about overvaluation.

Market Breadth: A healthy market typically exhibits broad participation from various sectors. However, the current market is heavily concentrated in a few sectors, such as technology and healthcare.

Economic Indicators: While the US economy has shown signs of recovery, there are still uncertainties, such as inflation and supply chain disruptions. These factors could impact the market's performance in the future.

Case Studies

Dot-Com Bubble: The late 1990s saw a similar speculative bubble in the tech sector, which eventually burst, leading to significant losses for investors.

Real Estate Bubble: The early 2000s witnessed a housing bubble, which contributed to the global financial crisis of 2008.

Conclusion

While the US stock market has experienced remarkable growth over the past few years, concerns about a potential bubble remain. It's crucial for investors to stay vigilant and consider the market's current state and future uncertainties before making investment decisions.

Trade Stocks for Us: How to Start Your Inve? new york stock exchange