In recent years, there has been a surge of interest regarding the influx of Chinese investment in the United States. The question "Is China buying US stocks?" has become a focal point for many investors and economists. This article delves into the reasons behind this trend, its impact on the US economy, and the potential risks and opportunities it presents.

The Growing Influence of Chinese Investment

China's Economic Growth

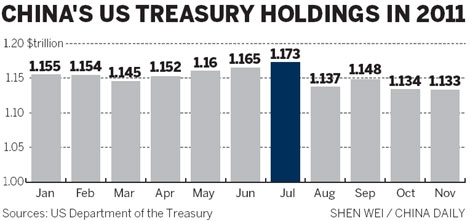

China's economic rise has been nothing short of remarkable. As the world's second-largest economy, China has been on a relentless path of expansion. This growth has been accompanied by a significant increase in China's foreign exchange reserves, which have reached over $3 trillion. This financial muscle has enabled China to invest heavily in foreign assets, including US stocks.

The Chinese Stock Market

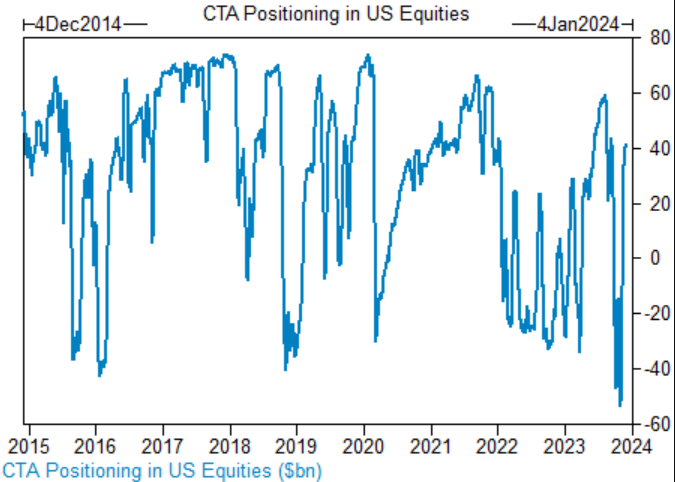

The Chinese stock market has experienced its own set of challenges and opportunities. While it has been subject to volatility, it has also shown remarkable resilience. Many Chinese investors are looking for diversification outside of their domestic market, and the US stock market has emerged as a prime destination.

The Role of US Stocks in Chinese Investment

Diversification

One of the primary reasons behind China's interest in US stocks is the need for diversification. The Chinese stock market, while robust, has been characterized by a heavy reliance on a few sectors. Investing in US stocks allows Chinese investors to spread their risk across a wider range of industries and sectors.

Return on Investment

The US stock market has historically offered higher returns compared to the Chinese market. This has made it an attractive option for Chinese investors looking to maximize their returns. Additionally, the US market's stability and strong regulatory framework provide a sense of security.

Impact on the US Economy

Boosting the Stock Market

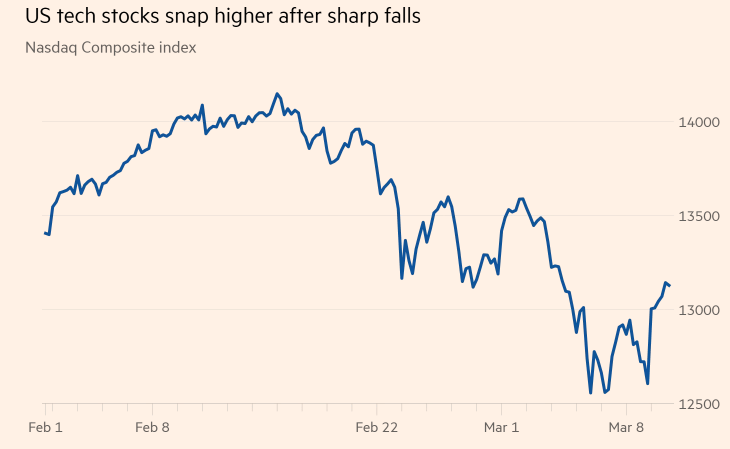

The influx of Chinese investment has significantly boosted the US stock market. This has been particularly evident during times of market uncertainty, such as the COVID-19 pandemic. Chinese investors' confidence in the US market has helped to stabilize it during these challenging times.

Job Creation

Chinese investment in the US has also contributed to job creation. Many Chinese companies have established operations in the US, leading to the creation of new jobs and economic opportunities.

Risks and Opportunities

Risks of Overdependence

While there are numerous benefits, there are also risks associated with China's investment in US stocks. One of the primary risks is the potential for overdependence. If the relationship between China and the US were to sour, it could have significant implications for the US stock market.

Opportunities for Strategic Partnerships

On the flip side, this trend presents opportunities for strategic partnerships. By fostering a closer economic relationship, the US and China can work together to create a more stable and prosperous global economy.

Conclusion

In conclusion, the question "Is China buying US stocks?" is a multifaceted issue with significant implications for both the US and Chinese economies. While there are risks and challenges, the potential benefits are substantial. As the global economy continues to evolve, understanding these dynamics is crucial for investors and policymakers alike.

Maximum Ticker Size Stock US: Unveiling the? new york stock exchange