Are you interested in expanding your investment portfolio beyond the United States? Investing in stocks outside the US can be a great way to diversify your portfolio and potentially increase your returns. However, navigating the foreign stock market can be complex and intimidating for many investors. In this article, we'll provide a comprehensive guide on how to buy stocks outside the US, including the necessary steps and considerations to ensure a successful investment experience.

Understanding the Foreign Stock Market

Before diving into buying stocks outside the US, it's crucial to understand the foreign stock market. The foreign stock market consists of exchanges in other countries, such as the London Stock Exchange (LSE), the Tokyo Stock Exchange (TSE), and the Hong Kong Stock Exchange (HKEX). Each of these exchanges operates under different regulations and trading hours than those in the US.

Choosing a Broker

The first step in buying stocks outside the US is to choose a brokerage firm that offers international trading capabilities. Several reputable brokers, such as TD Ameritrade, E*TRADE, and Fidelity, offer access to foreign stock markets. When selecting a broker, consider factors such as fees, customer service, and the range of available international stocks.

Opening an Account

Once you've chosen a broker, you'll need to open an account. The process is similar to opening an account with a domestic brokerage firm. You'll need to provide personal information, proof of identity, and financial information. Be prepared to answer some questions about your investment goals and experience level.

Understanding Currency Conversion

When buying stocks outside the US, you'll need to consider currency conversion. The value of the US dollar can fluctuate against other currencies, which can affect the price of your investments. It's important to understand how currency conversion works and how it can impact your returns.

Researching Stocks

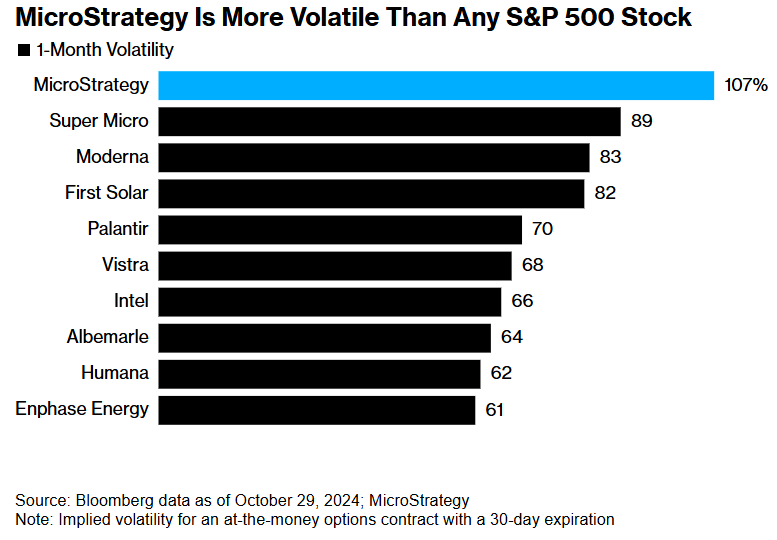

Before purchasing stocks, it's crucial to conduct thorough research. This includes analyzing the company's financial statements, earnings reports, and market trends. Additionally, consider the country's economic and political stability, as these factors can significantly impact the performance of your investments.

Using Stop-Loss Orders

To protect your investments, consider using stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a specific price. This can help limit your losses in the event of a market downturn.

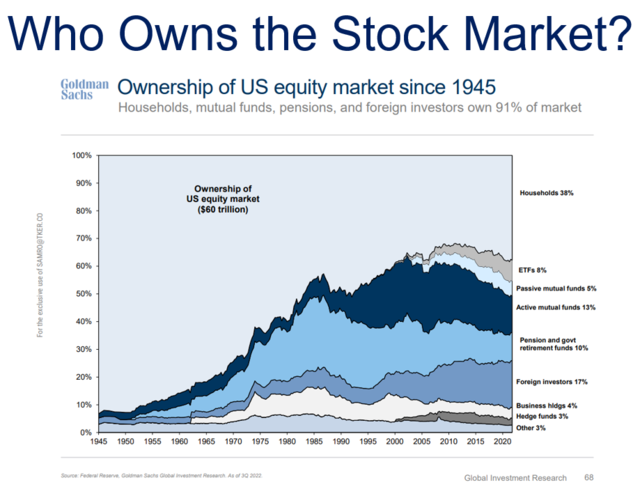

Diversifying Your Portfolio

Diversifying your portfolio is essential to mitigate risk. Consider investing in a variety of industries and countries to ensure that your portfolio is well-rounded. This can help protect you from the volatility of any single stock or market.

Case Study: Investing in European Stocks

Let's say you're interested in investing in European stocks. You might consider companies like Nestlé (Switzerland), Siemens (Germany), and L'Oréal (France). By researching these companies and understanding the European market, you can make informed decisions on which stocks to purchase.

Conclusion

Buying stocks outside the US can be a rewarding investment strategy, but it requires careful planning and research. By following the steps outlined in this guide, you can successfully invest in foreign stocks and diversify your portfolio. Remember to choose a reputable broker, conduct thorough research, and stay informed about market trends and currency conversion. Happy investing!

How to Buy Stocks Outside the US: A Compreh? new york stock exchange