In a stunning turn of events, Wall Street saw a sudden downturn as two major players, Goldman Sachs and Apple, announced disappointing news that dragged US stocks lower. The impact of these announcements was felt across the market, prompting investors to reassess their portfolios and question the future of the stock market.

Goldman Sachs' Profit Warning

The first major blow came from Goldman Sachs, one of the world's largest investment banks. In a surprise announcement, the bank reported a significant drop in its quarterly profits. This came as a shock to investors, as Goldman Sachs had been one of the most resilient banks during the pandemic. The decline in profits was attributed to a variety of factors, including reduced trading revenue and higher costs.

The news sent shockwaves through the financial sector, with many investors worrying about the broader implications for the economy. Goldman Sachs' warning serves as a stark reminder that even the most stable companies can face unexpected challenges.

Apple's Supply Chain Issues

The second blow came from Apple, the world's largest technology company. The company announced that it would miss its revenue targets for the third quarter due to supply chain disruptions. This comes as a major blow to Apple, as the company has been a major driver of growth in the tech industry.

The supply chain disruptions are due to a variety of factors, including the ongoing pandemic and increased demand for Apple's products. The situation has forced the company to reduce its production forecasts, which has had a significant impact on its share price.

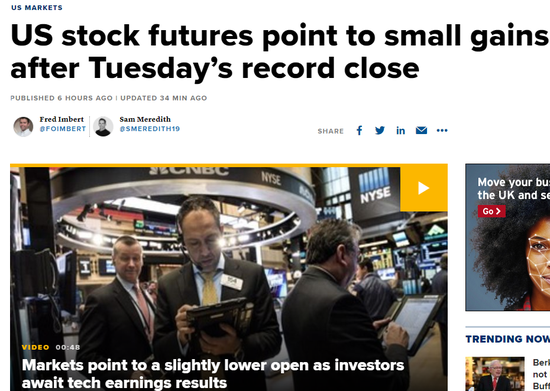

Market Reactions

The announcements from Goldman Sachs and Apple sent the US stock market tumbling. The S&P 500, a key index that tracks the performance of the stock market, fell sharply following the news. Many investors are now concerned about the future of the stock market and whether the downturn will continue.

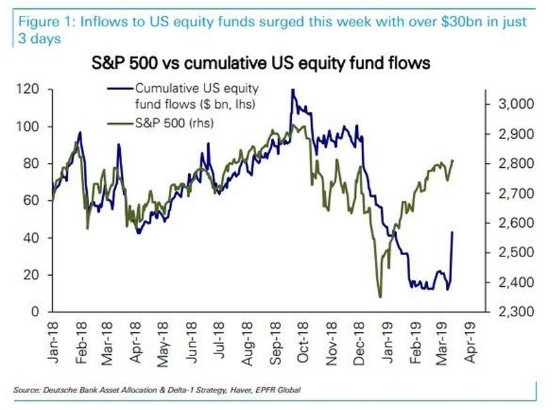

Investor Concerns

The news from Goldman Sachs and Apple has raised concerns among investors about the broader economy. Many are now questioning whether the economic recovery is as strong as previously thought. The situation has prompted many investors to reassess their portfolios and consider diversifying their investments.

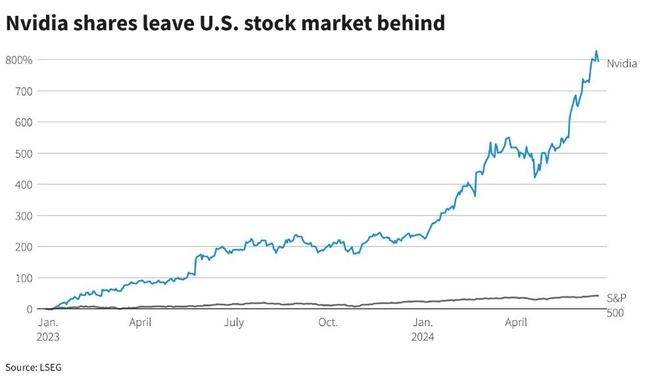

Case Study: Microsoft's Stock Performance

To understand the impact of such announcements on the market, let's take a look at a case study involving Microsoft. Despite the overall market downturn, Microsoft's stock has remained relatively stable. This can be attributed to the company's strong financial position and diversified business model.

Microsoft's ability to weather the storm can serve as a beacon of hope for investors, showing that even in times of uncertainty, there are opportunities to be found.

Conclusion

The announcements from Goldman Sachs and Apple have sent the US stock market into a tailspin. As investors reassess their portfolios and question the future of the stock market, it is important to remember that even the most stable companies can face unexpected challenges. The situation serves as a stark reminder that investing in the stock market is not without its risks, and it is important to be prepared for sudden downturns.

Understanding the Tencent US Stock Ticker: ? new york stock exchange