Are you a Canadian investor looking to diversify your portfolio by investing in US stocks? If so, you're not alone. Many Canadians are increasingly turning to the US stock market for investment opportunities due to its size, liquidity, and the potential for high returns. In this article, we'll explore the benefits of investing in US stocks from a Canadian perspective, the key factors to consider, and provide a step-by-step guide to get started.

Why Invest in US Stocks?

1. Size and Liquidity: The US stock market is the largest and most liquid in the world, offering a wide range of investment opportunities. This includes stocks from some of the most successful and well-known companies globally, such as Apple, Microsoft, and Google.

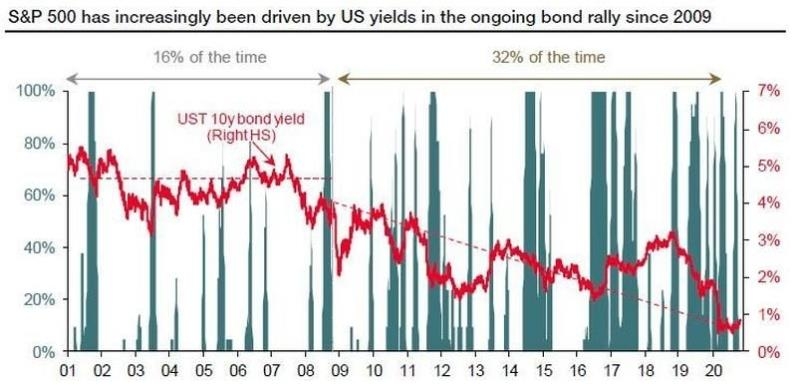

2. Diversification: Investing in US stocks can help diversify your portfolio, reducing your exposure to the Canadian market and potentially improving your overall risk-adjusted returns.

3. High Returns: Over the long term, the US stock market has historically provided higher returns than the Canadian market. This is due to several factors, including the presence of large, established companies with strong growth prospects.

Key Factors to Consider:

1. Currency Fluctuations: One of the main risks of investing in US stocks is currency fluctuations. The Canadian dollar's value can fluctuate against the US dollar, impacting the returns on your investments.

2. Tax Implications: When investing in US stocks, it's essential to understand the tax implications. While some Canadian investors may benefit from lower capital gains tax rates in the US, others may face higher taxes.

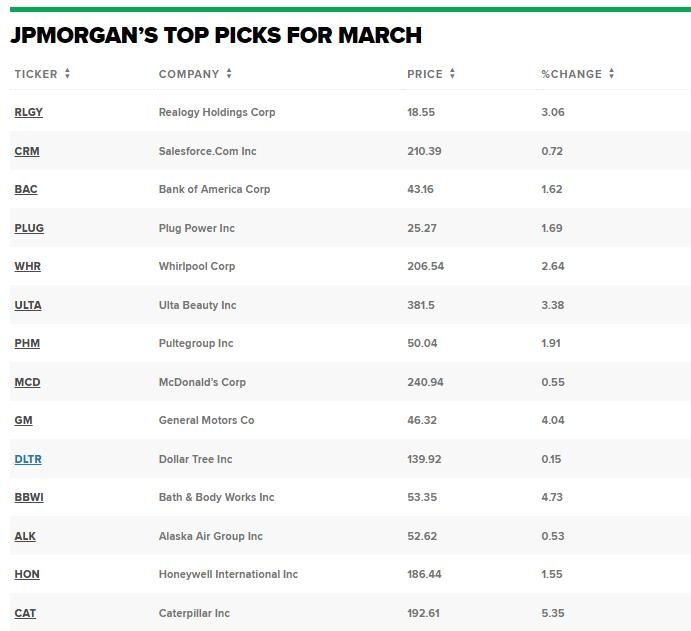

3. Research and Due Diligence: Like any investment, it's crucial to conduct thorough research and due diligence before investing in US stocks. This includes analyzing the financial health of the company, its industry position, and market trends.

How to Invest in US Stocks from Canada:

1. Open a Brokerage Account: The first step is to open a brokerage account with a reputable firm that offers access to US stocks. Some popular options for Canadians include TD Ameritrade, E*TRADE, and Questrade.

2. Choose Your Investments: Once you have your brokerage account, you can start researching and selecting US stocks to invest in. Consider factors such as the company's financial health, growth prospects, and industry position.

3. Monitor Your Investments: After investing, it's essential to monitor your portfolio regularly. This includes keeping an eye on market trends, company news, and your investments' performance.

Case Study: Investing in Apple Stock

One of the most popular US stocks among Canadian investors is Apple. Over the past decade, Apple has consistently delivered strong returns, making it an attractive investment for many.

In 2010, Apple's stock was trading at around

Conclusion

Investing in US stocks can be a valuable addition to your Canadian investment portfolio. By understanding the benefits, risks, and key factors to consider, you can make informed decisions and potentially achieve higher returns. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

US Large Cap Stocks 2025: Market Cap Over $? new york stock exchange