Investing in stocks outside the United States has become increasingly popular as investors seek diversification and growth opportunities. The global stock market offers a vast array of options, from emerging markets to established economies. This article explores the feasibility and benefits of investing in stocks outside the US, providing insights into the process and key considerations.

Understanding International Stock Investing

Investing in stocks outside the US involves purchasing shares of companies listed on foreign exchanges. This can be done through various means, including direct investment, American Depositary Receipts (ADRs), and exchange-traded funds (ETFs). Each method has its own advantages and considerations.

Direct Investment

Direct investment involves purchasing shares of foreign companies through their respective stock exchanges. This requires opening a brokerage account that supports international trading. While this method offers full exposure to the foreign market, it also comes with additional complexities, such as currency exchange rates and foreign tax considerations.

American Depositary Receipts (ADRs)

ADRs are certificates representing shares of a foreign company traded on a US exchange. They are designed to provide US investors with a convenient way to invest in foreign stocks without dealing with foreign currencies or regulatory hurdles. ADRs often trade at a premium or discount to the underlying foreign shares, reflecting market demand and supply.

Exchange-Traded Funds (ETFs)

ETFs are a popular choice for investors seeking exposure to a specific foreign market or sector. They track the performance of a basket of foreign stocks and are traded on US exchanges like individual stocks. ETFs offer diversification, lower transaction costs, and the convenience of buying and selling shares throughout the trading day.

Benefits of Investing in Stocks Outside the US

Investing in stocks outside the US offers several benefits:

- Diversification: Exposure to a wide range of markets and sectors can help reduce risk by spreading investments across different regions and industries.

- Growth Opportunities: Emerging markets often offer higher growth potential compared to mature economies, providing investors with the opportunity to capitalize on rapid economic development.

- Currency Exposure: Investing in foreign stocks can provide exposure to different currencies, potentially benefiting from favorable exchange rate movements.

- Access to Unique Companies: Investing in foreign stocks allows access to companies that may not be available on US exchanges, offering a broader range of investment opportunities.

Key Considerations

While investing in stocks outside the US offers numerous benefits, it also comes with certain considerations:

- Currency Risk: Fluctuations in exchange rates can impact the value of investments in foreign currencies.

- Political and Economic Risk: Investing in foreign markets involves exposure to political instability, economic volatility, and regulatory changes.

- Language and Cultural Barriers: Understanding the business practices, corporate governance, and cultural nuances of foreign companies is crucial for successful investing.

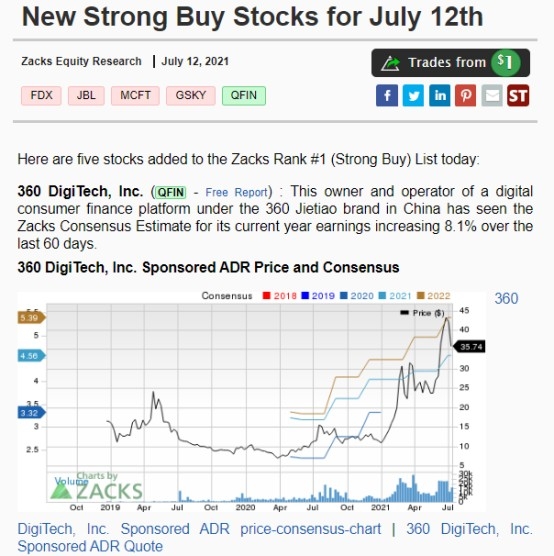

Case Study: Investing in China

A prime example of international stock investing is China. The Chinese stock market has experienced significant growth over the past decade, offering attractive investment opportunities. However, investing in China requires careful consideration of the country's unique market dynamics, including regulatory changes and currency risk.

Conclusion

Investing in stocks outside the US can be a valuable strategy for diversification and growth. By understanding the process, benefits, and considerations, investors can make informed decisions and capitalize on global market opportunities. Whether through direct investment, ADRs, or ETFs, the key is to conduct thorough research and seek professional advice to navigate the complexities of international stock investing.

Understanding US Stock Cap: What It Means f? new york stock exchange