Are you interested in expanding your investment portfolio to include US stocks, but you're not sure where to start? If so, Wealthsimple might just be the answer you're looking for. In this article, we'll explore whether you can buy US stocks on Wealthsimple, how to do it, and some key considerations to keep in mind.

Understanding Wealthsimple

Wealthsimple is a popular online financial platform that offers investment services, including a robo-advisor. It's designed for investors who want to manage their portfolios easily and efficiently. One of the standout features of Wealthsimple is its user-friendly interface and low fees.

Buying US Stocks on Wealthsimple

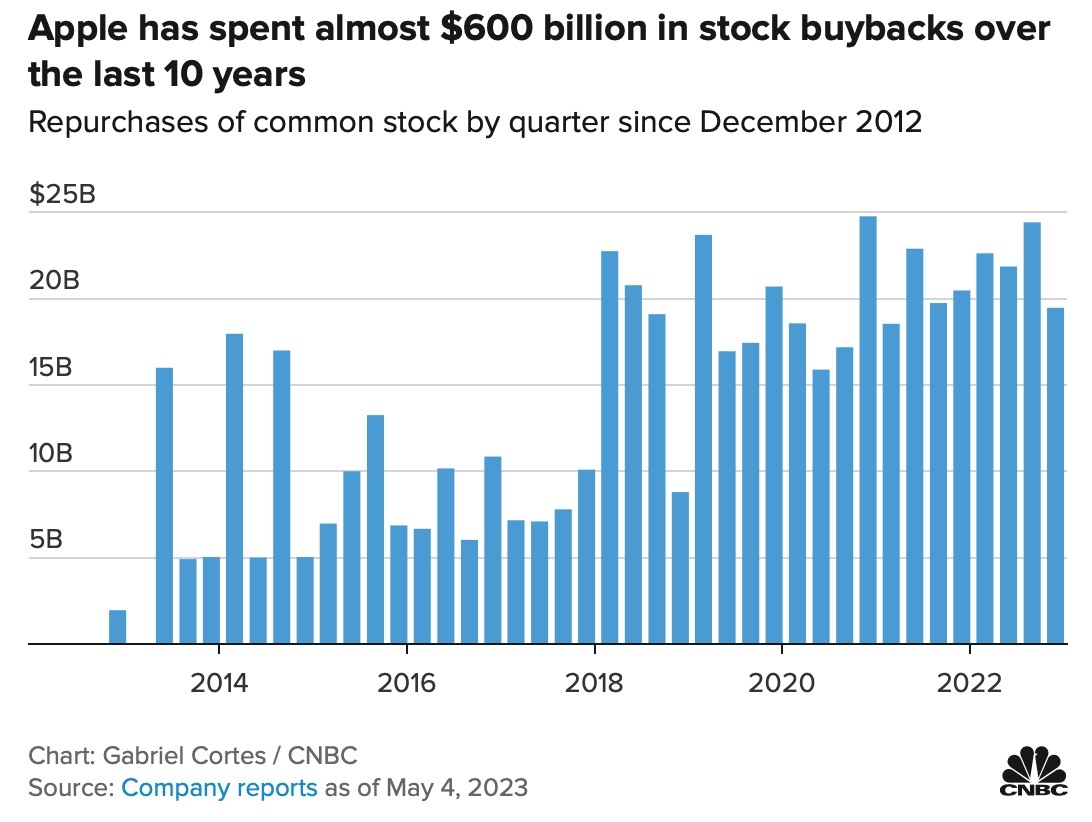

Yes, you can buy US stocks on Wealthsimple. The platform offers a range of US stocks, including some of the most popular companies such as Apple, Amazon, and Microsoft. Here's a step-by-step guide on how to buy US stocks on Wealthsimple:

- Open an Account: If you're new to Wealthsimple, you'll need to create an account. The process is straightforward and can be completed in a few minutes.

- Link Your Bank Account: To buy stocks, you'll need to link your bank account to your Wealthsimple account. This allows you to transfer funds into your investment account.

- Transfer Funds: Once your bank account is linked, you can transfer funds into your Wealthsimple account. This can be done via an electronic funds transfer or by depositing a check.

- Choose Your Stocks: Once you have funds in your account, you can search for US stocks on the platform. Wealthsimple offers a variety of options, so you can choose companies that align with your investment goals.

- Place an Order: Once you've selected your stocks, you can place an order to buy them. You'll be able to specify the number of shares you want to purchase.

- Monitor Your Investments: After you've bought your stocks, you can monitor their performance on the Wealthsimple platform.

Considerations When Buying US Stocks

While buying US stocks on Wealthsimple is straightforward, there are a few considerations to keep in mind:

- Currency Conversion: Since US stocks are priced in US dollars, you'll need to be aware of currency conversion fees if you're using a currency other than USD.

- Tax Implications: If you're a non-US resident, you may need to consider the tax implications of owning US stocks. It's important to consult with a tax professional to ensure you're compliant with all relevant tax laws.

- Research: Before buying any stock, it's important to do your research. This includes understanding the company's financial health, its industry position, and its future prospects.

Case Study

Let's say you're interested in investing in Apple (AAPL) on Wealthsimple. After doing your research, you determine that Apple is a solid investment with strong growth prospects. You transfer funds from your bank account to your Wealthsimple account, search for AAPL, and place an order to buy 10 shares. A few days later, the shares are purchased, and you can monitor their performance on the platform.

Conclusion

Buying US stocks on Wealthsimple is a convenient and straightforward process. With its user-friendly platform and low fees, it's an excellent choice for investors looking to diversify their portfolios. Just be sure to do your research and consider any potential tax implications before making your investments.

Understanding Stocks, Bonds, Capital Gains,? new york stock exchange