Investing in U.S. stocks can be a lucrative venture, especially for Canadian investors looking to diversify their portfolio. However, converting Canadian dollars to U.S. dollars for stock purchases can sometimes be a daunting task. This article aims to provide a comprehensive guide on buying U.S. stocks in Canadian dollars, helping you navigate the process with ease.

Understanding the Basics

Before diving into the details, it’s essential to understand the basics. When you buy U.S. stocks in Canadian dollars, you are essentially purchasing shares of a U.S. company using your Canadian currency. This can be done through a brokerage firm that offers international trading services.

Choosing the Right Brokerage

The first step in buying U.S. stocks in Canadian dollars is to choose the right brokerage firm. Several Canadian brokerage firms offer this service, including Questrade, TD Direct Investing, and Interactive Brokers. It’s important to compare the fees, commissions, and available services of each brokerage to find the one that best suits your needs.

Understanding Currency Conversion

When you buy U.S. stocks in Canadian dollars, you will need to consider the currency conversion process. The exchange rate between the Canadian dollar and the U.S. dollar will determine the amount of Canadian dollars required to purchase each share. It’s important to note that exchange rates fluctuate constantly, which can impact the cost of your investment.

Calculating the Cost

To calculate the cost of buying U.S. stocks in Canadian dollars, you will need to know the current exchange rate and the price of the stock. For example, if the exchange rate is 1.25 and a stock is priced at $100, you would need 125 Canadian dollars to purchase one share.

Paying Taxes

It’s important to understand the tax implications of buying U.S. stocks in Canadian dollars. Generally, capital gains on U.S. stocks are taxed in Canada at the same rate as capital gains on Canadian stocks. However, there may be additional taxes to consider, such as the Foreign Tax Credit.

Benefits of Diversifying Your Portfolio

Investing in U.S. stocks can offer several benefits, including diversification and potential higher returns. By diversifying your portfolio across different markets and sectors, you can reduce your risk and potentially increase your overall returns.

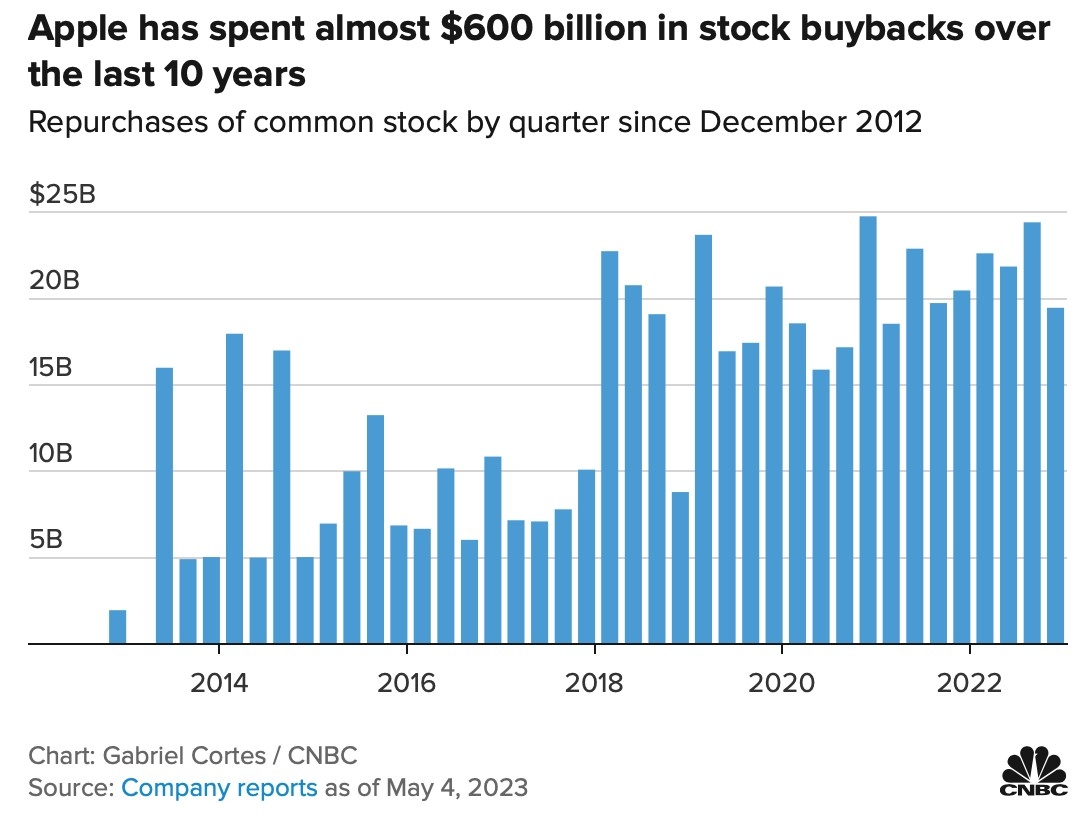

Case Study: Investing in Apple (AAPL) Using Canadian Dollars

Let’s consider a hypothetical scenario where you decide to invest in Apple (AAPL) using Canadian dollars. If the exchange rate is 1.25 and the stock is priced at $150, you would need 187.50 Canadian dollars to purchase one share. Over time, if the stock price increases, you could potentially earn a higher return in Canadian dollars.

Conclusion

Buying U.S. stocks in Canadian dollars can be a valuable investment strategy for Canadian investors. By understanding the basics, choosing the right brokerage, and considering the tax implications, you can make informed decisions and potentially increase your portfolio’s value. Remember to do your research and consult with a financial advisor before making any investment decisions.

Title: The Earliest US Joint Stock Company:? new york stock exchange