In today's volatile financial market, investors are constantly seeking opportunities to grow their wealth. One of the most popular investment avenues is the US stock market. But is investing in US stocks a wise decision for you in 2023? Let's delve into this question and explore the factors that can influence your decision.

Understanding the US Stock Market

The US stock market is one of the largest and most robust in the world, with a diverse range of companies across various sectors. The major indices, such as the S&P 500, the NASDAQ, and the Dow Jones, are often used as benchmarks to gauge the overall performance of the market.

Pros of Investing in US Stocks

- Strong Economic Foundation: The US economy has been consistently growing over the years, making it an attractive destination for investors.

- Innovative Companies: The US is home to numerous innovative companies, many of which are leaders in their respective industries.

- Diversification: Investing in US stocks allows you to diversify your portfolio and reduce risk.

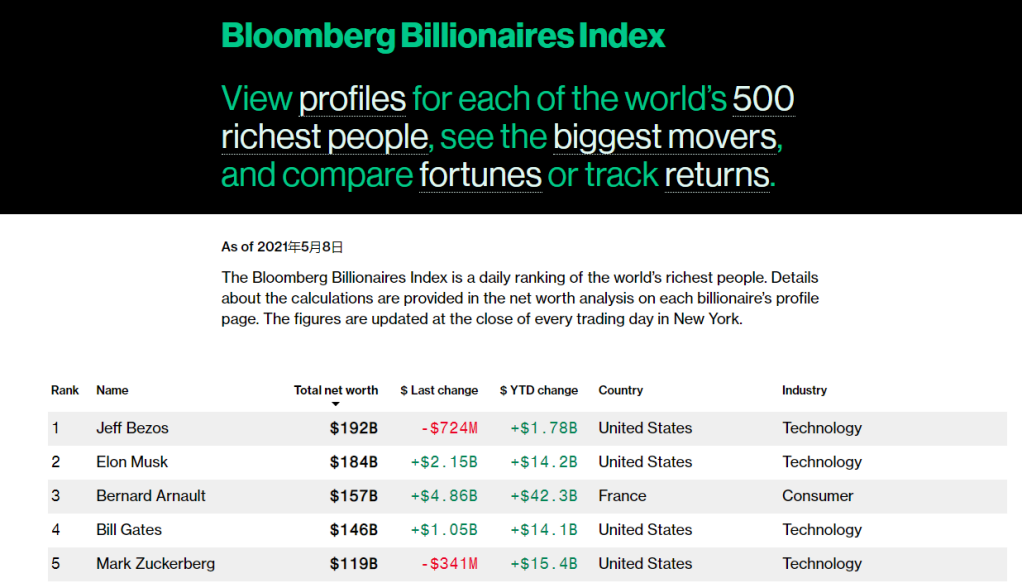

- Access to World-Class Companies: The US stock market offers access to some of the world's most successful companies, such as Apple, Microsoft, and Google.

- Historical Performance: Historically, the US stock market has provided significant returns over the long term.

Cons of Investing in US Stocks

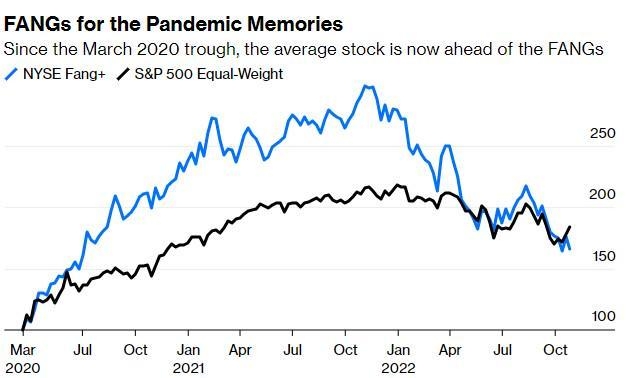

- Volatility: The US stock market can be highly volatile, leading to significant price fluctuations.

- Political and Economic Uncertainties: Factors such as political instability and economic downturns can impact the market.

- High Fees: Some investors may incur high fees due to brokerage commissions and other expenses.

- Market Risk: Investing in stocks carries inherent market risk, and there is no guarantee of returns.

Factors to Consider Before Investing

- Investment Goals: Determine your investment goals and risk tolerance before investing in US stocks.

- Diversification: Diversify your portfolio to reduce risk.

- Research: Conduct thorough research on the companies you are considering investing in.

- Market Trends: Stay updated on market trends and economic indicators.

Case Studies

Let's take a look at two companies that have performed well in the US stock market:

- Apple Inc. (AAPL): Apple has been a leader in the technology industry for decades. Its products, such as the iPhone, iPad, and Mac, have made it one of the most valuable companies in the world.

- Tesla Inc. (TSLA): Tesla has revolutionized the automotive industry with its electric vehicles and has become a key player in the stock market.

Conclusion

Investing in US stocks can be a wise decision, but it's essential to consider the factors mentioned above. By doing thorough research and understanding the risks involved, you can make informed decisions and potentially achieve significant returns.

Key Takeaways

- The US stock market offers numerous opportunities for growth and diversification.

- Investing in US stocks carries inherent risks and requires thorough research.

- Consider your investment goals and risk tolerance before investing in US stocks.

- Stay updated on market trends and economic indicators to make informed decisions.

Is the US Stock Market Open? Understanding ? new york stock exchange