In today's global market, the stock price of Apple Inc. (AAPL) is a subject of great interest, especially in the context of China-US trade relations. This article delves into the factors influencing AAPL's stock price, the impact of the China-US trade war, and the broader implications for investors.

The Importance of AAPL Stock Price

Apple Inc., often referred to as AAPL, is one of the most valuable companies in the world. Its stock price is a reflection of its financial health, market performance, and the overall sentiment of investors. For investors looking to understand the global economic landscape, keeping an eye on AAPL's stock price is crucial.

China-US Trade Dynamics and AAPL Stock Price

The China-US trade relationship has been a major factor influencing AAPL's stock price. In recent years, tensions between the two countries have escalated, leading to trade disputes and tariffs. This has had a direct impact on Apple's business operations in China.

Impact of Tariffs on AAPL's Operations in China

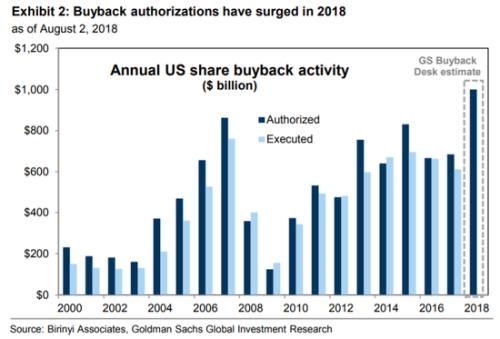

In 2018, the United States imposed tariffs on Chinese goods, including electronics. As a result, AAPL faced increased costs for importing its products from China. This, in turn, affected its profit margins and led to a decline in AAPL's stock price.

Countermeasures and the Resumption of Growth

In response to the tariffs, AAPL took several measures to mitigate the impact. The company increased its production in China and diversified its supply chain. These efforts helped the company to recover from the downturn and resume growth.

The Role of the China-US Trade War in AAPL's Stock Price

The China-US trade war has been a significant factor in shaping AAPL's stock price. As tensions have eased, the stock price has stabilized and even shown signs of growth. This highlights the importance of geopolitical factors in the global market.

Investment Opportunities in AAPL

Despite the challenges posed by the China-US trade war, AAPL remains a strong investment opportunity. The company's strong financial position, innovative products, and global market presence make it a resilient player in the tech industry.

Case Study: AAPL's Response to the China-US Trade War

In 2019, AAPL announced that it would invest $1 billion in China to expand its manufacturing capabilities. This move was seen as a strategic response to the trade tensions and a sign of the company's commitment to the Chinese market.

Conclusion

The stock price of AAPL is a complex indicator of the company's financial health and the broader economic landscape. Understanding the impact of the China-US trade war on AAPL's stock price is crucial for investors looking to navigate the global market. By analyzing the factors influencing AAPL's stock price, investors can make informed decisions and capitalize on the opportunities presented by the company's resilience and growth potential.

US Market Stock Recommendations: Top Picks ? new york stock exchange