In the ever-evolving world of investments, understanding the nuances of various stock types is crucial for investors seeking to maximize their returns. One such category is cyclical growth stocks, which are particularly popular in the United States. This article delves into the world of US cyclical growth stocks, providing a comprehensive guide for investors looking to tap into this dynamic segment of the market.

What Are US Cyclical Growth Stocks?

To start, let's define what cyclical growth stocks are. These stocks are associated with companies that experience rapid growth during economic upswings and contract during economic downturns. This is because their products and services are often sensitive to economic cycles. Examples include companies in the consumer discretionary, technology, and industrial sectors.

Key Characteristics of Cyclical Growth Stocks

Several key characteristics set cyclical growth stocks apart from other types of stocks:

Economic Sensitivity: As mentioned earlier, these stocks are highly sensitive to economic cycles. When the economy is booming, cyclical growth stocks tend to perform exceptionally well. Conversely, during economic downturns, these stocks may struggle.

High Growth Potential: Cyclical growth stocks often have strong growth potential, especially during economic upswings. This is because these companies can take advantage of increased consumer spending and business investment.

Volatility: Due to their economic sensitivity, cyclical growth stocks are generally more volatile than their non-cyclical counterparts. This means their stock prices can fluctuate widely over short periods.

Investing in US Cyclical Growth Stocks

Investing in cyclical growth stocks requires a keen understanding of economic trends and the ability to predict market movements. Here are some tips for investing in this segment:

Stay Informed: Keep up with economic news and trends, as these can have a significant impact on cyclical growth stocks. This includes following indicators such as GDP growth, consumer spending, and business investment.

Analyze Company Fundamentals: Look for companies with strong fundamentals, such as high revenue growth, positive earnings, and solid financial health. This can help mitigate some of the risks associated with cyclical stocks.

Diversify Your Portfolio: While cyclical growth stocks can offer high returns, they also come with higher risk. Diversifying your portfolio with a mix of cyclical and non-cyclical stocks can help mitigate this risk.

Case Studies: Successful Investments in US Cyclical Growth Stocks

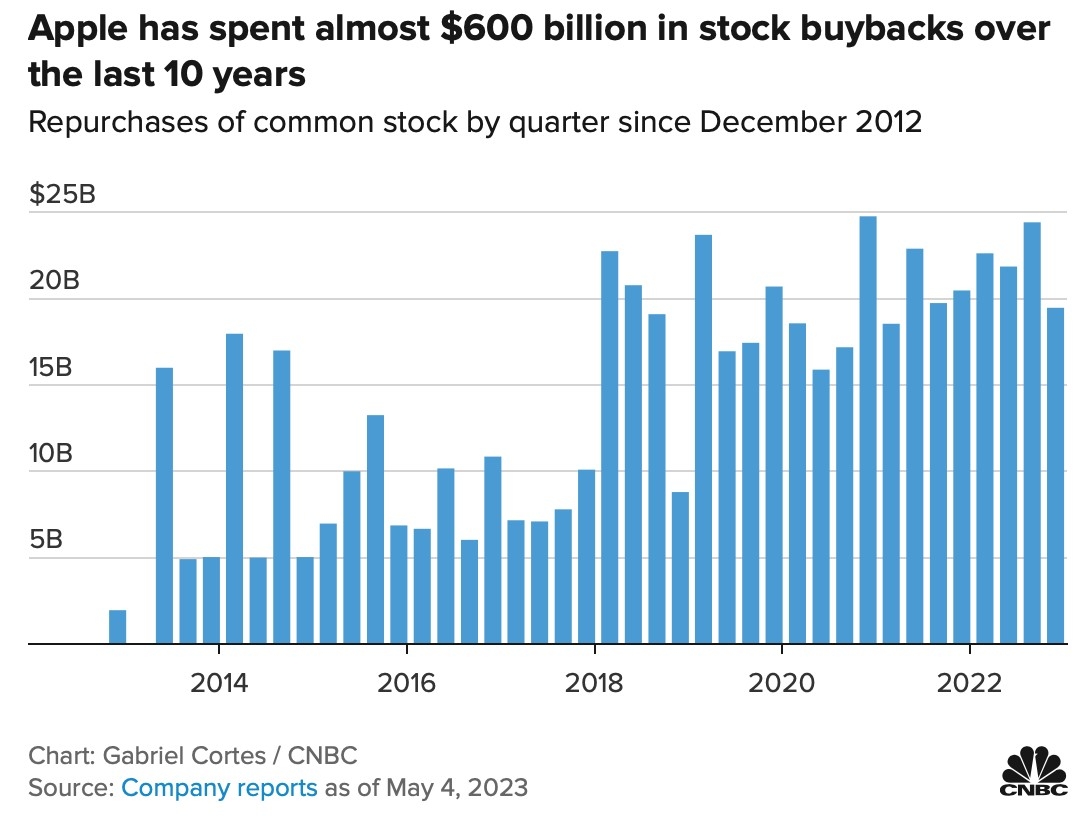

Several high-profile investments in US cyclical growth stocks have yielded significant returns. For instance, investing in technology companies like Apple (AAPL) and Microsoft (MSFT) during the tech boom of the late 1990s and early 2000s provided substantial gains. Similarly, investing in consumer discretionary companies like Netflix (NFLX) and Amazon (AMZN) during the current economic expansion has proven to be a wise decision.

In conclusion, US cyclical growth stocks can be a powerful addition to any investment portfolio. However, it's essential to understand the risks and rewards associated with these stocks and stay informed about economic trends to make informed investment decisions.

US High Yield Stock: A Guide to High-Paying? can foreigners buy us stocks