The US stock market, often referred to as the "Wall Street," is a cornerstone of the global financial landscape. It's where millions of investors from around the world come to trade stocks, bonds, and other securities. Understanding the US stock market is essential for anyone looking to invest in this vibrant and dynamic financial environment. In this article, we'll explore the key aspects of the US stock market, including its structure, major indices, and investment strategies.

Understanding the Structure of the US Stock Market

The US stock market is divided into two main segments: the primary market and the secondary market. The primary market is where new stocks are issued and sold to the public. This is typically done through an initial public offering (IPO), where a company offers its shares to investors for the first time. The secondary market, on the other hand, is where existing shares are bought and sold among investors.

The most prominent exchanges in the US stock market include the New York Stock Exchange (NYSE) and the NASDAQ. The NYSE is known for its traditional trading floor, where traders in colorful jackets buy and sell stocks in person. The NASDAQ, on the other hand, is a fully electronic exchange that lists many of the world's largest and most innovative companies.

Major Indices in the US Stock Market

The US stock market is represented by several major indices, each tracking the performance of a specific segment of the market. The most well-known indices include:

- Dow Jones Industrial Average (DJIA): This index tracks the performance of 30 large, publicly-owned companies in the United States and is often used as a benchmark for the overall health of the US stock market.

- S&P 500: This index includes the 500 largest companies listed on the NYSE and NASDAQ and is considered a broader representation of the US stock market.

- NASDAQ Composite: This index tracks all companies listed on the NASDAQ exchange and is known for its inclusion of technology companies.

Investment Strategies in the US Stock Market

Investing in the US stock market can be a lucrative venture, but it also comes with its fair share of risks. Here are some key investment strategies to consider:

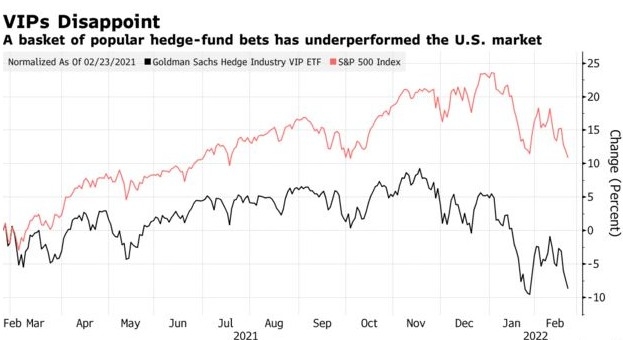

- Diversification: Investing in a variety of stocks across different sectors and industries can help mitigate risk and potentially lead to better returns.

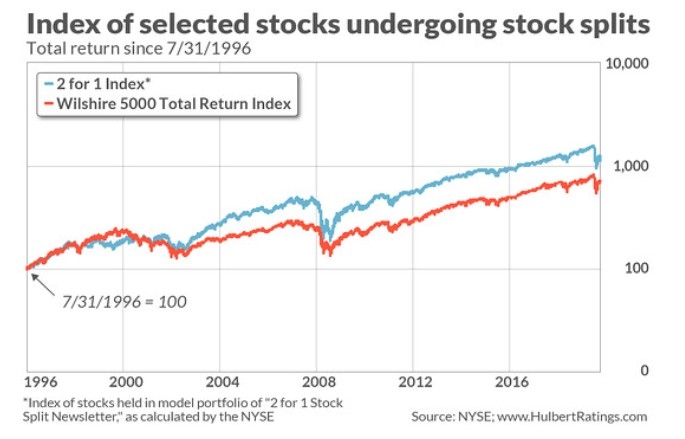

- Long-term Investing: Historically, the stock market has shown a positive trend over the long term. Investing for the long term can help you ride out market volatility and potentially benefit from the market's growth.

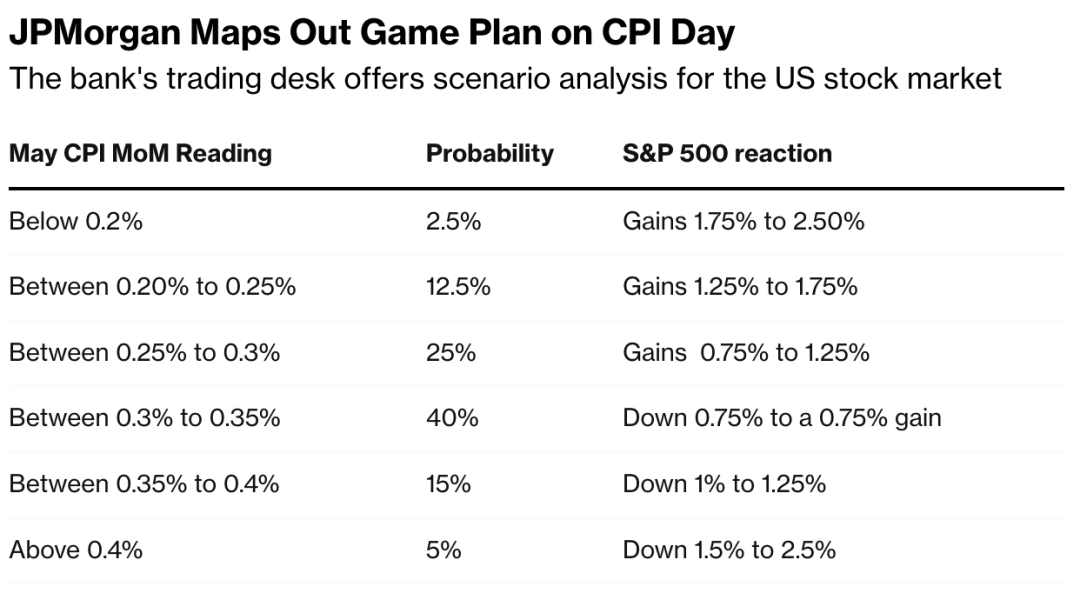

- Technical Analysis: This involves analyzing past stock prices and trading volumes to predict future price movements. It's a popular strategy among short-term traders.

- Fundamental Analysis: This involves analyzing a company's financial statements, industry position, and management to determine its intrinsic value.

Case Studies: Successful Investments in the US Stock Market

Several companies have made significant gains in the US stock market, turning small investments into substantial profits. Here are a few notable examples:

- Apple Inc.: Since its IPO in 1980, Apple has become one of the world's most valuable companies. Investors who bought Apple's stock in the early 1980s have seen their investments grow exponentially.

- Amazon.com Inc.: Amazon went public in 1997 and has since become a dominant player in the retail and technology sectors. Investors who bought Amazon's stock early on have seen their investments soar.

- Tesla, Inc.: Tesla's stock has experienced significant volatility, but it has also seen substantial growth. Investors who bought Tesla's stock in the early 2010s have seen their investments multiply many times over.

In conclusion, the US stock market is a complex and dynamic environment that offers numerous opportunities for investors. Understanding its structure, major indices, and investment strategies is crucial for anyone looking to invest in this market. By doing your research and staying informed, you can navigate the US stock market and potentially achieve your investment goals.

US Stock Companies Invested in Huawei: A Cl? can foreigners buy us stocks